- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Aker BP (OB:AKRBP): Assessing Valuation Following Q3 Production and Sales Update

Reviewed by Kshitija Bhandaru

Aker BP (OB:AKRBP) released its production numbers for the third quarter, reporting an average daily output of 414 thousand barrels of oil equivalents. Net sales volumes reached 396 thousand barrels per day. Investors are now weighing what these figures mean for the company’s revenue and trends in operational efficiency.

See our latest analysis for Aker BP.

Aker BP’s share price has seen some volatility lately, with a modest 2.2% gain over the past month and a positive 7.2% return so far this year. Over the past twelve months, the stock’s total shareholder return stands at an impressive 21.1%, reflecting both share price appreciation and dividends. In the broader context, this steady momentum signals investors are increasingly confident in Aker BP’s growth potential. Consistent production results also reinforce the long-term story.

If you’re looking to broaden your investing scope beyond energy stocks, now is a great time to discover fast growing stocks with high insider ownership.

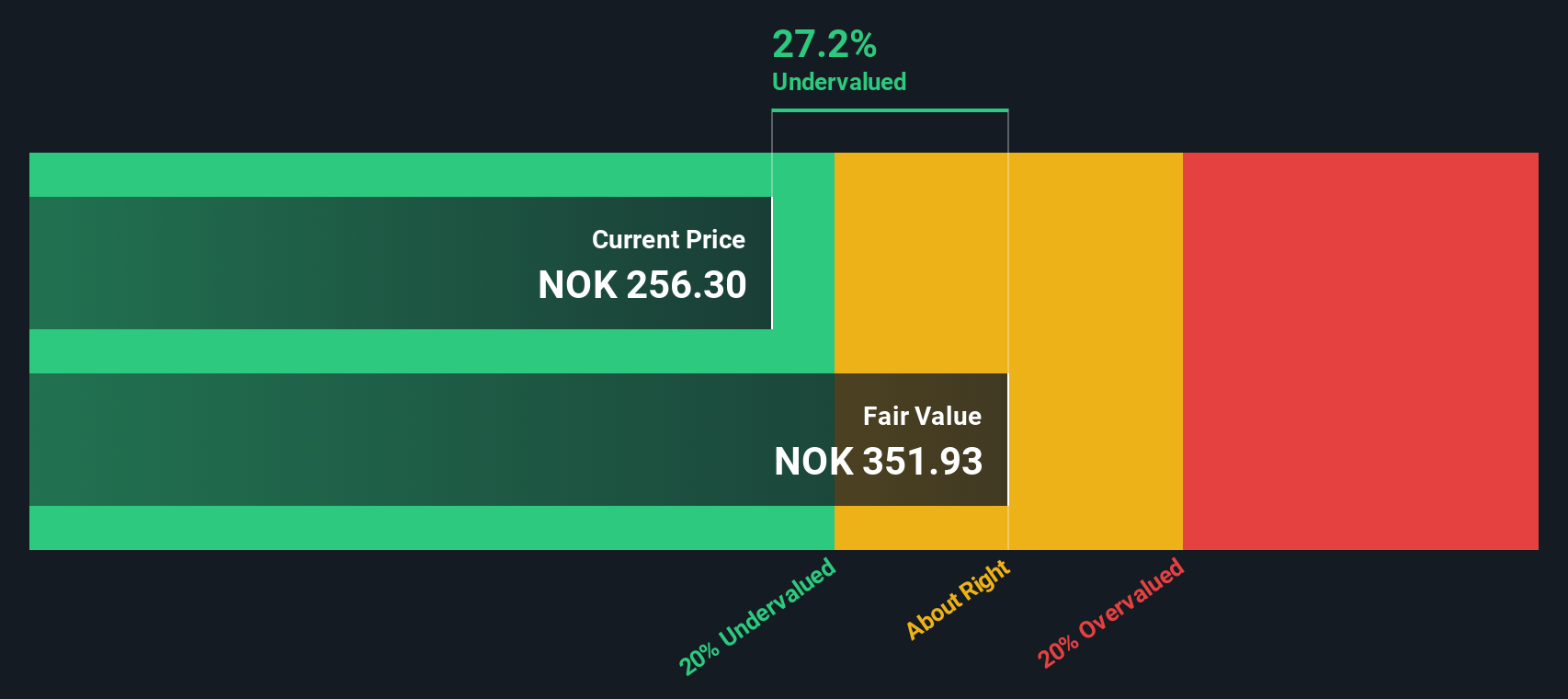

That brings us to the key question: with shares showing solid medium-term returns and production holding steady, does Aker BP remain undervalued or has the market already factored in the company’s future growth prospects?

Most Popular Narrative: 2.8% Undervalued

Aker BP’s most closely watched narrative suggests a fair value just above the current close, with analysts expecting cautious upside. Let’s see what’s driving this outlook.

The Yggdrasil project is designed to be technologically advanced and low-emission, powered by renewable electricity from shore, ensuring efficient and cost-effective operations that will likely improve net margins by reducing operational costs and environmental compliance expenses.

Curious why future margin expansion is at the heart of this narrative? The fair value hinges on advanced technology, big assumptions about cost discipline, and a major boost to operating efficiency. Want to know which financial levers analysts are betting on for Aker BP’s next chapter? The full story behind this price target features bold projections and a high-stakes transformation plan, all unpacked in the full narrative.

Result: Fair Value of $256.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising emissions costs and heavy reliance on key assets could quickly shift Aker BP’s margin outlook and threaten revenue stability in the coming years.

Find out about the key risks to this Aker BP narrative.

Another View: Our DCF Model Points to Deeper Value

Looking at Aker BP through the lens of our SWS DCF model, the shares appear to be trading at a significant discount, about 30% below what the model flags as fair value (NOK359). This lens suggests a much more substantial undervaluation than the consensus price target alone. So, do the market’s expectations underestimate the company’s long-term cash flow potential?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Aker BP Narrative

If you’d rather dig into the numbers yourself or build a perspective that fits your own research, you can craft your own analysis in just minutes. Do it your way.

A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single opportunity slip by. Now is the perfect time to act on trends shaping tomorrow’s markets and strengthen your portfolio with smart picks.

- Target future demand by zeroing in on these 33 healthcare AI stocks transforming medicine and unlocking new growth in digital health innovations and precision diagnostics.

- Tap into huge upside potential with these 878 undervalued stocks based on cash flows offering solid fundamentals and room for appreciation before they catch the market’s attention.

- Seize the moment in rapidly evolving tech by checking out these 25 AI penny stocks at the forefront of artificial intelligence and automation breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives