- Norway

- /

- Commercial Services

- /

- OB:ACC

Companies Like Aker Carbon Capture (OB:ACC) Can Afford To Invest In Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

So should Aker Carbon Capture (OB:ACC) shareholders be worried about its cash burn? In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

How Long Is Aker Carbon Capture's Cash Runway?

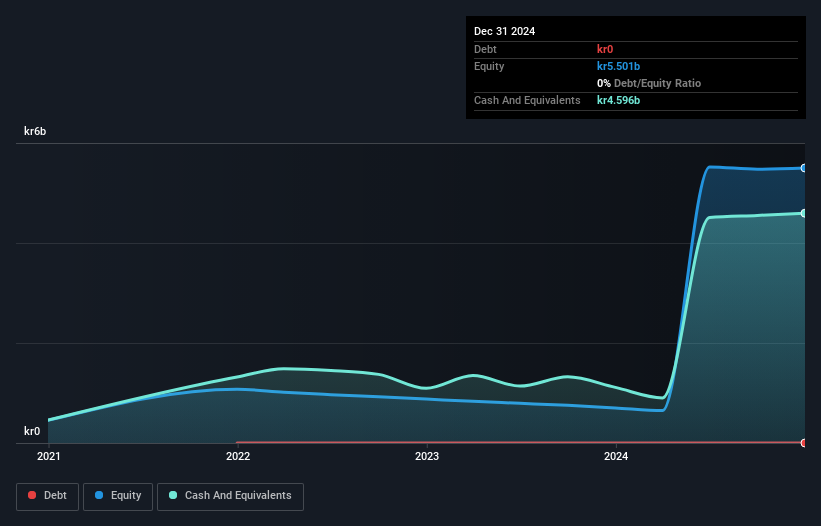

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at December 2024, Aker Carbon Capture had cash of kr4.6b and no debt. In the last year, its cash burn was kr230m. So it had a very long cash runway of many years from December 2024. Notably, however, analysts think that Aker Carbon Capture will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. Depicted below, you can see how its cash holdings have changed over time.

View our latest analysis for Aker Carbon Capture

How Hard Would It Be For Aker Carbon Capture To Raise More Cash For Growth?

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Aker Carbon Capture has a market capitalisation of kr2.1b and burnt through kr230m last year, which is 11% of the company's market value. As a result, we'd venture that the company could raise more cash for growth without much trouble, albeit at the cost of some dilution.

So, Should We Worry About Aker Carbon Capture's Cash Burn?

Given it's an early stage company, we don't have a lot of data with which to judge Aker Carbon Capture's cash burn. Having said that, we can say that its cash runway was a real positive. Overall, we don't think shareholders need to be worried about its cash burn in the near term. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 2 warning signs for Aker Carbon Capture that investors should know when investing in the stock.

Of course Aker Carbon Capture may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

If you're looking to trade Aker Carbon Capture, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ACC

Aker Carbon Capture

Provides products, technology, and solutions within the field of carbon capture technologies, utilization, and storage in Norway and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives