- Norway

- /

- Energy Services

- /

- OB:SOFF

Investors Still Aren't Entirely Convinced By Solstad Offshore ASA's (OB:SOFF) Revenues Despite 27% Price Jump

Those holding Solstad Offshore ASA (OB:SOFF) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 44% in the last year.

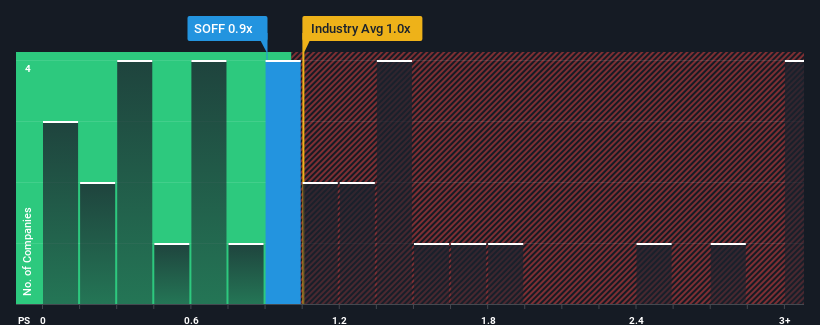

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Solstad Offshore's P/S ratio of 0.9x, since the median price-to-sales (or "P/S") ratio for the Energy Services industry in Norway is also close to 1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Solstad Offshore

How Solstad Offshore Has Been Performing

While the industry has experienced revenue growth lately, Solstad Offshore's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Solstad Offshore.Is There Some Revenue Growth Forecasted For Solstad Offshore?

Solstad Offshore's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 30%. This means it has also seen a slide in revenue over the longer-term as revenue is down 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 59% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 16%, which is noticeably less attractive.

With this information, we find it interesting that Solstad Offshore is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Solstad Offshore's P/S Mean For Investors?

Solstad Offshore's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Solstad Offshore currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

You should always think about risks. Case in point, we've spotted 2 warning signs for Solstad Offshore you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SOFF

Solstad Offshore

Operates offshore service vessels and maritime services to offshore energy industry.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives