- Norway

- /

- Oil and Gas

- /

- OB:AGAS

Discovering Undiscovered Gems on None in November 2024

Reviewed by Simply Wall St

In the wake of a "red sweep" in the U.S. elections, global markets have experienced a surge, with small-cap stocks like those in the Russell 2000 Index showing significant gains despite remaining below record highs. This environment of anticipated economic growth and regulatory changes presents an opportune moment to explore lesser-known stocks that possess strong fundamentals and potential for growth, often overlooked amidst broader market movements.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interactive Digital Technologies | 9.01% | 4.39% | 3.03% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Cenergy Holdings (ENXTBR:CENER)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cenergy Holdings SA is a company that manufactures and sells aluminium, copper, cables, steel, and steel pipes in Belgium and internationally with a market capitalization of approximately €1.84 billion.

Operations: Cenergy Holdings generates revenue primarily from its Cables and Steel Pipes segments, with €1.79 billion from Cables and €708.50 million from Steel Pipes. The company has a market capitalization of approximately €1.84 billion.

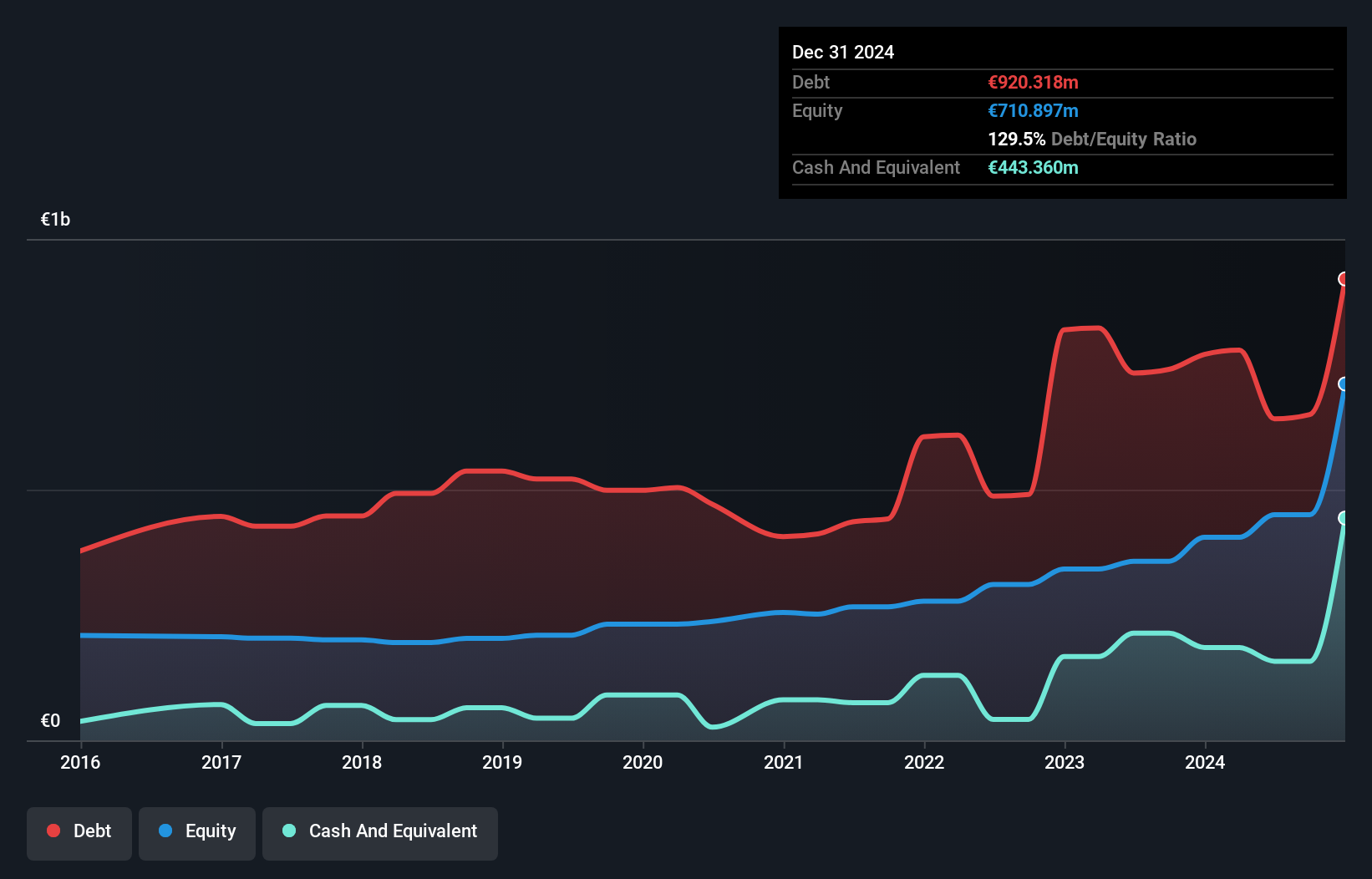

Cenergy Holdings, a smaller player in the electrical industry, has shown significant progress with earnings growth of 61% over the past year, outpacing the industry's 0.7%. Despite a high net debt to equity ratio of 107.5%, which is down from 248.5% five years ago, its interest payments are well covered by EBIT at three times coverage. The company trades at a substantial discount of 56% below estimated fair value and reported impressive half-year sales of €812 million and net income of €56 million as of June 2024, reflecting strong operational performance despite recent shareholder dilution concerns.

Avance Gas Holding (OB:AGAS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Avance Gas Holding Ltd, along with its subsidiaries, operates in the global transportation of liquefied petroleum gas (LPG) and has a market capitalization of NOK 8.13 billion.

Operations: The company's revenue is primarily derived from the transportation of liquefied petroleum gas (LPG), amounting to $374.51 million.

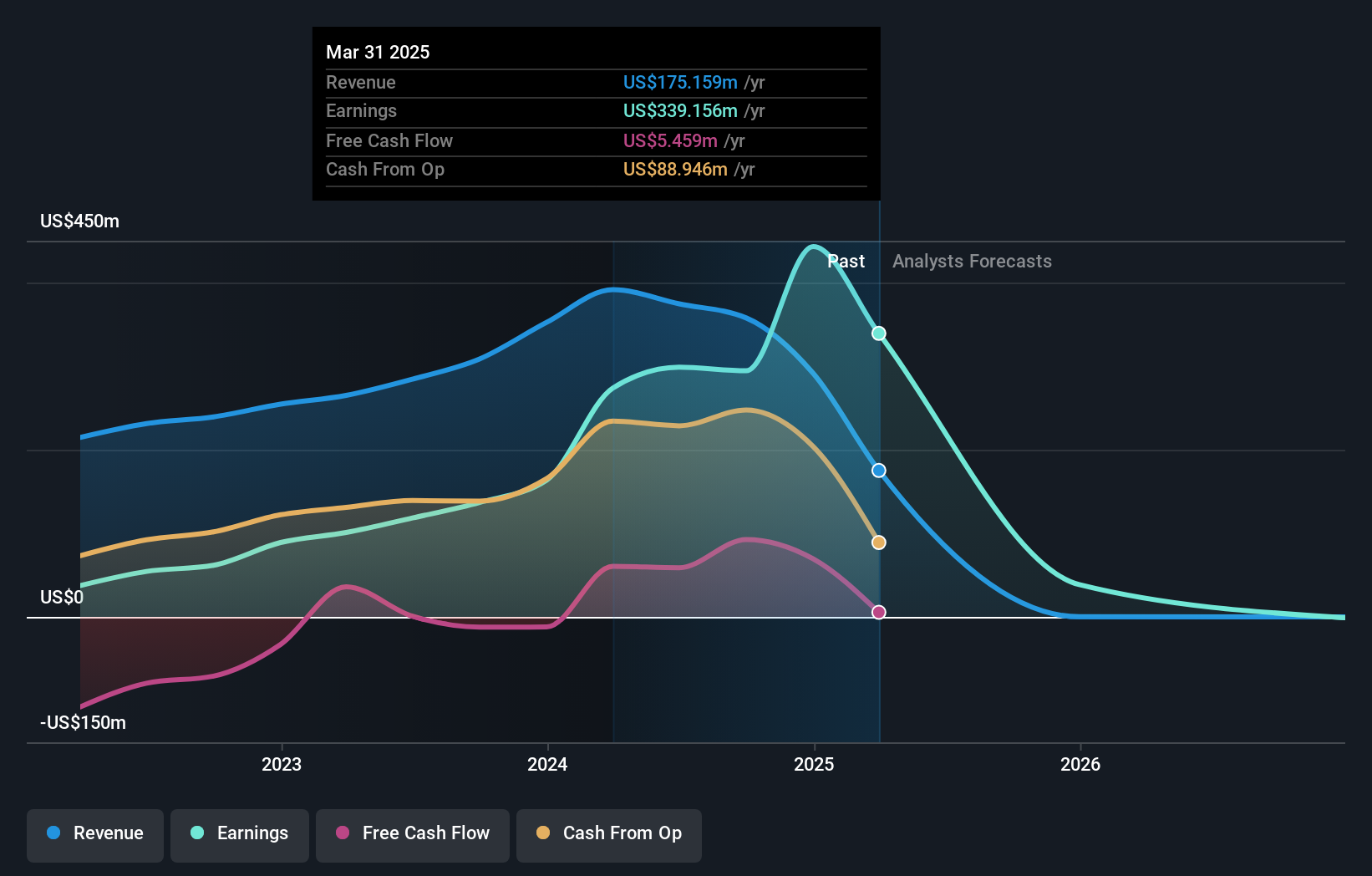

Avance Gas Holding, a nimble player in the energy sector, showcases impressive financial resilience with a debt to equity ratio reduced from 149% to 61% over five years. The company has outpaced industry growth with earnings surging by 152% last year, while its net debt to equity stands at a satisfactory 16%. Recent strategic moves include selling the VLGC Chinook and acquiring shares in BW LPG, potentially enhancing its market position. Despite volatile share prices recently, Avance Gas's interest payments are well-covered by EBIT at 9x coverage. However, future earnings might face headwinds as forecasts suggest an average annual decline of 82%.

- Get an in-depth perspective on Avance Gas Holding's performance by reading our health report here.

Examine Avance Gas Holding's past performance report to understand how it has performed in the past.

Polenergia (WSE:PEP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Polenergia S.A. is involved in the generation, distribution, trading, and sale of electricity both in Poland and internationally, with a market capitalization of PLN5.73 billion.

Operations: Polenergia's primary revenue streams include Trading and Sales, generating PLN3.75 billion, and onshore wind farms contributing PLN718.49 million. The company also earns from Gas and Clean Fuel at PLN149.41 million, with Distribution and eMobility adding PLN204.79 million to its revenue mix.

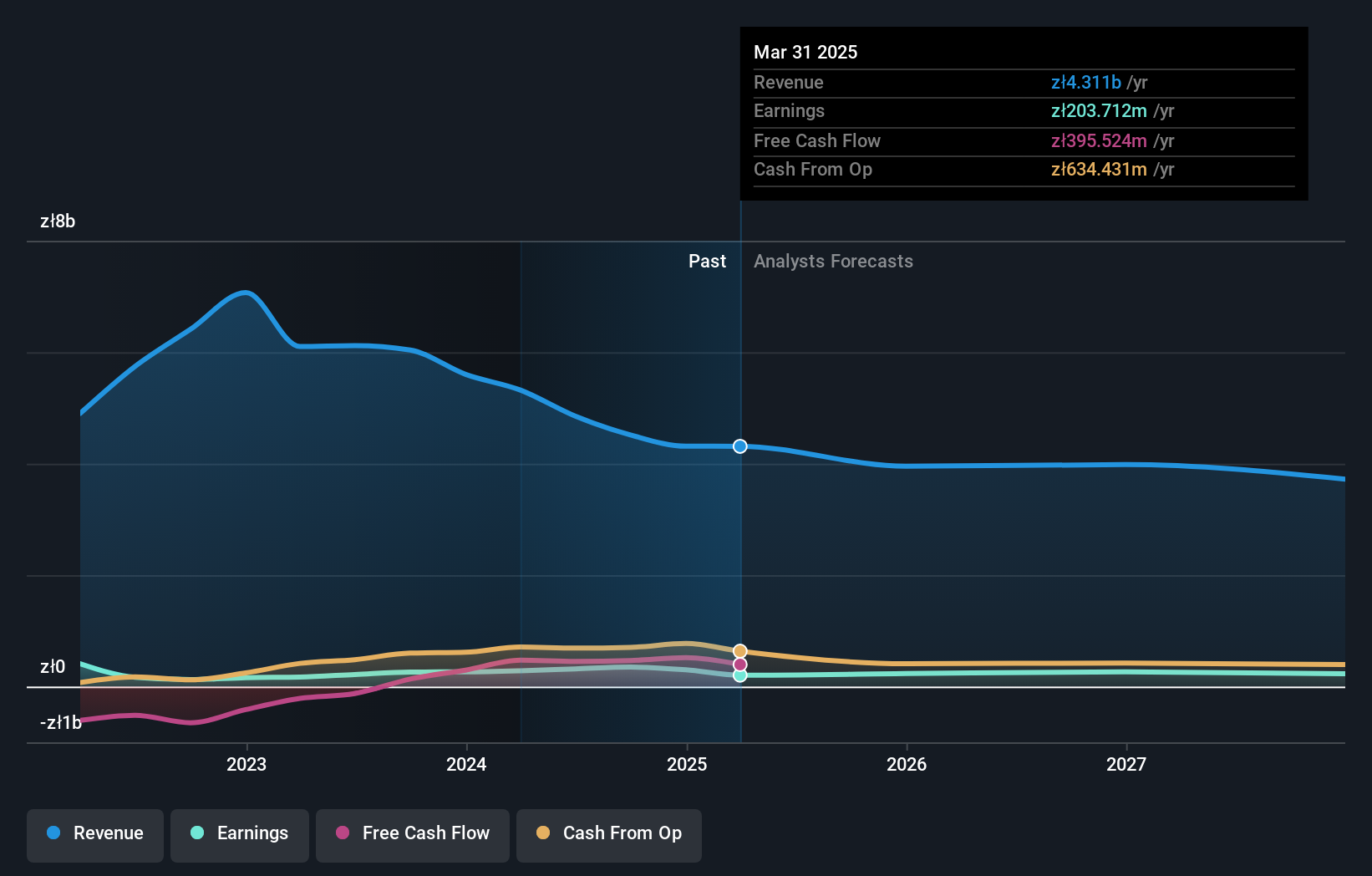

Polenergia, a notable player in renewable energy, has shown impressive earnings growth of 46.3% over the past year, outpacing the industry average. Trading at 48.7% below its estimated fair value suggests potential undervaluation. Their debt to equity ratio improved from 66.8% to 32.9% over five years, indicating better financial health and interest payments are comfortably covered by EBIT at an 11.2x coverage ratio. Recent activities include securing PLN 750 million through green bonds and obtaining permits for significant offshore wind projects with Equinor, reflecting strategic expansion efforts in sustainable energy infrastructure development.

- Navigate through the intricacies of Polenergia with our comprehensive health report here.

Review our historical performance report to gain insights into Polenergia's's past performance.

Where To Now?

- Gain an insight into the universe of 4643 Undiscovered Gems With Strong Fundamentals by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AGAS

Avance Gas Holding

Engages in the transportation of liquefied petroleum gas (LPG) worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives