- Norway

- /

- Oil and Gas

- /

- OB:CLCO

Investors Don't See Light At End Of Cool Company Ltd.'s (OB:CLCO) Tunnel And Push Stock Down 27%

Cool Company Ltd. (OB:CLCO) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 35% in that time.

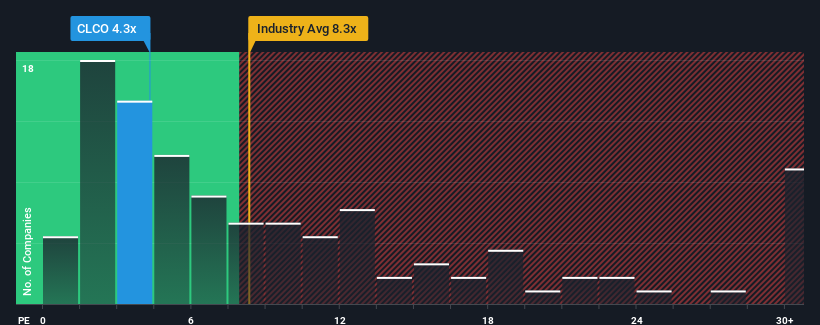

Even after such a large drop in price, given about half the companies in Norway have price-to-earnings ratios (or "P/E's") above 12x, you may still consider Cool as a highly attractive investment with its 4.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Cool hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Cool

What Are Growth Metrics Telling Us About The Low P/E?

Cool's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 52%. As a result, earnings from three years ago have also fallen 92% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 14% as estimated by the four analysts watching the company. With the market predicted to deliver 30% growth , that's a disappointing outcome.

With this information, we are not surprised that Cool is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Cool's P/E?

Cool's P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Cool's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 5 warning signs for Cool (2 are potentially serious!) that you need to take into consideration.

You might be able to find a better investment than Cool. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:CLCO

Cool

Acquires, owns, operates, and charters liquefied natural gas carriers (LNGCs).

Undervalued low.

Similar Companies

Market Insights

Community Narratives