- Norway

- /

- Energy Services

- /

- OB:DOFG

European Growth Companies With High Insider Ownership July 2025

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively stable amidst mixed returns across major stock indexes, investors are keeping a close watch on inflation trends and labor market conditions in the eurozone. In this context, identifying growth companies with high insider ownership can be particularly appealing, as they often indicate strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 44.9% |

| MilDef Group (OM:MILDEF) | 13.7% | 75.6% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 34.2% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

We'll examine a selection from our screener results.

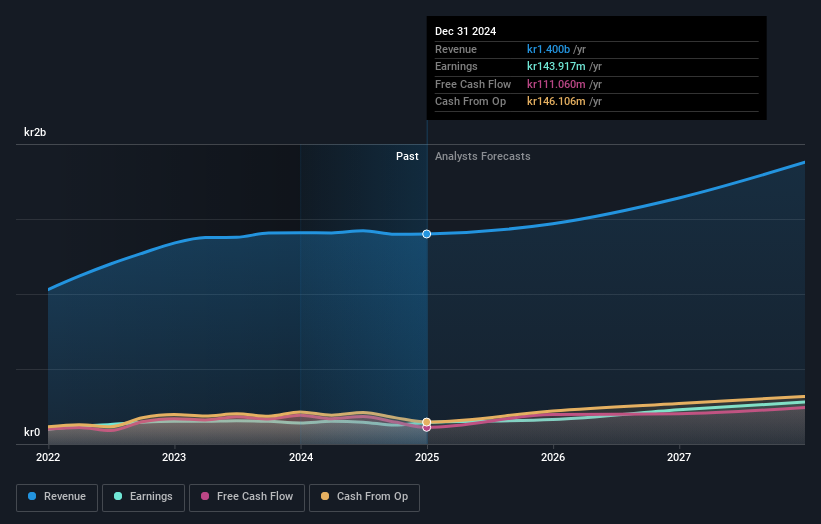

NTG Nordic Transport Group (CPSE:NTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NTG Nordic Transport Group A/S, with a market cap of DKK4.39 billion, offers asset-light freight forwarding services across road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Operations: The company's revenue segments comprise DKK2.89 billion from Air & Ocean and DKK7.04 billion from Road & Logistics services.

Insider Ownership: 24.6%

Earnings Growth Forecast: 20.8% p.a.

NTG Nordic Transport Group is positioned for significant earnings growth, with forecasts indicating a 20.8% annual increase, outpacing the Danish market. Despite high debt levels and recent declines in profit margins from 4.2% to 2.8%, NTG trades at a substantial discount to its estimated fair value and analysts expect an 84.3% price rise. Recent Q1 results showed increased sales (DKK 2,695 million), though net income decreased to DKK 52 million year-over-year.

- Dive into the specifics of NTG Nordic Transport Group here with our thorough growth forecast report.

- According our valuation report, there's an indication that NTG Nordic Transport Group's share price might be on the cheaper side.

DOF Group (OB:DOFG)

