- Norway

- /

- Energy Services

- /

- OB:SDRL

Shareholders In Seadrill (OB:SDRL) Should Look Beyond Earnings For The Full Story

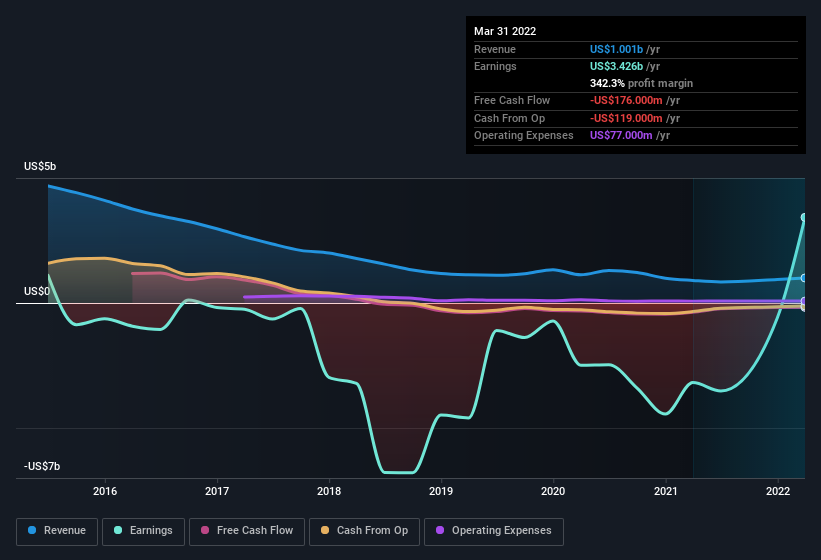

Despite posting strong earnings, Seadrill Limited's (OB:SDRL) stock didn't move much over the last week. We decided to have a deeper look, and we believe that investors might be worried about several concerning factors that we found.

See our latest analysis for Seadrill

Examining Cashflow Against Seadrill's Earnings

In high finance, the key ratio used to measure how well a company converts reported profits into free cash flow (FCF) is the accrual ratio (from cashflow). To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. The ratio shows us how much a company's profit exceeds its FCF.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. That's because some academic studies have suggested that high accruals ratios tend to lead to lower profit or less profit growth.

Over the twelve months to March 2022, Seadrill recorded an accrual ratio of 1.71. Statistically speaking, that's a real negative for future earnings. And indeed, during the period the company didn't produce any free cash flow whatsoever. In the last twelve months it actually had negative free cash flow, with an outflow of US$176m despite its profit of US$3.43b, mentioned above. We also note that Seadrill's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of US$176m. However, that's not all there is to consider. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part. The good news for shareholders is that Seadrill's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Given the accrual ratio, it's not overly surprising that Seadrill's profit was boosted by unusual items worth US$3.5b in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And, after all, that's exactly what the accounting terminology implies. Seadrill had a rather significant contribution from unusual items relative to its profit to March 2022. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Seadrill's Profit Performance

Summing up, Seadrill received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. On reflection, the above-mentioned factors give us the strong impression that Seadrill'sunderlying earnings power is not as good as it might seem, based on the statutory profit numbers. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. At Simply Wall St, we found 2 warning signs for Seadrill and we think they deserve your attention.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SDRL

Seadrill

Provides offshore drilling services to the oil and gas industry worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026