- Norway

- /

- Energy Services

- /

- OB:EMGS

These Return Metrics Don't Make Electromagnetic Geoservices (OB:EMGS) Look Too Strong

To avoid investing in a business that's in decline, there's a few financial metrics that can provide early indications of aging. A business that's potentially in decline often shows two trends, a return on capital employed (ROCE) that's declining, and a base of capital employed that's also declining. This indicates to us that the business is not only shrinking the size of its net assets, but its returns are falling as well. On that note, looking into Electromagnetic Geoservices (OB:EMGS), we weren't too upbeat about how things were going.

Return On Capital Employed (ROCE): What Is It?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Electromagnetic Geoservices:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.26 = US$6.4m ÷ (US$31m - US$7.1m) (Based on the trailing twelve months to June 2025).

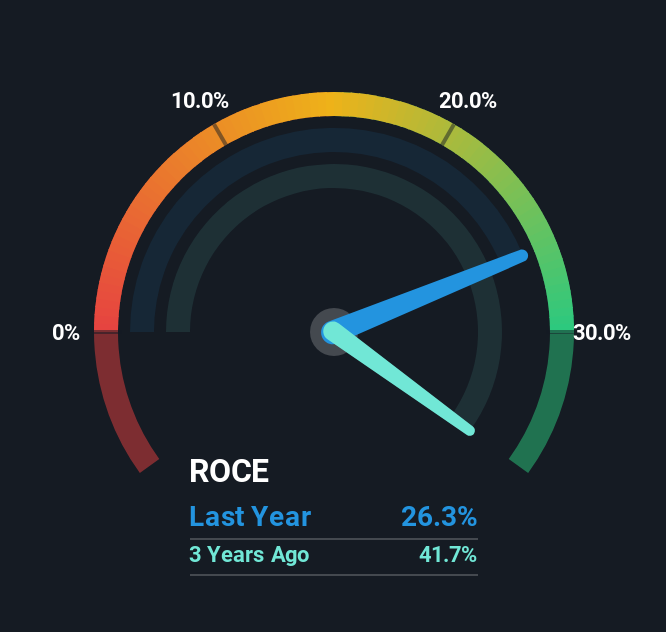

Thus, Electromagnetic Geoservices has an ROCE of 26%. In absolute terms that's a great return and it's even better than the Energy Services industry average of 14%.

See our latest analysis for Electromagnetic Geoservices

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating Electromagnetic Geoservices' past further, check out this free graph covering Electromagnetic Geoservices' past earnings, revenue and cash flow.

How Are Returns Trending?

In terms of Electromagnetic Geoservices' historical ROCE trend, it isn't fantastic. To be more specific, today's ROCE was 37% five years ago but has since fallen to 26%. In addition to that, Electromagnetic Geoservices is now employing 54% less capital than it was five years ago. The combination of lower ROCE and less capital employed can indicate that a business is likely to be facing some competitive headwinds or seeing an erosion to its moat. If these underlying trends continue, we wouldn't be too optimistic going forward.

The Bottom Line On Electromagnetic Geoservices' ROCE

In summary, it's unfortunate that Electromagnetic Geoservices is shrinking its capital base and also generating lower returns. But investors must be expecting an improvement of sorts because over the last five yearsthe stock has delivered a respectable 85% return. In any case, the current underlying trends don't bode well for long term performance so unless they reverse, we'd start looking elsewhere.

Electromagnetic Geoservices does come with some risks though, we found 3 warning signs in our investment analysis, and 1 of those is significant...

Electromagnetic Geoservices is not the only stock earning high returns. If you'd like to see more, check out our free list of companies earning high returns on equity with solid fundamentals.

Valuation is complex, but we're here to simplify it.

Discover if Electromagnetic Geoservices might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:EMGS

Electromagnetic Geoservices

Provides electromagnetic (EM) surveying technology and services to the offshore oil and gas exploration industry.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026