Simply Wall St Growth Rating: ★★★★☆☆

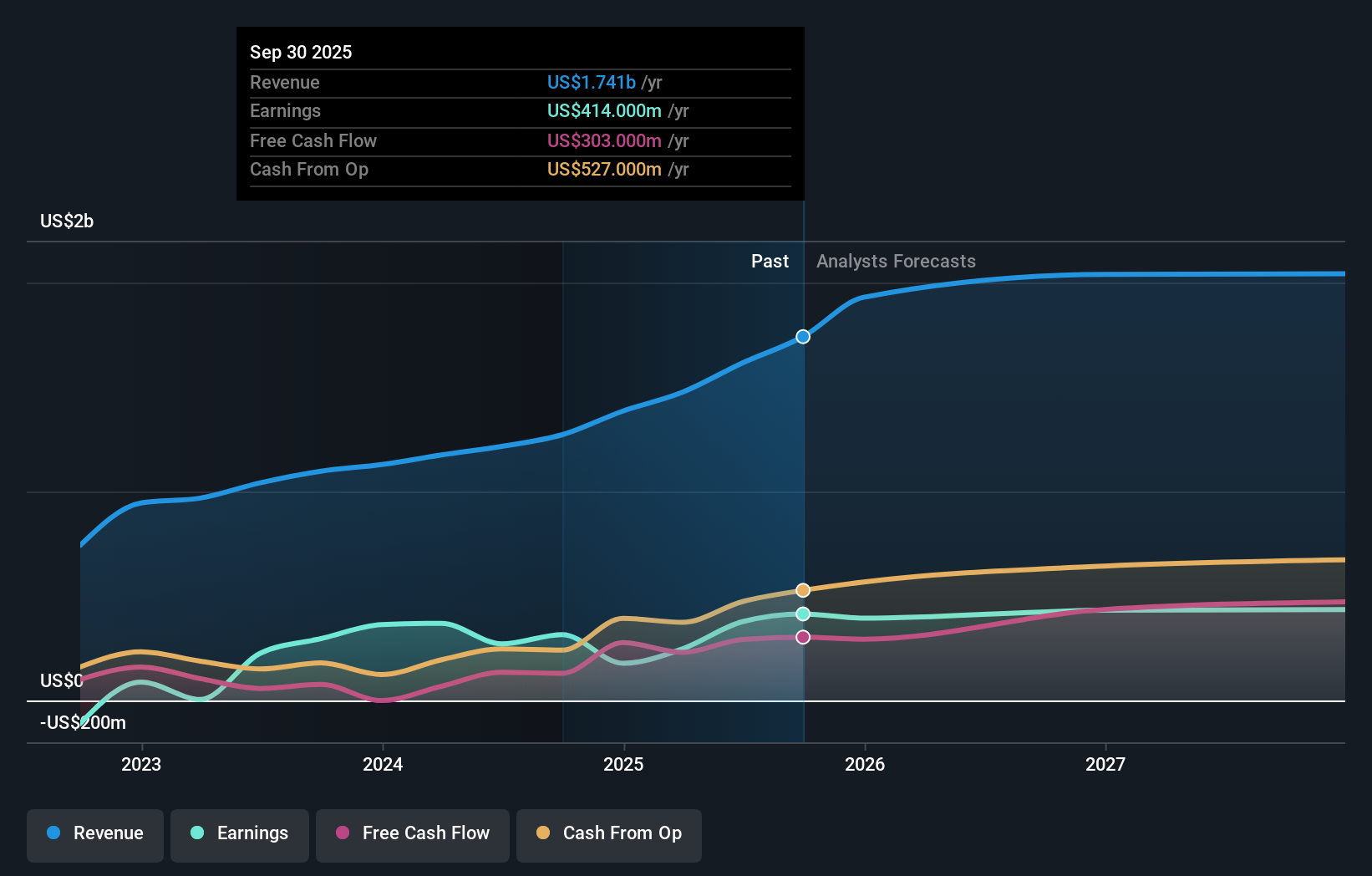

Overview: DOF Group ASA owns and operates a fleet of offshore and subsea vessels, with a market cap of NOK22.29 billion.

Operations: The company's revenue segments include Norskan with $259 million and Corporate/Management contributing $72 million.

Insider Ownership: 11.5%

Earnings Growth Forecast: 19.1% p.a.

DOF Group shows potential for growth with earnings projected to rise by 19.1% annually, surpassing the Norwegian market. Recent contracts in Brazil worth over US$755 million bolster its revenue outlook, though high debt levels and substantial past shareholder dilution present challenges. Despite profit margins dropping from 31.4% to 16.7%, DOF trades significantly below fair value estimates, with analysts forecasting a stock price increase of 35%. The dividend yield of 13.39% is not well-supported by free cash flows.

- Delve into the full analysis future growth report here for a deeper understanding of DOF Group.

- Our valuation report here indicates DOF Group may be undervalued.

Absolent Air Care Group (OM:ABSO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units and has a market cap of SEK2.75 billion.

Operations: The company's revenue segments include Industrial at SEK1116.73 million and Commercial Kitchen at SEK238.67 million.

Insider Ownership: 12.6%

Earnings Growth Forecast: 30.7% p.a.

Absolent Air Care Group's insider activity shows more shares bought than sold recently, indicating confidence in its growth prospects. Despite a recent decline in Q1 earnings and sales, the company's earnings are forecast to grow significantly at 30.7% annually, outpacing the Swedish market. However, revenue growth is expected at a slower 13.9% per year. Trading below estimated fair value by 44.4%, Absolent presents an attractive valuation despite challenges like low future return on equity forecasts of 17.1%.

- Click to explore a detailed breakdown of our findings in Absolent Air Care Group's earnings growth report.

- The valuation report we've compiled suggests that Absolent Air Care Group's current price could be quite moderate.

Key Takeaways

- Unlock more gems! Our Fast Growing European Companies With High Insider Ownership screener has unearthed 211 more companies for you to explore.Click here to unveil our expertly curated list of 214 Fast Growing European Companies With High Insider Ownership.

- Ready For A Different Approach? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DOFG

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives