Tomra Systems (OB:TOM): Evaluating Valuation Following Leadership Change in Recycling Division

Reviewed by Simply Wall St

Most Popular Narrative: 12.6% Undervalued

According to the most widely followed valuation narrative, Tomra Systems is undervalued by 12.6% when comparing the current share price to the consensus fair value. This view is founded on expectations of strong revenue growth, improving margins, and a rebound in earnings as market conditions normalize.

"The upcoming implementation of new deposit return systems in multiple countries (including Poland, Portugal, Spain, Moldova, and ongoing progress in the UK) is set to significantly expand Tomra's addressable market for reverse vending machines and services, supporting strong future revenue growth and higher recurring service revenues."

Curious why analysts see double-digit upside for Tomra Systems? Behind this bullish forecast lie ambitious projections for revenue acceleration, margin expansion, and sector-shaping regulatory tailwinds. The narrative's math centers on a promising growth trajectory. Can Tomra deliver on these lofty expectations?

Result: Fair Value of NOK174.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering uncertainty in key recycling markets and persistently weak demand for recycled plastics could quickly unravel Tomra's bullish outlook.

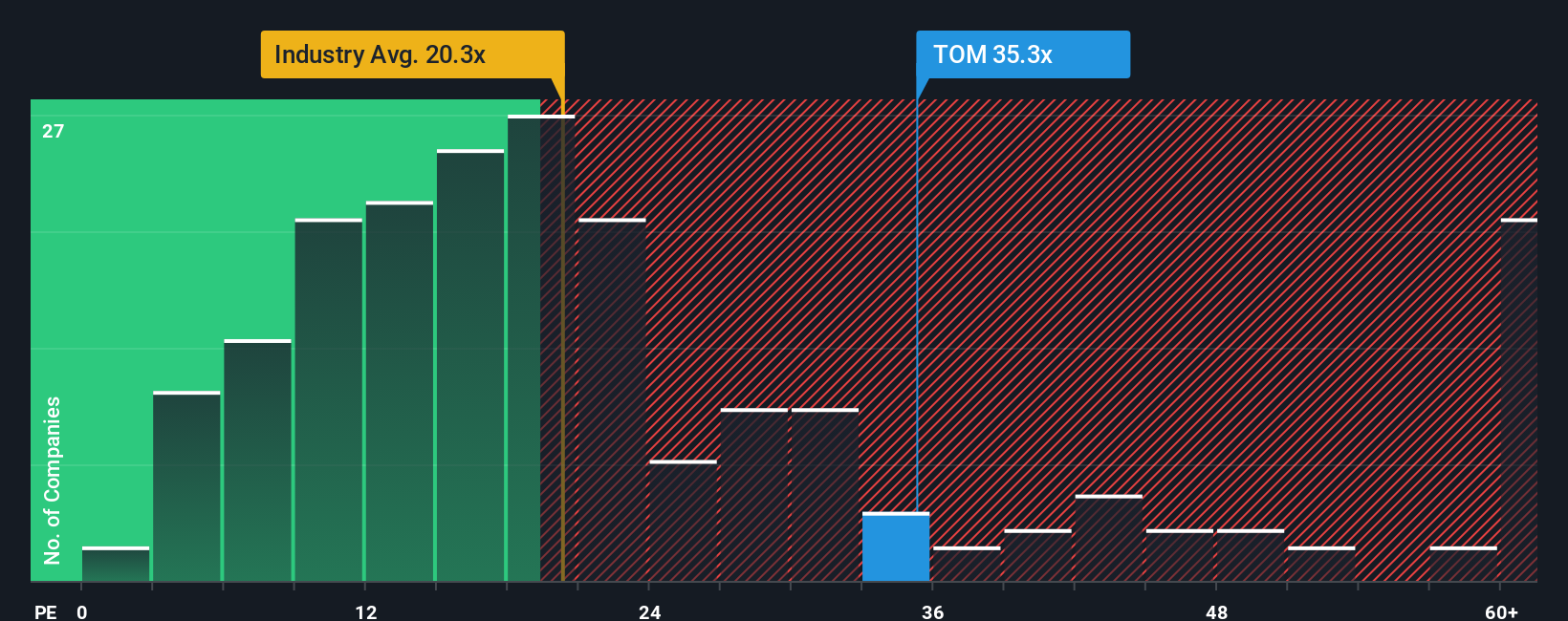

Find out about the key risks to this Tomra Systems narrative.Another View: Market Multiples Raise Questions

Looking at Tomra Systems from a different perspective, its current price is significantly higher than the broader industry when measured against earnings. This brings the earlier undervaluation into question and raises debate about the potential for future upside. Which scenario will unfold?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Tomra Systems to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Tomra Systems Narrative

Readers who want to examine the numbers firsthand or challenge the current story have the tools to craft their own perspective in just a few minutes, so why not Do it your way?

A great starting point for your Tomra Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock new opportunities beyond Tomra Systems by checking out screens tailored for your style and goals. If you skip these, you might overlook some of tomorrow's top performers.

- Pinpoint undervalued gems trading at attractive discounts by analyzing undervalued stocks based on cash flows and get ahead of the curve.

- Power up your portfolio with next-generation breakthroughs in medicine and technology by spotting standout companies through healthcare AI stocks.

- Boost your income and balance risk by searching for reliable businesses offering strong payouts using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tomra Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About OB:TOM

Tomra Systems

Provides sensor-based solutions for optimal resource productivity worldwide.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives