- Norway

- /

- Energy Services

- /

- OB:BBERG

These 4 Measures Indicate That Beerenberg (OB:BBERG) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Beerenberg AS (OB:BBERG) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Beerenberg

What Is Beerenberg's Net Debt?

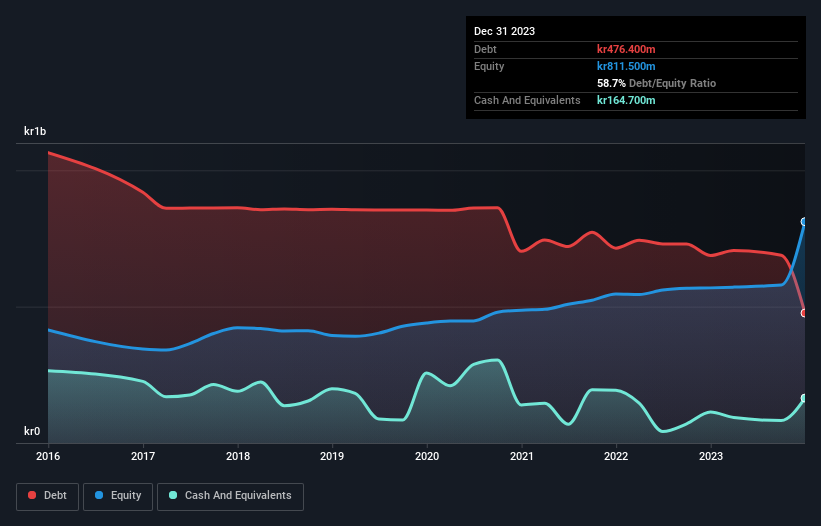

As you can see below, Beerenberg had kr476.4m of debt at December 2023, down from kr687.4m a year prior. On the flip side, it has kr164.7m in cash leading to net debt of about kr311.7m.

A Look At Beerenberg's Liabilities

Zooming in on the latest balance sheet data, we can see that Beerenberg had liabilities of kr583.7m due within 12 months and liabilities of kr439.0m due beyond that. On the other hand, it had cash of kr164.7m and kr470.6m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by kr387.4m.

This is a mountain of leverage relative to its market capitalization of kr557.7m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though Beerenberg's debt is only 1.6, its interest cover is really very low at 1.3. This does have us wondering if the company pays high interest because it is considered risky. Either way there's no doubt the stock is using meaningful leverage. One way Beerenberg could vanquish its debt would be if it stops borrowing more but continues to grow EBIT at around 19%, as it did over the last year. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Beerenberg can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Beerenberg produced sturdy free cash flow equating to 78% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Based on what we've seen Beerenberg is not finding it easy, given its interest cover, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its conversion of EBIT to free cash flow. Considering this range of data points, we think Beerenberg is in a good position to manage its debt levels. Having said that, the load is sufficiently heavy that we would recommend any shareholders keep a close eye on it. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 2 warning signs with Beerenberg , and understanding them should be part of your investment process.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking to trade Beerenberg, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beerenberg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:BBERG

Beerenberg

Through its subsidiaries, provides newbuild, maintenance, modification, and lifetime extension services for the oil and gas industry in Norway and internationally.

Solid track record with excellent balance sheet.