- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Does Aker BP’s Share Price Reflect the Impact of Stable Production Amid Market Shifts in 2025?

Reviewed by Bailey Pemberton

If you are trying to figure out what to do with Aker BP’s stock, you are definitely not alone. Over the last year, Aker BP shares have returned an impressive 16.5%. If you extend your gaze back five years, the stock has soared by 143.2%. Even so, the journey has hardly been a straight line. In the last week, shares ticked down 2.7%. Looking at a broader timeframe, there is a 3.3% gain over the past month and a tidy 10% upswing year to date. These swings reflect shifts in how investors see the company’s risk and growth potential, especially as global energy market dynamics continue to change. Some of the recent uptick can be traced to investor optimism around stable production levels despite broader market uncertainty.

But numbers only tell part of the story. Is Aker BP undervalued at these levels, or has the market already priced in its strengths? By running the company through six classic valuation checks, Aker BP scores just 2 out of 6 for being undervalued, suggesting a mixed picture. In the next section, each of these checks will be broken down one by one, and later, you will see a more effective way to cut through the noise and understand what Aker BP’s share price really means.

Aker BP scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Aker BP Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and discounting them back to reflect what they are worth today. For Aker BP, the model uses the “2 Stage Free Cash Flow to Equity” approach, projecting its ability to generate cash over time.

Currently, Aker BP’s Free Cash Flow stands at $3.44 Billion. Analysts have provided forecasts for the next several years, with annual Free Cash Flow expected to reach $1.95 Billion by the end of 2029. After this, projections are extended based on industry expectations for slowing growth over time.

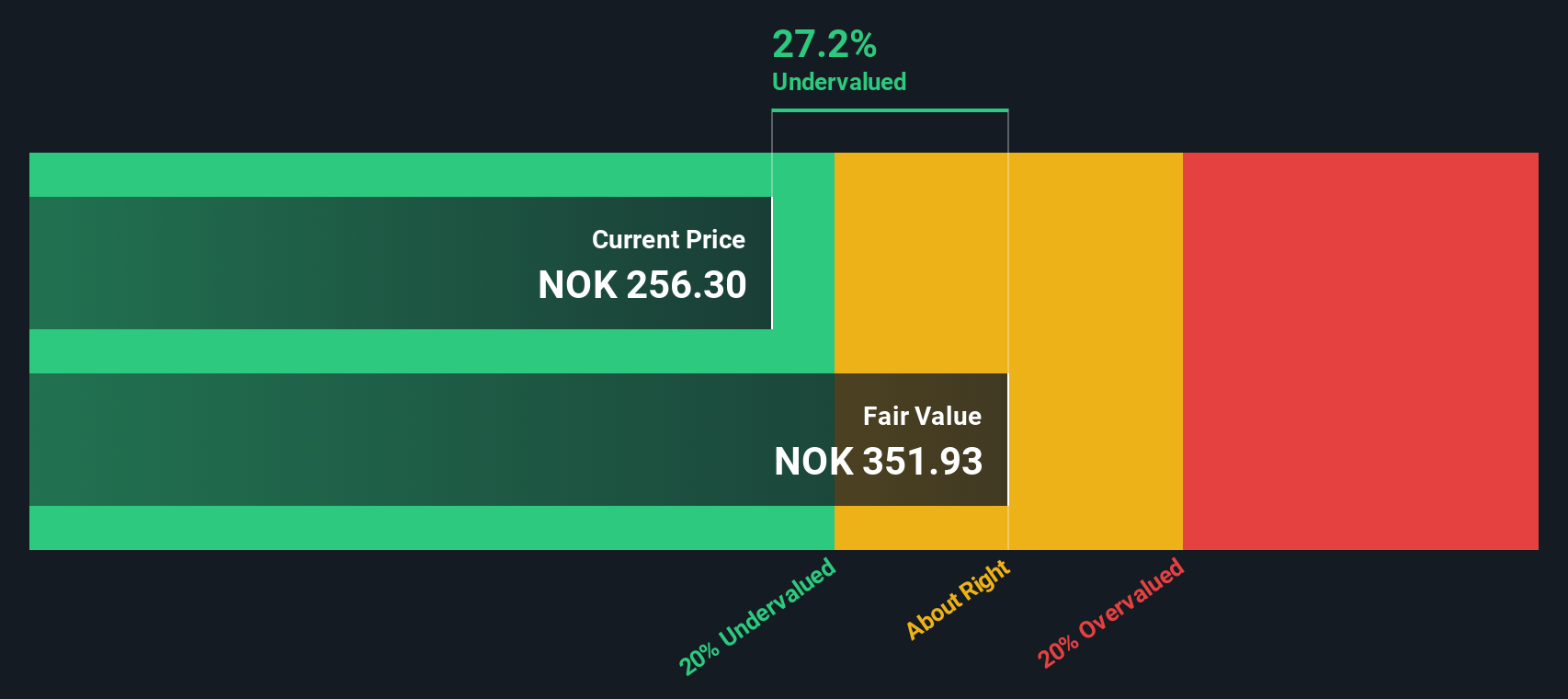

According to this model, Aker BP’s fair value, derived from its discounted future cash flows, is estimated at $352.03 per share. The DCF calculation implies a 27.2% discount to the current trading price, suggesting the stock is significantly undervalued at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Aker BP is undervalued by 27.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Aker BP Price vs Earnings

The Price-to-Earnings (PE) ratio is a popular metric for valuing profitable companies like Aker BP because it directly compares a company’s share price to its earnings. This approach is especially useful for businesses generating reliable profits, as it offers insight into how much investors are willing to pay for each unit of earnings.

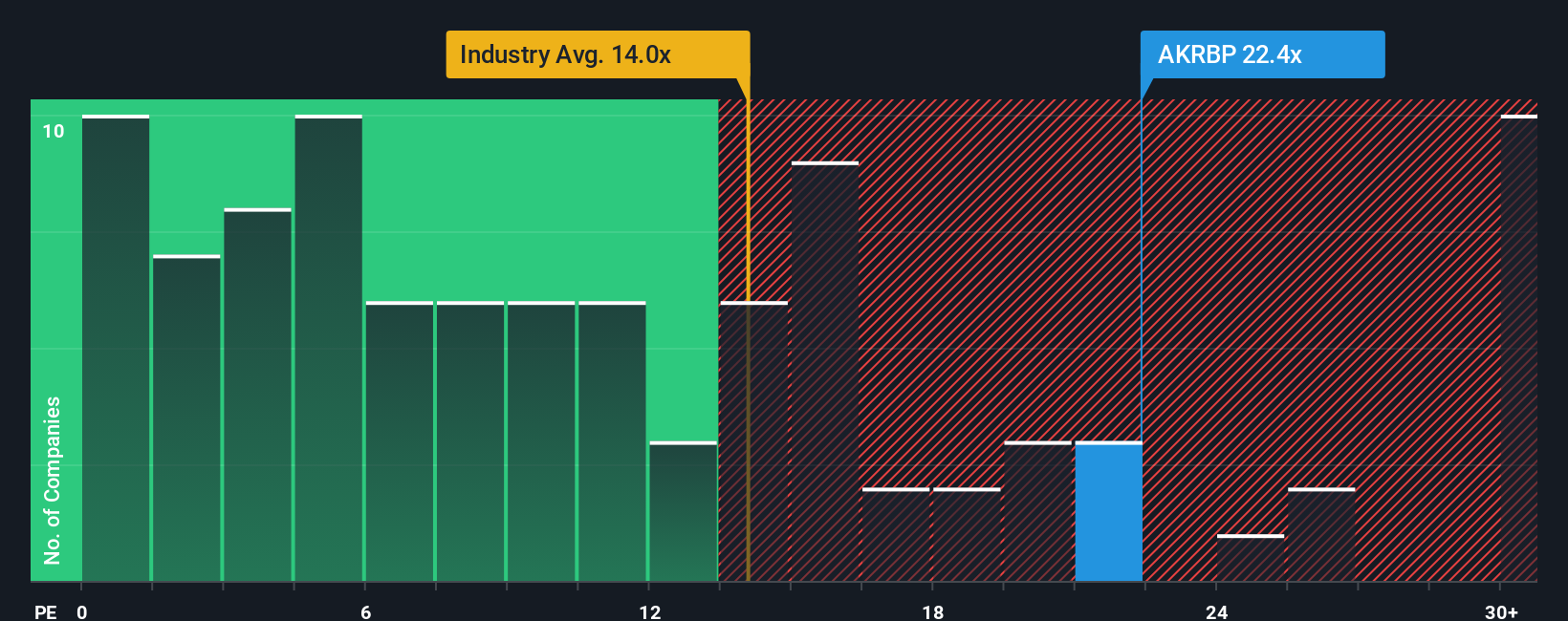

A company's "normal" or "fair" PE ratio is shaped by its growth prospects and the risks it faces. Companies expected to deliver faster earnings growth typically command higher PE ratios, while higher risks or uncertain growth can pull the ratio lower. For context, Aker BP currently trades at a PE of 22.36x, significantly above the oil and gas industry average of 12.92x and its peer group’s average of 8.29x. This suggests that the market is pricing in higher expectations or perceives lower risks compared to competitors.

