- Norway

- /

- Commercial Services

- /

- OB:ACC

Broker Revenue Forecasts For Aker Carbon Capture ASA (OB:ACC) Are Surging Higher

Aker Carbon Capture ASA (OB:ACC) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's forecasts. The analysts have sharply increased their revenue numbers, with a view that Aker Carbon Capture will make substantially more sales than they'd previously expected.

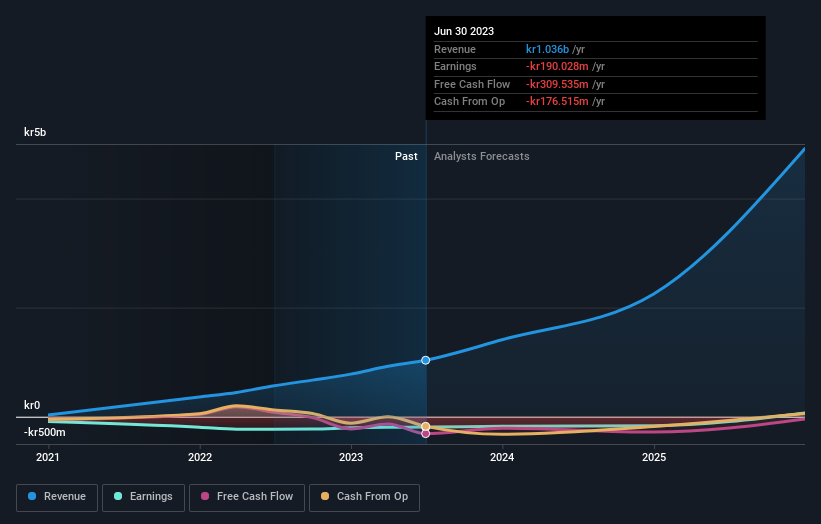

After this upgrade, Aker Carbon Capture's eight analysts are now forecasting revenues of kr1.4b in 2023. This would be a sizeable 36% improvement in sales compared to the last 12 months. The loss per share is expected to ameliorate slightly, reducing to kr0.29. However, before this estimates update, the consensus had been expecting revenues of kr1.2b and kr0.32 per share in losses. We can see there's definitely been a change in sentiment in this update, with the analysts administering a sizeable upgrade to this year's revenue estimates, while at the same time reducing their loss estimates.

Check out our latest analysis for Aker Carbon Capture

Of course, another way to look at these forecasts is to place them into context against the industry itself. We can infer from the latest estimates that forecasts expect a continuation of Aker Carbon Capture'shistorical trends, as the 86% annualised revenue growth to the end of 2023 is roughly in line with the 82% annual revenue growth over the past year. Compare this with the broader industry, which analyst estimates (in aggregate) suggest will see revenues grow 39% annually. So although Aker Carbon Capture is expected to maintain its revenue growth rate, it's definitely expected to grow faster than the wider industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Aker Carbon Capture is moving incrementally towards profitability. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. Seeing the dramatic upgrade to this year's forecasts, it might be time to take another look at Aker Carbon Capture.

Better yet, Aker Carbon Capture is expected to break-even soon - within the next few years - according to analyst forecasts, which would be a momentous event for shareholders. For more information, you can click through to our free platform to learn more about these forecasts.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ACC

Aker Carbon Capture

Provides products, technology, and solutions within the field of carbon capture technologies, utilization, and storage in Norway and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives