- Norway

- /

- Electrical

- /

- OB:OTOVO

Subdued Growth No Barrier To Otovo ASA (OB:OTOVO) With Shares Advancing 30%

Otovo ASA (OB:OTOVO) shares have had a really impressive month, gaining 30% after a shaky period beforehand. But the last month did very little to improve the 85% share price decline over the last year.

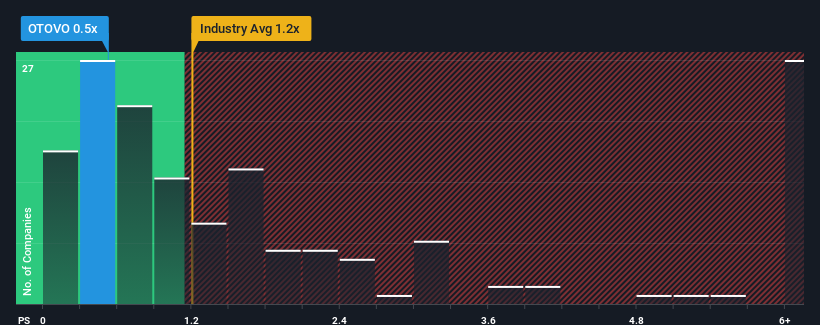

Even after such a large jump in price, it's still not a stretch to say that Otovo's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Electrical industry in Norway, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Otovo

How Otovo Has Been Performing

With revenue growth that's inferior to most other companies of late, Otovo has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Otovo's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

Otovo's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 9.6% gain to the company's revenues. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 5.7% during the coming year according to the four analysts following the company. With the industry predicted to deliver 11% growth, the company is positioned for a weaker revenue result.

In light of this, it's curious that Otovo's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Otovo appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that Otovo's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Having said that, be aware Otovo is showing 5 warning signs in our investment analysis, and 3 of those are a bit concerning.

If you're unsure about the strength of Otovo's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:OTOVO

Slight with mediocre balance sheet.

Market Insights

Community Narratives