- Norway

- /

- Electrical

- /

- OB:ZAP

Take Care Before Jumping Onto Zaptec ASA (OB:ZAP) Even Though It's 26% Cheaper

Zaptec ASA (OB:ZAP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

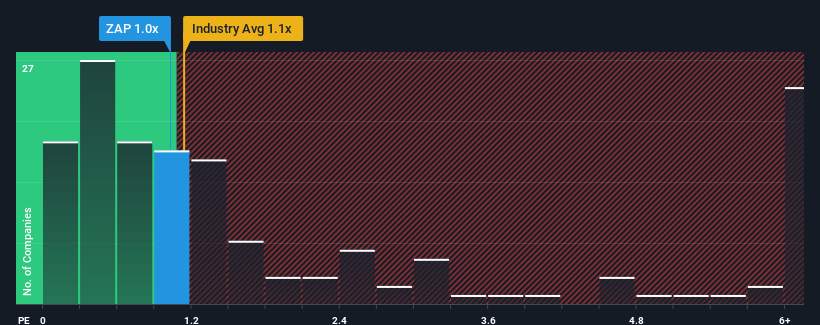

Although its price has dipped substantially, there still wouldn't be many who think Zaptec's price-to-sales (or "P/S") ratio of 1x is worth a mention when it essentially matches the median P/S in Norway's Electrical industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Zaptec

How Zaptec Has Been Performing

With revenue growth that's superior to most other companies of late, Zaptec has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Zaptec will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Zaptec?

The only time you'd be comfortable seeing a P/S like Zaptec's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 88% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 23% per year during the coming three years according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 11% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Zaptec's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Zaptec's P/S

Following Zaptec's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Zaptec currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Zaptec (1 is significant!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zaptec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ZAP

Zaptec

Engages in the development and sale of chargers, charging systems, and services for electric car charging in Norway, Sweden, Switzerland, Denmark, Iceland, rest of Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives