Tomra Systems (OB:TOM): Valuation Insights Following Chairman’s Recent Share Purchase

Reviewed by Simply Wall St

Tomra Systems (OB:TOM) drew attention after a regulatory filing revealed that Johan Hjertonsson, chairman and primary insider, purchased 10,000 additional shares. This move doubled his stake to 20,000 shares. Investors often watch insider activity for signals on management outlook and commitment.

See our latest analysis for Tomra Systems.

This insider buying comes after what has been a challenging stretch for Tomra Systems, with the share price sliding nearly 19% year-to-date and the one-year total shareholder return at negative 17.7%. While recent news may have offered a brief boost, momentum overall has been fading and long-term total returns remain underwhelming.

If you are looking to spot other companies where leadership is backing growth, this is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading well below analyst price targets despite the company’s recent struggles, the question now is whether Tomra Systems is undervalued, or if the market has already incorporated all future growth into its current price.

Most Popular Narrative: 21.8% Undervalued

Tomra Systems’ last close of NOK121.40 stands well below the most widely followed fair value estimate of NOK155.33. This highlights a sizable disconnect between market price and narrative expectations. The wide gap between market valuation and this narrative sets the tone for a debate over Tomra’s true potential and the assumptions driving its fair value.

The upcoming implementation of new deposit return systems in multiple countries (including Poland, Portugal, Spain, Moldova, and ongoing progress in the UK) is set to significantly expand Tomra's addressable market for reverse vending machines and services, supporting strong future revenue growth and higher recurring service revenues.

Curious what assumptions turn expansion plans into an eye-catching undervaluation? The narrative factors in bold growth moves, accelerating recurring revenues, and a future profit profile that could surprise the market. The catch: The actual math and forecasts underpinning this valuation are anything but obvious. Uncover which numbers analysts believe could justify such a bullish fair value.

Result: Fair Value of NOK155.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures and unpredictable order flows in key markets could quickly undermine even the most optimistic case for Tomra’s future returns.

Find out about the key risks to this Tomra Systems narrative.

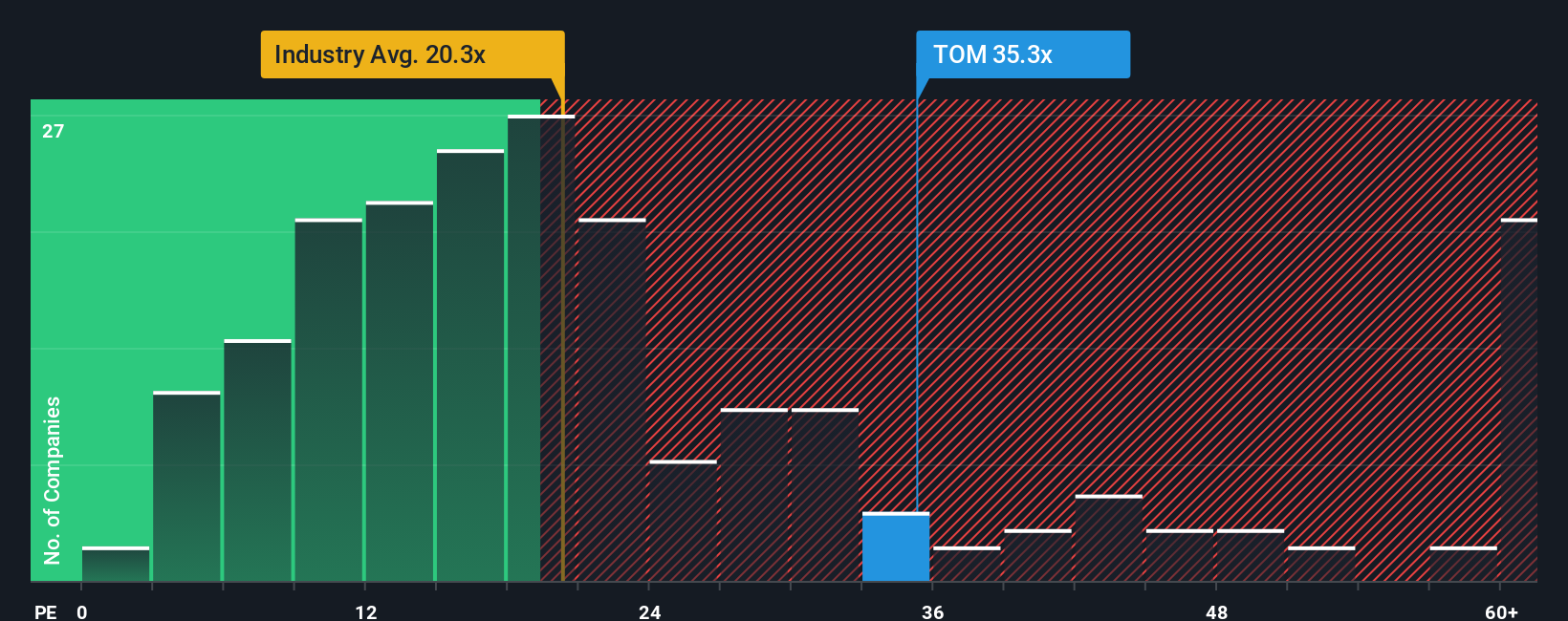

Another View: Market Multiples Tell a Different Story

Looking at Tomra Systems through the lens of earnings multiples challenges the bullish narrative. The company’s price-to-earnings ratio stands at 30.6x, which is notably higher than both the peer group average (22.4x) and the broader European Machinery sector (20x). Even compared to the estimated fair ratio of 34.9x, Tomra looks pricey. This could indicate that much of its future potential is already reflected in the share price, raising the question of whether this premium could limit returns if expectations change.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tomra Systems Narrative

If you want to test the numbers and assumptions for yourself, it's easy to dig into the data and shape your own perspective in minutes. Do it your way

A great starting point for your Tomra Systems research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave potential gains on the table. The right opportunities are out there and the Simply Wall St screener helps you spot them confidently, with no guesswork or FOMO required.

- Tap fresh sources of passive income and secure your portfolio with these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

- Position yourself at the front of medical innovation and uncover growth stories in these 31 healthcare AI stocks that are transforming healthcare with artificial intelligence.

- Challenge the market consensus and seize value with these 879 undervalued stocks based on cash flows that stand out based on robust cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomra Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:TOM

Tomra Systems

Provides sensor-based solutions for optimal resource productivity worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives