As global markets navigate a complex landscape marked by mixed earnings reports and fluctuating economic indicators, investors are increasingly turning their attention to stable income sources like dividend stocks. In the current environment, characterized by cautious optimism and strategic fiscal maneuvers, a good dividend stock is often defined by its ability to provide consistent payouts while maintaining resilience amid economic uncertainties.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.86% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.29% | ★★★★★★ |

| Globeride (TSE:7990) | 4.12% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.96% | ★★★★★★ |

| Innotech (TSE:9880) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 4.22% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.57% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.59% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2030 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

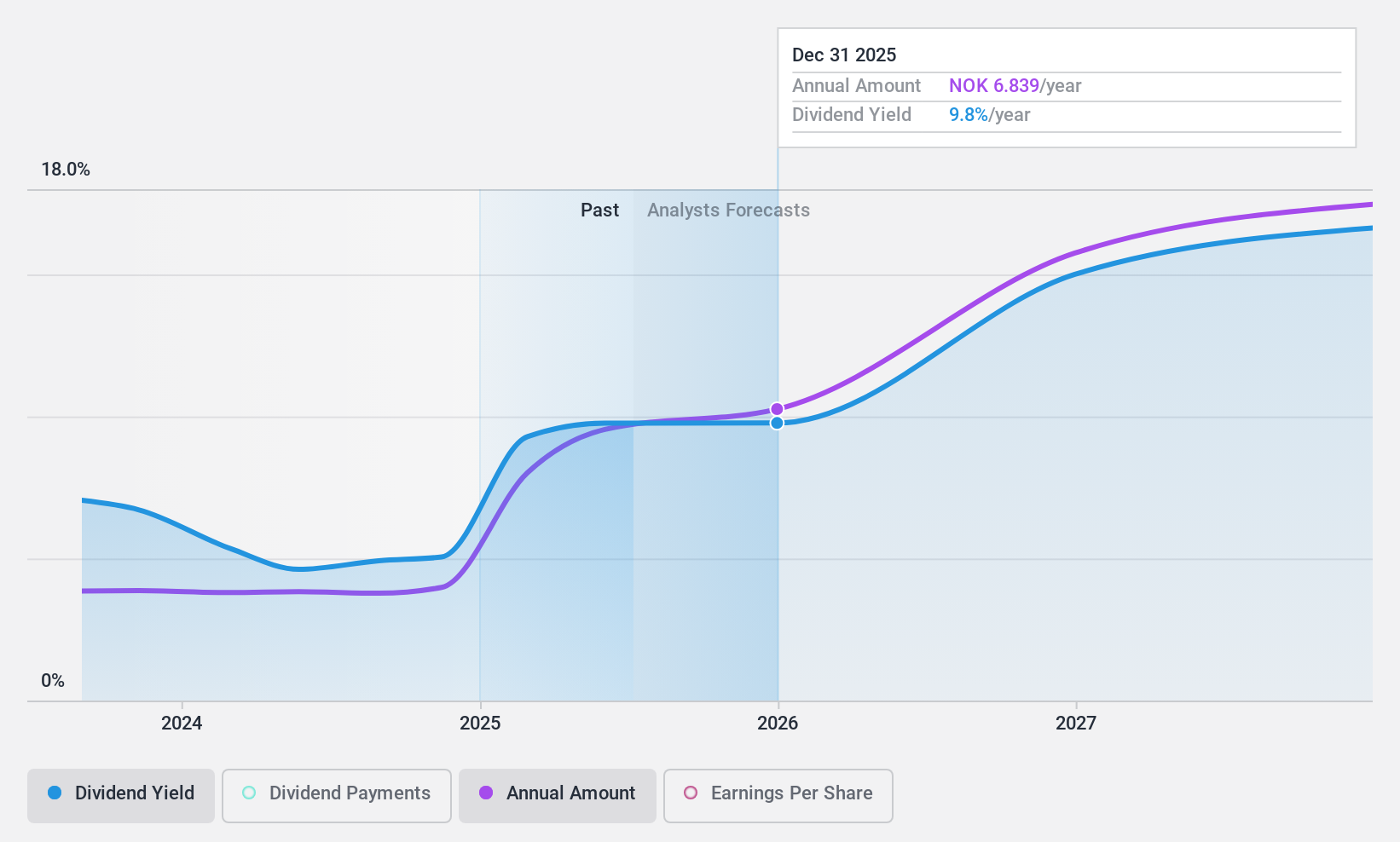

Odfjell Drilling (OB:ODL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Odfjell Drilling Ltd. owns and operates mobile offshore drilling units mainly in Norway and Namibia, with a market cap of NOK12.40 billion.

Operations: Odfjell Drilling Ltd. generates its revenue from its Own Fleet, contributing $590.50 million, and External Fleet operations, which add $169 million.

Dividend Yield: 5.1%

Odfjell Drilling offers a reliable dividend yield of 5.11%, supported by a low payout ratio of 23.8% and a cash payout ratio of 30.4%, indicating strong coverage by earnings and cash flows. Despite trading below its estimated fair value, the stock's dividend yield is lower than top-tier Norwegian payers. Recent earnings growth, with net income rising to US$16.4 million in Q2 2024 from US$11.4 million the previous year, supports ongoing dividend stability and growth potential.

- Take a closer look at Odfjell Drilling's potential here in our dividend report.

- Our expertly prepared valuation report Odfjell Drilling implies its share price may be lower than expected.

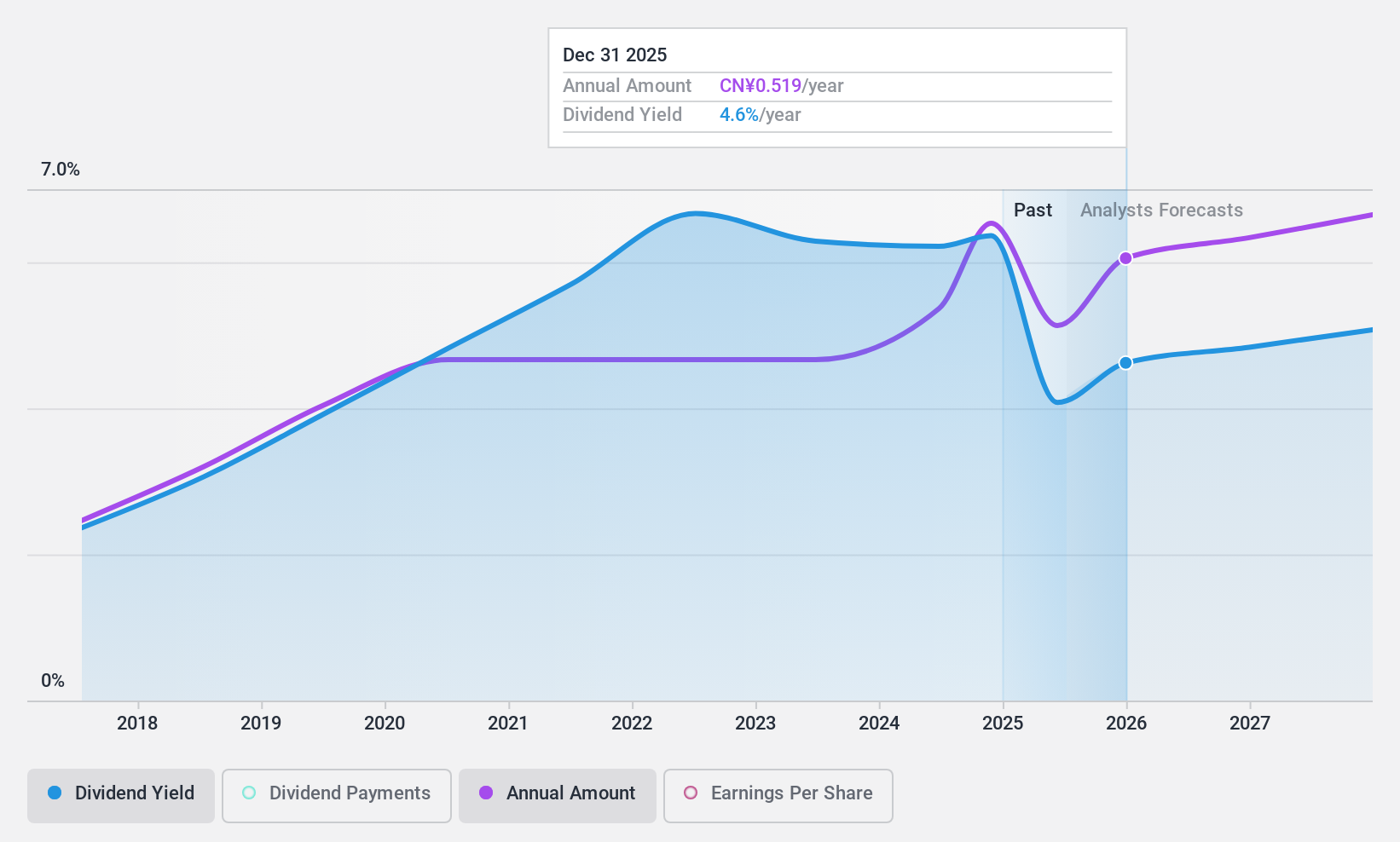

Bank of Shanghai (SHSE:601229)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank of Shanghai Co., Ltd. offers a range of personal and corporate banking products and services mainly in Mainland China, with a market cap of CN¥116.07 billion.

Operations: Bank of Shanghai Co., Ltd.'s revenue segments include various personal and corporate banking products and services primarily in Mainland China.

Dividend Yield: 6.9%

Bank of Shanghai's dividend yield ranks in the top 25% of CN market payers, supported by a moderate payout ratio of 47.7%, indicating coverage by earnings. Although dividends have grown over seven years, stability is less established due to the short history. Earnings are projected to grow annually by 5.05%, enhancing future dividend sustainability. Recent earnings reports show stable net income growth, with CNY 17.59 billion for nine months ending September 2024, supporting its dividend profile amidst good relative stock value.

- Navigate through the intricacies of Bank of Shanghai with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Bank of Shanghai is trading behind its estimated value.

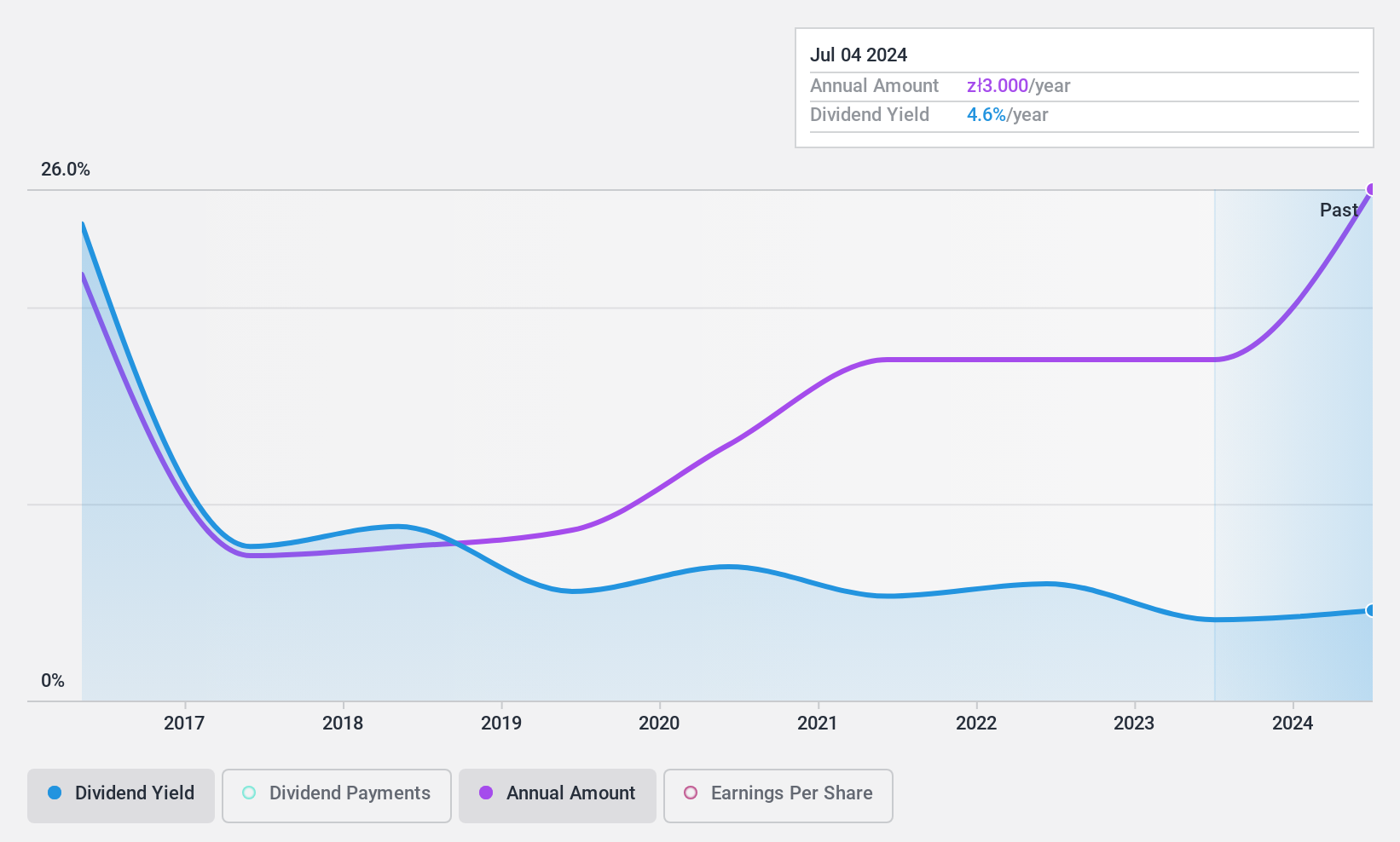

Decora (WSE:DCR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Decora S.A. is involved in the production, distribution, sale, and export of flooring products and accessories in Poland with a market cap of PLN679.23 million.

Operations: Decora S.A.'s revenue segments include PLN125.33 million from Wall products and PLN435.56 million from Flooring products.

Dividend Yield: 4.7%

Decora's dividends are well covered by earnings and cash flows, with payout ratios of 40.5% and 39.6%, respectively. Despite a decade-long increase in dividend payments, their reliability is undermined by volatility, with significant annual drops over the past ten years. Recent earnings show improvement, with net income rising to PLN 44.6 million for the half year ending June 2024. The stock trades significantly below its estimated fair value but offers a lower yield compared to top Polish market payers.

- Delve into the full analysis dividend report here for a deeper understanding of Decora.

- The valuation report we've compiled suggests that Decora's current price could be quite moderate.

Next Steps

- Discover the full array of 2030 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Shanghai might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601229

Bank of Shanghai

Provides various personal and corporate banking products and services primarily in Mainland China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives