- Norway

- /

- Oil and Gas

- /

- OB:CLCO

Pulling back 10% this week, Cool's OB:CLCO) one-year decline in earnings may be coming into investors focus

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. For example, the Cool Company Ltd. (OB:CLCO) share price is down 12% in the last year. That's disappointing when you consider the market returned 8.5%. Because Cool hasn't been listed for many years, the market is still learning about how the business performs. The last week also saw the share price slip down another 10%. However, this move may have been influenced by the broader market, which fell 5.4% in that time.

After losing 10% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for Cool

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

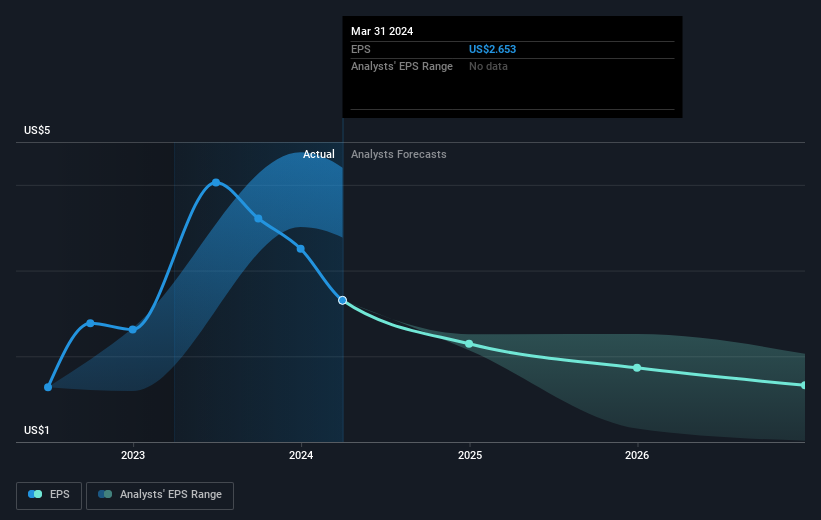

Unhappily, Cool had to report a 16% decline in EPS over the last year. The share price fall of 12% isn't as bad as the reduction in earnings per share. So the market may not be too worried about the EPS figure, at the moment -- or it may have expected earnings to drop faster.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

This free interactive report on Cool's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Cool's TSR for the last 1 year was 0.8%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Cool shareholders have gained 0.8% for the year (even including dividends). Unfortunately this falls short of the market return of around 8.5%. Unfortunately the share price is down 1.4% over the last quarter. It may simply be that the share price got ahead of itself, and its quite possible it will keep moving in the right direction, especially if the business continues to deliver good financial results. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Cool (at least 2 which are significant) , and understanding them should be part of your investment process.

We will like Cool better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:CLCO

Cool

Engages in the acquisition, ownership, operation, and chartering of liquefied natural gas carriers (LNGCs).

Undervalued slight.