- Norway

- /

- Oil and Gas

- /

- OB:HAFNI

Hafnia (OB:HAFNI) Swings to Q3 Loss, Testing Bullish High-Margin Valuation Narrative

Reviewed by Simply Wall St

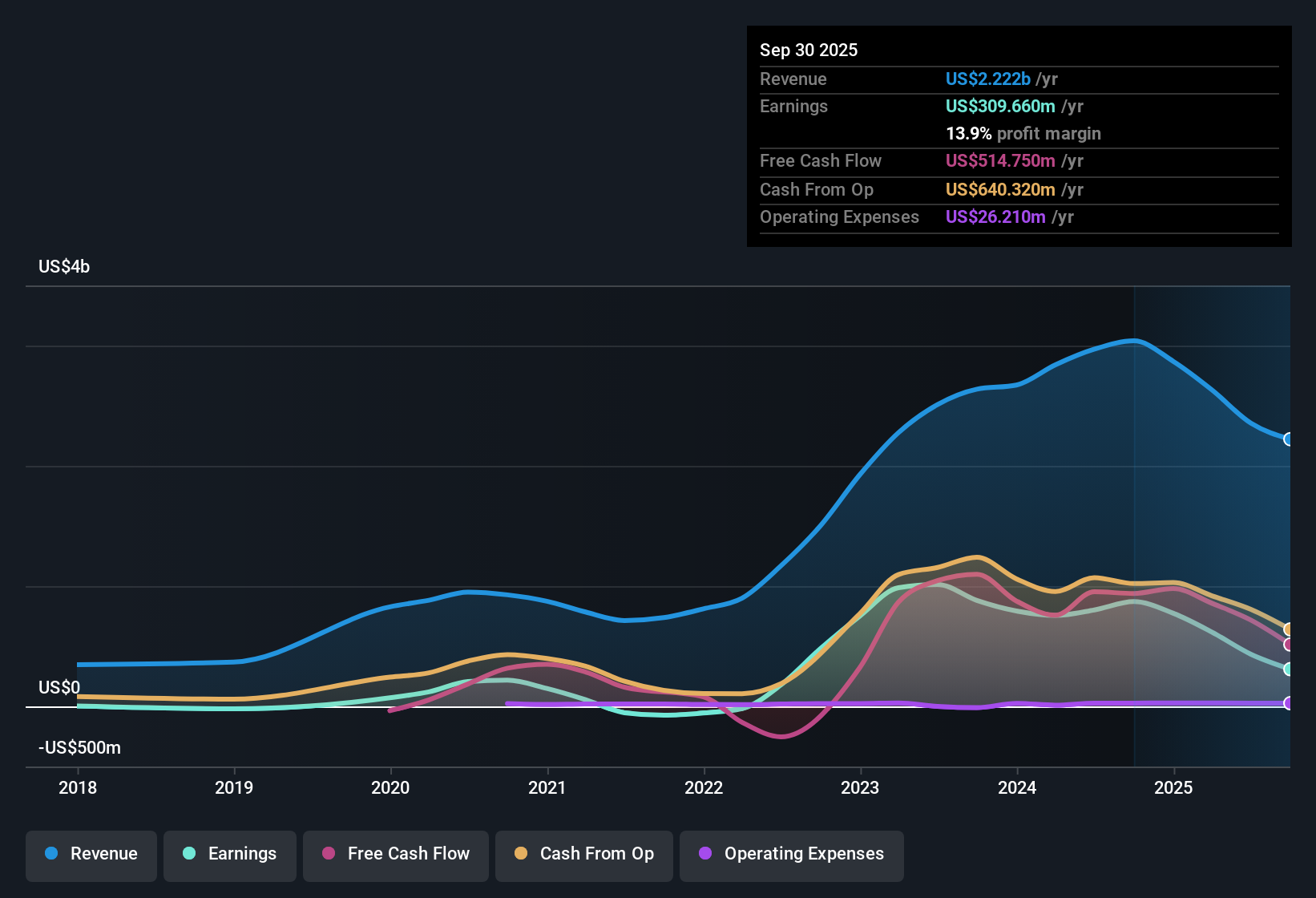

Hafnia (OB:HAFNI) delivered a tough Q3 2025 print, with revenue of about $735.6 million and basic EPS of roughly -$0.09, as net income swung to a loss of $47.0 million versus a $215.6 million profit and EPS of about $0.42 in Q3 2024. Over the past few quarters the company has seen revenue move from $831.2 million in Q2 2024 to $719.7 million in Q3 2024 and then to $735.6 million in Q3 2025. EPS stepped down from $0.51 to $0.42 before turning negative, setting up a more cautious backdrop for the latest update. Margin resilience on a trailing basis gives investors something to work with, but this quarter’s loss puts profitability firmly under the microscope.

See our full analysis for Hafnia.With the headline numbers on the table, the next step is to see how this latest earnings snapshot lines up with the dominant narratives around Hafnia, highlighting where the data backs the story and where it starts to push back.

See what the community is saying about Hafnia

Trailing profit still strong at 29.1 percent margin

- Over the last 12 months, Hafnia generated about $2.2 billion in revenue and $635.5 million in net income, which works out to a 29.1 percent net profit margin compared with 28.7 percent a year earlier.

- Consensus narrative notes that robust demand and constrained tanker supply support margins, yet the latest negative Q3 net income of $47.0 million highlights a tension between

- record like trailing profitability and the near term hit to quarterly earnings, even as the fleet is described as modern and eco efficient,

- and investors counting on structurally higher margins versus the reality that single quarter swings can still be material for a cyclical shipping business.

Deep valuation discount versus industry peers

- At a share price of NOK58.88, Hafnia trades on a trailing price to earnings ratio of 4.5 times, versus about 13 times for the wider European Oil and Gas industry and 9.6 times for peers, while also sitting far below a discounted cash flow (DCF) fair value of roughly NOK248.58.

- What stands out for the bullish view is that this low multiple and large gap to DCF fair value sit alongside strong trailing earnings, yet

- analysts only see moderate price upside, with the stock trading below a NOK71.67 analyst target,

- which means bulls need to believe the combination of high margins and a discounted price to earnings ratio can offset the softer near term earnings trend.

Forecast declines challenge the long term story

- Analysts currently expect earnings to fall by about 29.2 percent per year and revenue by around 33.9 percent per year over the next three years, after a period when earnings had previously grown 34 percent per year over five years.

- Bears argue that these forecast drops in revenue and earnings could weigh on the stock, and the data gives them support because

- the latest Q3 loss of $47.0 million and negative EPS follow a year in which earnings already declined versus the prior 12 month period,

- and the company is described as having an unstable dividend track record, which makes it harder to rely on payouts if the downtrend in revenue materializes.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hafnia on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? In just a few minutes you can turn that view into a fresh take on Hafnia’s outlook, Do it your way.

A great starting point for your Hafnia research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

Hafnia’s sharp forecast declines in revenue and earnings, combined with a recent quarterly loss and unstable dividends, indicate that its outlook may be entering a tougher phase.

If you prefer companies with more predictable trajectories instead of this potential shift, use our stable growth stocks screener (2073 results) to quickly focus on steadier performers built for consistency across different market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hafnia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:HAFNI

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026