The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Veidekke (OB:VEI). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Veidekke

How Fast Is Veidekke Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. To the delight of shareholders, Veidekke has achieved impressive annual EPS growth of 42%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

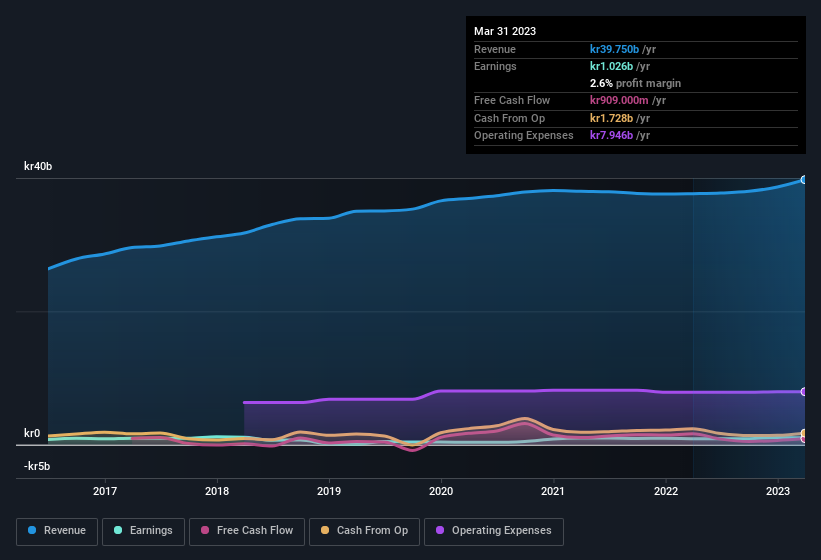

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Veidekke maintained stable EBIT margins over the last year, all while growing revenue 5.6% to kr40b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Veidekke's balance sheet strength, before getting too excited.

Are Veidekke Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Insiders both bought and sold Veidekke shares in the last year, but the good news is they spent kr144k more buying than they netted selling. When you weigh that up, it is a mild positive, indicating increased alignment between shareholders and management.

It's commendable to see that insiders have been buying shares in Veidekke, but there is more evidence of shareholder friendly management. Namely, Veidekke has a very reasonable level of CEO pay. For companies with market capitalisations between kr11b and kr35b, like Veidekke, the median CEO pay is around kr8.6m.

Veidekke's CEO took home a total compensation package worth kr6.4m in the year leading up to December 2022. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add Veidekke To Your Watchlist?

Veidekke's earnings per share have been soaring, with growth rates sky high. The company can also boast of insider buying, and reasonable remuneration for the CEO. The strong EPS growth suggests Veidekke may be at an inflection point. For those attracted to fast growth, we'd suggest this stock merits monitoring. It is worth noting though that we have found 1 warning sign for Veidekke that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Veidekke, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:VEI

Veidekke

Operates as a construction and property development company in Norway, Sweden, and Denmark.

Outstanding track record with excellent balance sheet and pays a dividend.