Enter the Simply Wall St "Fair Ratio," a tailored benchmark that factors in not only industry and peer comparisons but also Aker BP’s own earnings growth outlook, profit margins, business size and specific risk profile. This makes it a more precise measure for judging value, as it considers the real picture for the company rather than relying solely on broad averages. For Aker BP, the Fair Ratio is calculated at 10.61x. With its actual PE at 22.36x, shares are trading well above what would be considered fair on this more personalized basis, pointing to an overvalued position right now.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aker BP Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. In simple terms, a Narrative is a story or perspective you create around a company. It is where you outline what you believe about Aker BP’s future, why you believe it, and then translate those beliefs into financial forecasts such as expected revenues, profit margins, and a fair value estimate.

Narratives connect your view of the company’s story to a set of financial assumptions and then to a calculated fair value, making investment decisions both logical and personal. On Simply Wall St’s platform, Narratives are easy to create and compare within the Community page, where millions of investors share their perspectives and update them as new information comes in, whether it is company news or fresh earnings results.

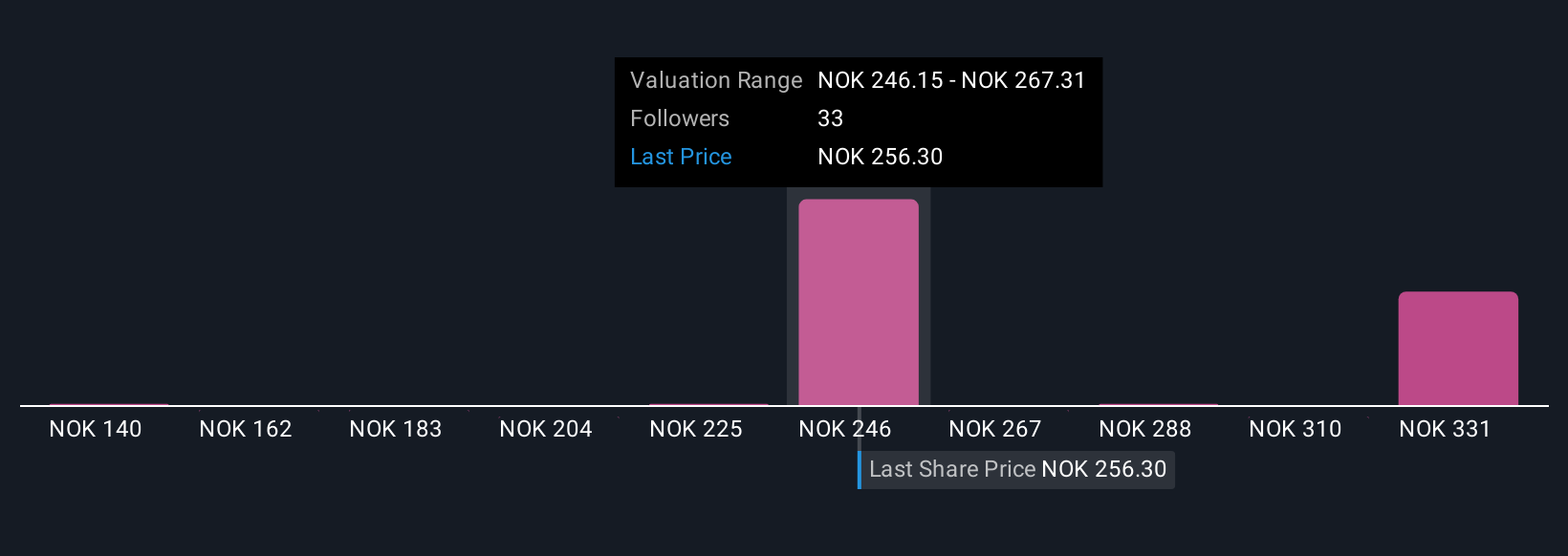

This means you can quickly see how your Narrative stacks up against others and know exactly when a stock looks attractive to you by comparing your calculated fair value to today’s market price. For example, with Aker BP, some investors’ Narratives see aggressive growth from projects like Yggdrasil supporting price targets as high as NOK300, while more cautious perspectives focused on rising emissions costs and margin risks lean towards targets as low as NOK190. Narratives help you interpret and act on these differences with clarity and confidence.

Do you think there's more to the story for Aker BP? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives