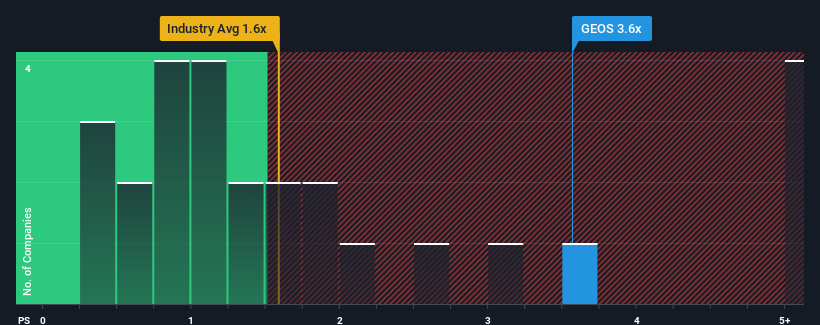

When you see that almost half of the companies in the Oil and Gas industry in Norway have price-to-sales ratios (or "P/S") below 1.6x, Golden Energy Offshore Services ASA (OB:GEOS) looks to be giving off some sell signals with its 3.6x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Golden Energy Offshore Services

What Does Golden Energy Offshore Services' P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Golden Energy Offshore Services has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Golden Energy Offshore Services will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Golden Energy Offshore Services would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 49% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 200% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 3.5% shows it's a great look while it lasts.

In light of this, it's understandable that Golden Energy Offshore Services' P/S sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader industry going backwards. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Golden Energy Offshore Services revealed its growing revenue over the medium-term is helping prop up its high P/S compared to its peers, given the industry is set to shrink. It could be said that investors feel this revenue growth will continue into the future, justifying a higher P/S ratio. We still remain cautious about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

You need to take note of risks, for example - Golden Energy Offshore Services has 4 warning signs (and 3 which are a bit unpleasant) we think you should know about.

If you're unsure about the strength of Golden Energy Offshore Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:GEOS

Golden Energy Offshore Services

Owns and operates offshore service vessels for the oil and gas service industry in the North Sea and the Caribbean.

Slightly overvalued with imperfect balance sheet.

Market Insights

Community Narratives