- Norway

- /

- Oil and Gas

- /

- OB:BWLPG

How Lower Q3 Earnings and a Steady Dividend At BWG (OB:BWLPG) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- BW LPG Limited has reported past results for the third quarter and nine months to 30 September 2025, with net income of US$57.07 million for the quarter and US$138.08 million year to date, alongside basic earnings per share of US$0.38 and US$0.91 respectively.

- Despite earnings being lower than a year earlier, the board also approved a third-quarter 2025 cash dividend of US$0.40 per share, highlighting an ongoing focus on returning capital to shareholders.

- We will now examine how the reduced earnings alongside a maintained US$0.40 dividend per share could reshape BW LPG's existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

BWG Investment Narrative Recap

To own BW LPG, you need to be comfortable with a cyclical shipping business that is currently seeing weaker earnings but still returning substantial cash to shareholders. The latest results confirm that lower VLGC spot rates and softer earnings remain the key short term overhang, while the near term upside case rests on how quickly freight markets and export volumes recover. The maintained US$0.40 dividend, despite reduced profits, does not materially change those immediate catalysts or risks.

The third quarter dividend announcement of US$0.40 per share stands out in this context, because it follows a period of falling net income and thinner profit margins. With dividends already flagged as not being well covered by free cash flow, this decision links directly to the existing concern about how sustainable elevated payouts are if earnings remain under pressure and spot rates stay low.

Yet investors should be aware that if dividends keep running ahead of underlying cash generation and VLGC spot rates stay weak for longer, then ...

Read the full narrative on BWG (it's free!)

BWG’s narrative projects $283.7 million revenue and $264.9 million earnings by 2028.

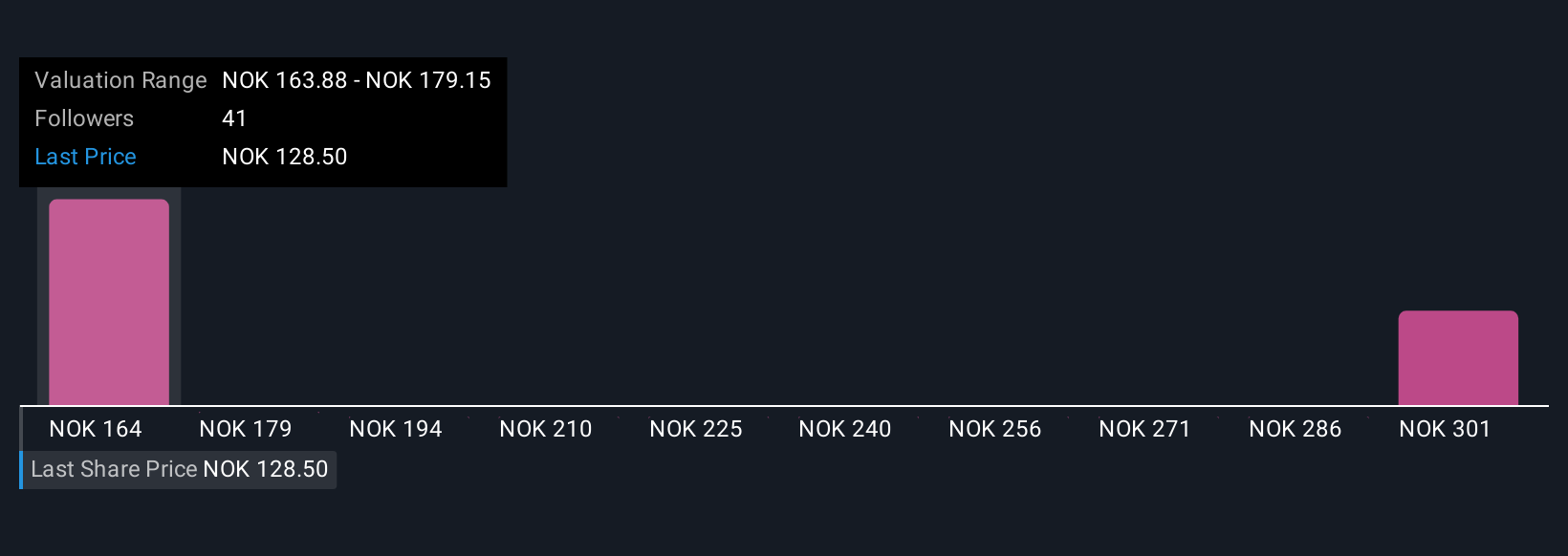

Uncover how BWG's forecasts yield a NOK163.88 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community place BW LPG’s fair value between NOK163.88 and NOK432.14, showing a very wide spread of views. When you weigh those opinions against the current pressure from lower VLGC spot rates and softer earnings, it underlines how important it is to compare multiple perspectives before forming a view on the business.

Explore 5 other fair value estimates on BWG - why the stock might be worth just NOK163.88!

Build Your Own BWG Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BWG research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free BWG research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BWG's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BWG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BWLPG

BWG

An investment holding company, engages in ship owning and chartering activities worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026