- Norway

- /

- Oil and Gas

- /

- OB:IOX

Interoil Exploration and Production ASA (OB:IOX) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Interoil Exploration and Production ASA (OB:IOX) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 61% loss during that time.

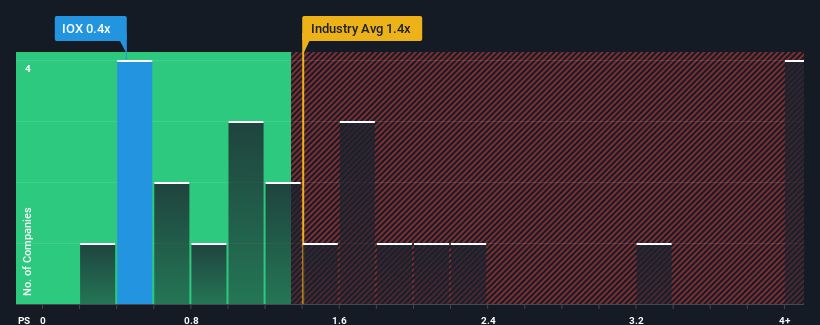

After such a large drop in price, when close to half the companies operating in Norway's Oil and Gas industry have price-to-sales ratios (or "P/S") above 1.4x, you may consider Interoil Exploration and Production as an enticing stock to check out with its 0.4x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Interoil Exploration and Production

How Has Interoil Exploration and Production Performed Recently?

Revenue has risen firmly for Interoil Exploration and Production recently, which is pleasing to see. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Interoil Exploration and Production will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Interoil Exploration and Production's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Interoil Exploration and Production?

Interoil Exploration and Production's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Pleasingly, revenue has also lifted 103% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

In contrast to the company, the rest of the industry is expected to decline by 3.5% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that Interoil Exploration and Production's P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

What We Can Learn From Interoil Exploration and Production's P/S?

Interoil Exploration and Production's P/S has taken a dip along with its share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Upon analysing the past data, we see it is unexpected that Interoil Exploration and Production is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. We think potential risks might be placing significant pressure on the P/S ratio and share price. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors think future revenue could see a lot of volatility.

Before you take the next step, you should know about the 5 warning signs for Interoil Exploration and Production (4 are a bit concerning!) that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:IOX

Interoil Exploration and Production

Operates as an upstream oil exploration and production company in Argentina and Colombia.

Good value slight.

Market Insights

Community Narratives