In recent weeks, the European market has shown resilience, with the pan-European STOXX Europe 600 Index snapping a two-week losing streak amid hopes for increased government spending. However, ongoing trade tensions and inflation concerns continue to influence central bank policies across the region. In such an environment, dividend stocks can offer investors a potential source of steady income and stability, making them an appealing choice for those looking to enhance their portfolios amidst economic uncertainty.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.91% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.01% | ★★★★★★ |

| Mapfre (BME:MAP) | 5.55% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.33% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.26% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.46% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.70% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Thermador Groupe (ENXTPA:THEP) | 3.05% | ★★★★★☆ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

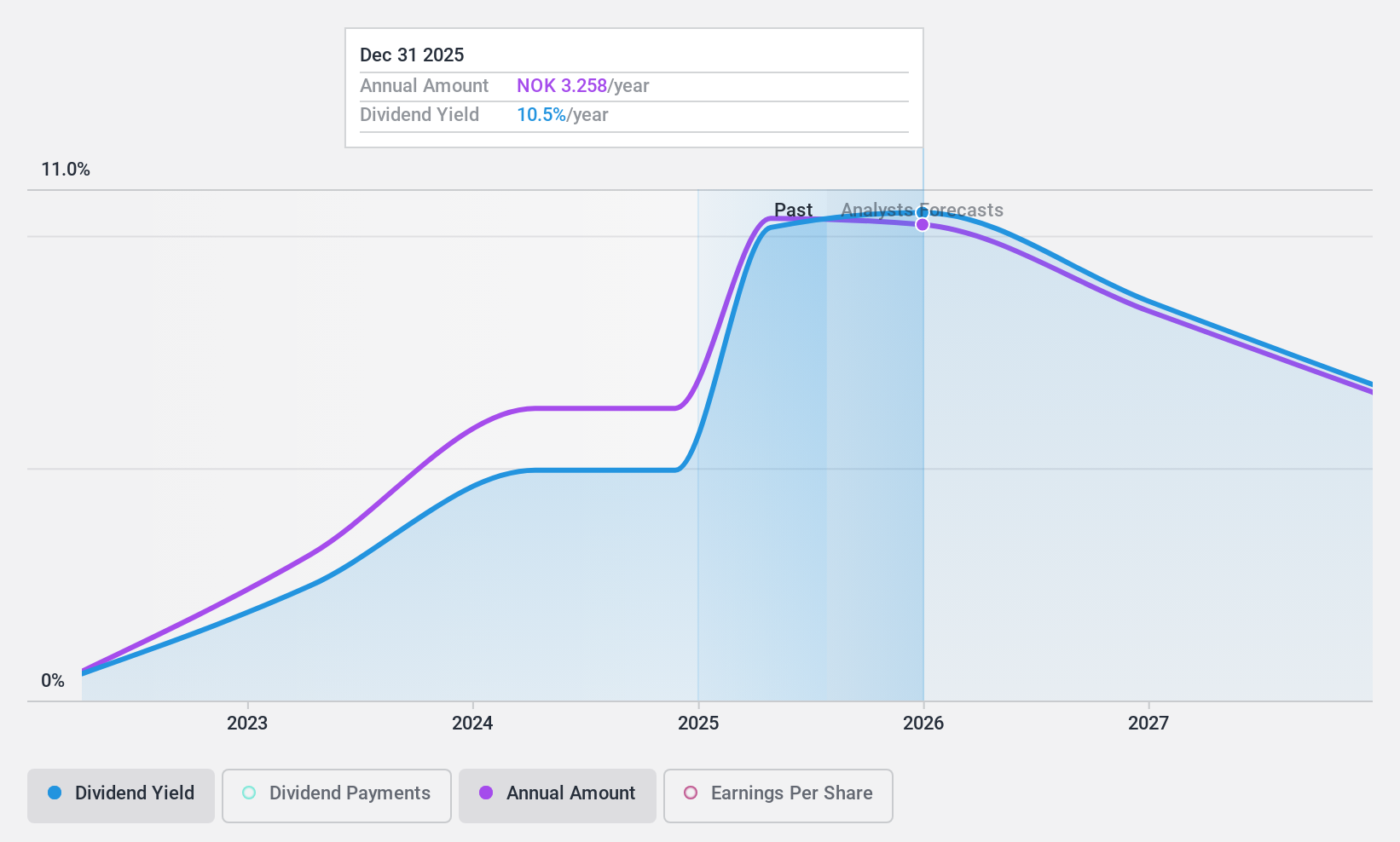

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aker Solutions ASA offers solutions, products, systems, and services to the oil and gas industry across various countries including Norway, the United States, and Brazil, with a market cap of NOK16.16 billion.

Operations: Aker Solutions ASA's revenue segments include Life Cycle at NOK13.25 billion and Renewables and Field Development at NOK38.09 billion.

Dividend Yield: 9.8%

Aker Solutions' proposed dividend of NOK 3.30 per share for 2024, pending approval, aligns with its policy to distribute about 50% of net income. Despite a high cash payout ratio of 95.7%, dividends are covered by earnings with a reasonable payout ratio of 59.9%. The company reported strong revenue growth in 2024 but faced declining net income, impacting dividend sustainability. Recent contracts in renewables could bolster future revenues, yet earnings forecasts suggest potential declines ahead.

- Unlock comprehensive insights into our analysis of Aker Solutions stock in this dividend report.

- The valuation report we've compiled suggests that Aker Solutions' current price could be quite moderate.

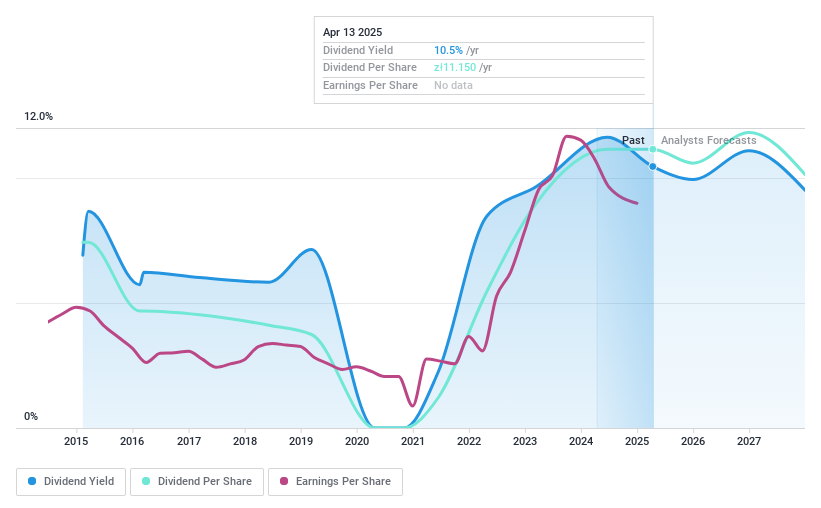

Bank Handlowy w Warszawie (WSE:BHW)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bank Handlowy w Warszawie S.A. offers a variety of commercial banking services to both individual and corporate clients in Poland and internationally, with a market capitalization of PLN15.50 billion.

Operations: Bank Handlowy w Warszawie S.A. and its subsidiaries generate revenue by providing a comprehensive suite of banking services to both personal and business clients across Poland and global markets.

Dividend Yield: 9.4%

Bank Handlowy w Warszawie offers a high dividend yield of 9.4%, placing it in the top 25% of Polish dividend payers, but concerns exist regarding sustainability and reliability. Current earnings cover the payout ratio of 77%, yet future coverage is uncertain with a forecasted 92.5% payout ratio in three years. The bank's net income fell to PLN 1.76 billion for 2024, highlighting challenges amid volatile dividends and high non-performing loans at 2.8%.

- Click to explore a detailed breakdown of our findings in Bank Handlowy w Warszawie's dividend report.

- According our valuation report, there's an indication that Bank Handlowy w Warszawie's share price might be on the cheaper side.

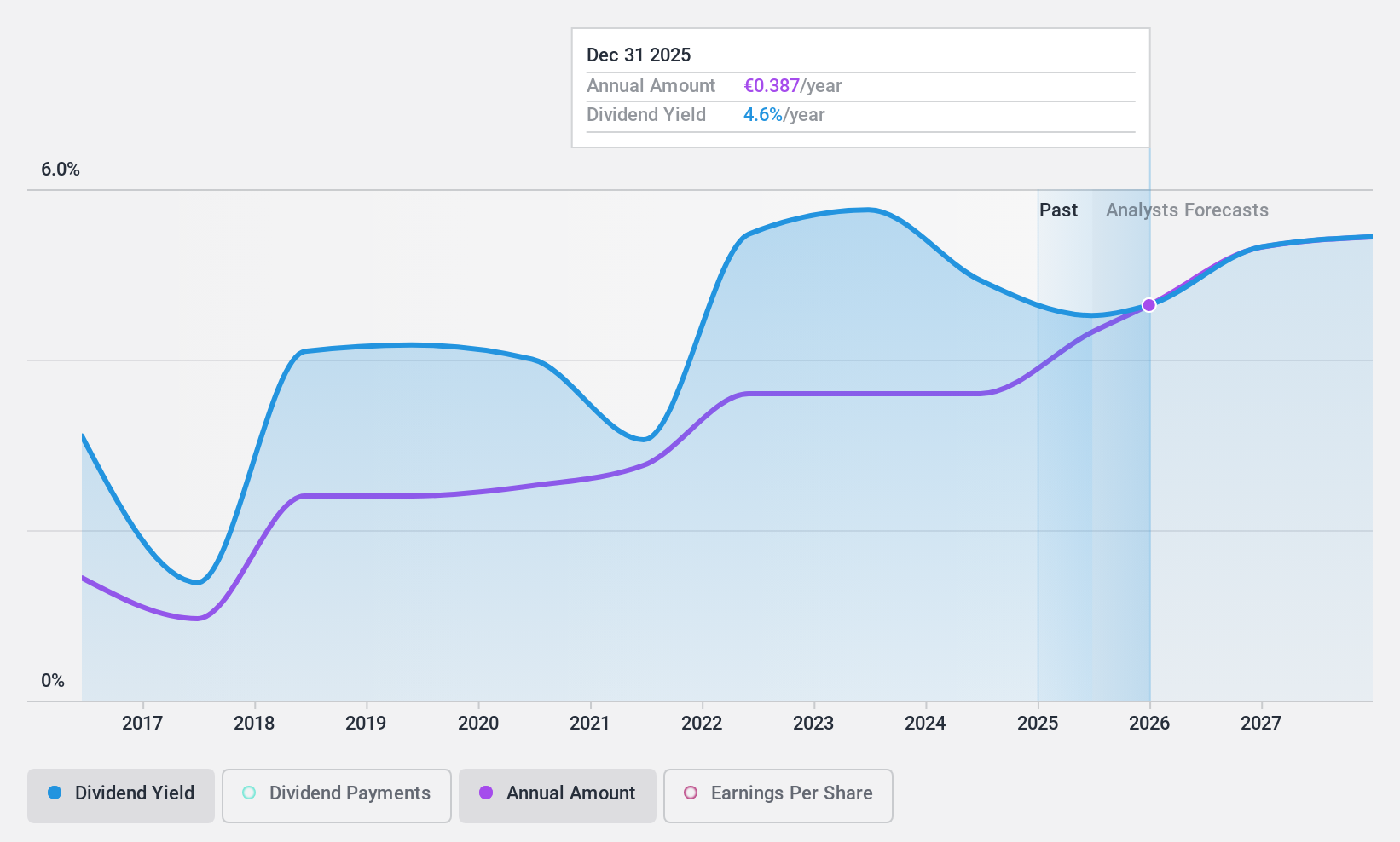

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MLP SE, with a market cap of €866.87 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue through its financial services offerings to private, corporate, and institutional clients in Germany.

Dividend Yield: 4.5%

MLP SE's dividend yield of 4.53% ranks it among the top 25% in Germany, supported by a low cash payout ratio of 18.6%, indicating strong coverage by cash flows. However, its dividend history is marked by volatility and unreliability over the past decade. Recent earnings growth—net income rose to €69.3 million—and a planned annual dividend increase to €0.36 per share suggest potential stability, though historical inconsistencies remain a concern for investors focusing on reliable dividends.

- Take a closer look at MLP's potential here in our dividend report.

- Our valuation report unveils the possibility MLP's shares may be trading at a discount.

Turning Ideas Into Actions

- Get an in-depth perspective on all 237 Top European Dividend Stocks by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank Handlowy w Warszawie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:BHW

Bank Handlowy w Warszawie

Provides a range of banking services for individual and corporate clients in Poland and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives