- Norway

- /

- Electrical

- /

- OB:OTOVO

Otovo ASA (OB:OTOVO) Not Doing Enough For Some Investors As Its Shares Slump 25%

The Otovo ASA (OB:OTOVO) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 85% loss during that time.

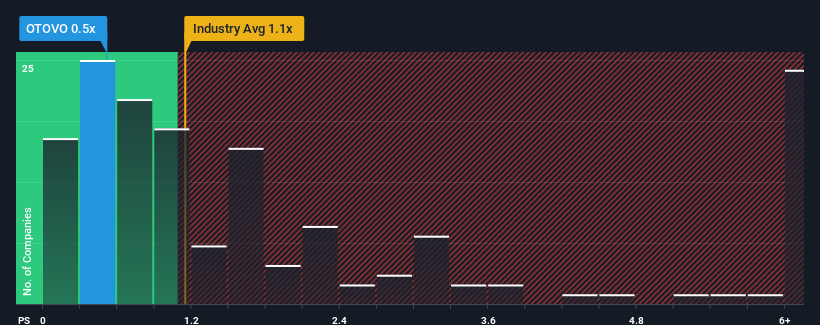

Since its price has dipped substantially, it would be understandable if you think Otovo is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.5x, considering almost half the companies in Norway's Electrical industry have P/S ratios above 1.1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Otovo

How Has Otovo Performed Recently?

Recent revenue growth for Otovo has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. Those who are bullish on Otovo will be hoping that this isn't the case.

Want the full picture on analyst estimates for the company? Then our free report on Otovo will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Otovo's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 9.6%. The latest three year period has seen an incredible overall rise in revenue, even though the last 12 month performance was only fair. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth is heading into negative territory, declining 6.8% over the next year. That's not great when the rest of the industry is expected to grow by 9.2%.

With this in consideration, we find it intriguing that Otovo's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Final Word

The southerly movements of Otovo's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Otovo's analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Otovo (at least 2 which make us uncomfortable), and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:OTOVO

Slight with mediocre balance sheet.

Market Insights

Community Narratives