- Norway

- /

- Energy Services

- /

- OB:ABL

AqualisBraemar LOC's (OB:AQUA) Upcoming Dividend Will Be Larger Than Last Year's

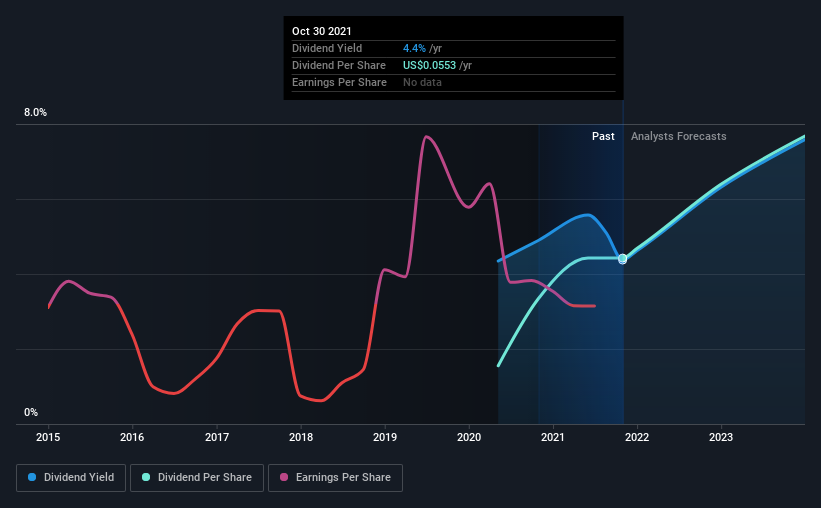

The board of AqualisBraemar LOC ASA (OB:AQUA) has announced that it will be increasing its dividend on the 3rd of December to kr0.25. Based on the announced payment, the dividend yield for the company will be 4.7%, which is fairly typical for the industry.

View our latest analysis for AqualisBraemar LOC

AqualisBraemar LOC's Distributions May Be Difficult To Sustain

We like to see a healthy dividend yield, but that is only helpful to us if the payment can continue. AqualisBraemar LOC isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

If the trend of the last few years continues, EPS will grow by 45.1% over the next 12 months. The company seems to be going down the right path, but it will probably take a little bit longer than a year to cross over into profitability. Unless this can be done in short order, the dividend might be difficult to sustain.

AqualisBraemar LOC Doesn't Have A Long Payment History

It's not possible for us to make a backward looking judgement just based on a short payment history. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Company Could Face Some Challenges Growing The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. AqualisBraemar LOC has seen EPS rising for the last five years, at 45% per annum. While the company is not yet turning a profit, it is growing at a good rate. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

We'd also point out that AqualisBraemar LOC has issued stock equal to 38% of shares outstanding. Regularly doing this can be detrimental - it's hard to grow dividends per share when new shares are regularly being created.

The Dividend Could Prove To Be Unreliable

Overall, we always like to see the dividend being raised, but we don't think AqualisBraemar LOC will make a great income stock. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 2 warning signs for AqualisBraemar LOC that investors should know about before committing capital to this stock. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:ABL

ABL Group

An investment holding company, provides energy, and marine and engineering consultancy services to renewables, maritime, and oil and gas industries worldwide.

Excellent balance sheet with reasonable growth potential.