As the European markets rebound, with major stock indexes rising and the STOXX Europe 600 Index climbing 3.93% over a recent week, investor sentiment has been buoyed by the European Central Bank's rate cuts and delayed tariff impositions by President Trump. In this context, penny stocks—though an older term—remain relevant as they often represent smaller or newer companies that can offer growth opportunities at lower price points. By focusing on those with strong balance sheets and solid fundamentals, investors may uncover potential gems in this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.11 | SEK2.02B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.70 | SEK249.54M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.65 | SEK273.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.66 | SEK222.67M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.60 | PLN122.02M | ✅ 3 ⚠️ 2 View Analysis > |

| FAE Technology (BIT:FAE) | €2.34 | €46.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Cellularline (BIT:CELL) | €2.53 | €53.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.975 | €32.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.01 | €23.22M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.215 | €305.81M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 430 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Anora Group Oyj (HLSE:ANORA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anora Group Oyj is involved in the production, importation, marketing, distribution, and sale of alcoholic beverages across Finland, Europe, and internationally with a market cap of €220.56 million.

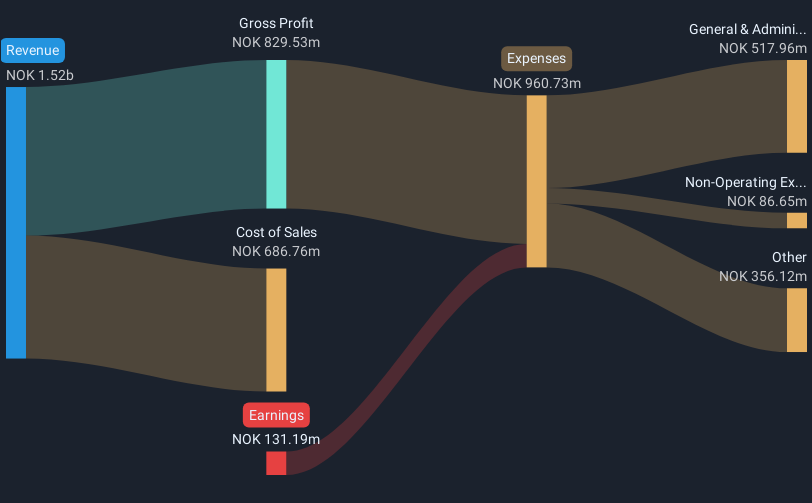

Operations: The company's revenue is derived from three main segments: Wine (€323 million), Spirits (€227 million), and Industrial (€234 million).

Market Cap: €220.56M

Anora Group Oyj, with a market cap of €220.56 million, has become profitable recently, reporting a net income of €7.9 million for the fourth quarter of 2024 compared to a loss the previous year. The company maintains a satisfactory net debt to equity ratio of 0.9% and its short-term assets exceed both short-term and long-term liabilities, indicating financial stability. However, its dividend yield of 6.74% is not well covered by earnings and interest payments are not adequately covered by EBIT. Recent leadership changes include Kirsi Puntila's appointment as CEO and Rebecca Tallmark joining the board.

- Click here and access our complete financial health analysis report to understand the dynamics of Anora Group Oyj.

- Learn about Anora Group Oyj's future growth trajectory here.

Inin Group (OB:ININ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Inin Group AS is an investment company that concentrates on infrastructure and industry services in Norway, Sweden, and internationally, with a market cap of NOK371.17 million.

Operations: Inin Group does not report specific revenue segments.

Market Cap: NOK371.17M

Inin Group AS, with a market cap of NOK371.17 million, has shown significant revenue growth, reporting NOK548.58 million in sales for Q4 2024 compared to NOK321.87 million the previous year. Despite this growth, the company remains unprofitable with a net loss of NOK64.97 million for the same period and faces high share price volatility over recent months. The company's financial position is bolstered by sufficient cash runway exceeding three years due to positive free cash flow growth of 53.8% annually, although short-term liabilities slightly exceed short-term assets by NOK33.3 million as it navigates its acquisition by Qben Infra AB (publ).

- Unlock comprehensive insights into our analysis of Inin Group stock in this financial health report.

- Assess Inin Group's future earnings estimates with our detailed growth reports.

Heidelberg Pharma (XTRA:HPHA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heidelberg Pharma AG is a biopharmaceutical company specializing in oncology and antibody targeted amanitin conjugates (ATAC) with operations in Germany, the United States, and internationally, and has a market cap of €128.16 million.

Operations: The company's revenue is primarily derived from its ADC Technology and Customer Specific Research segment, generating €6.85 million.

Market Cap: €128.16M

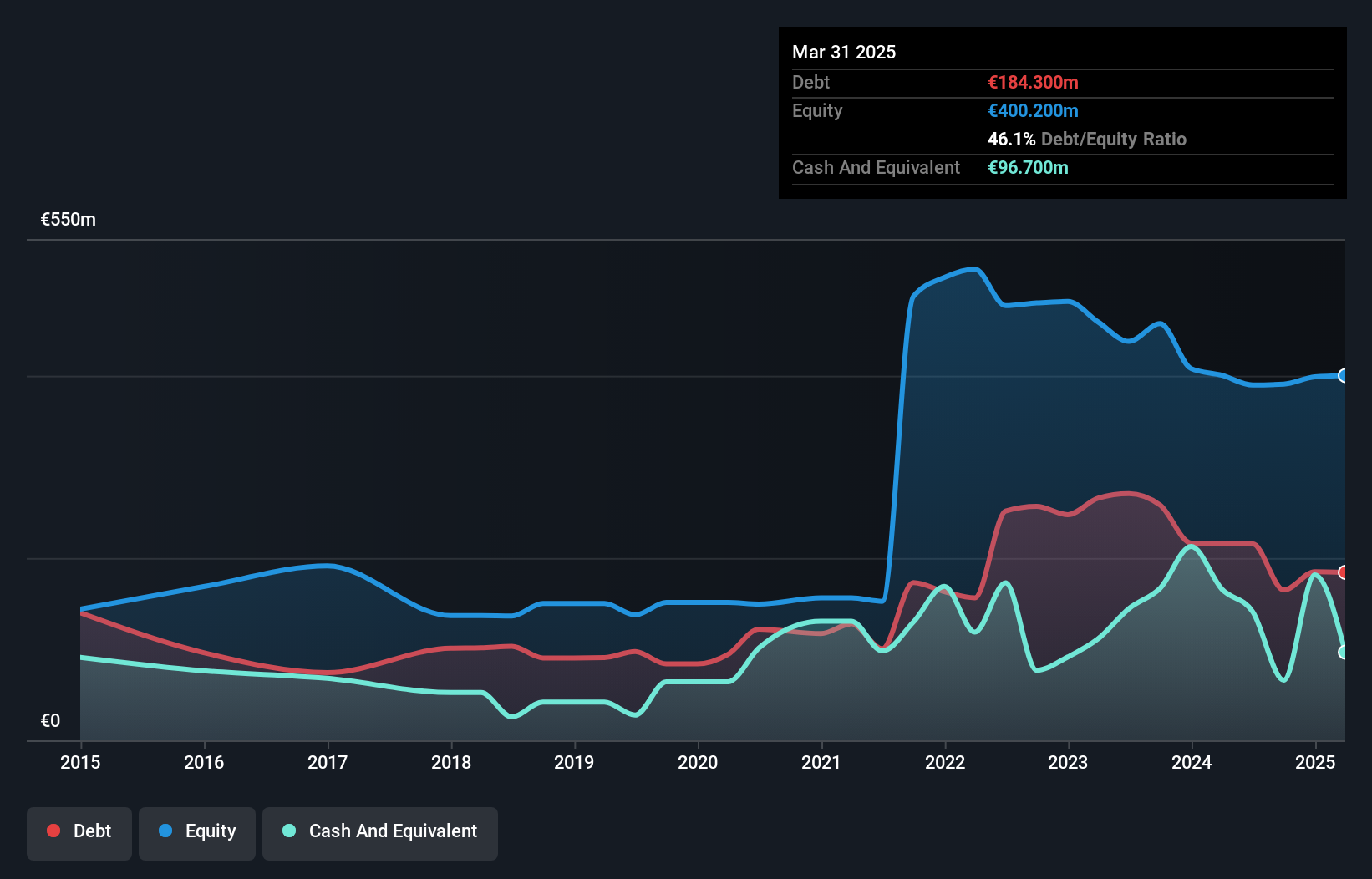

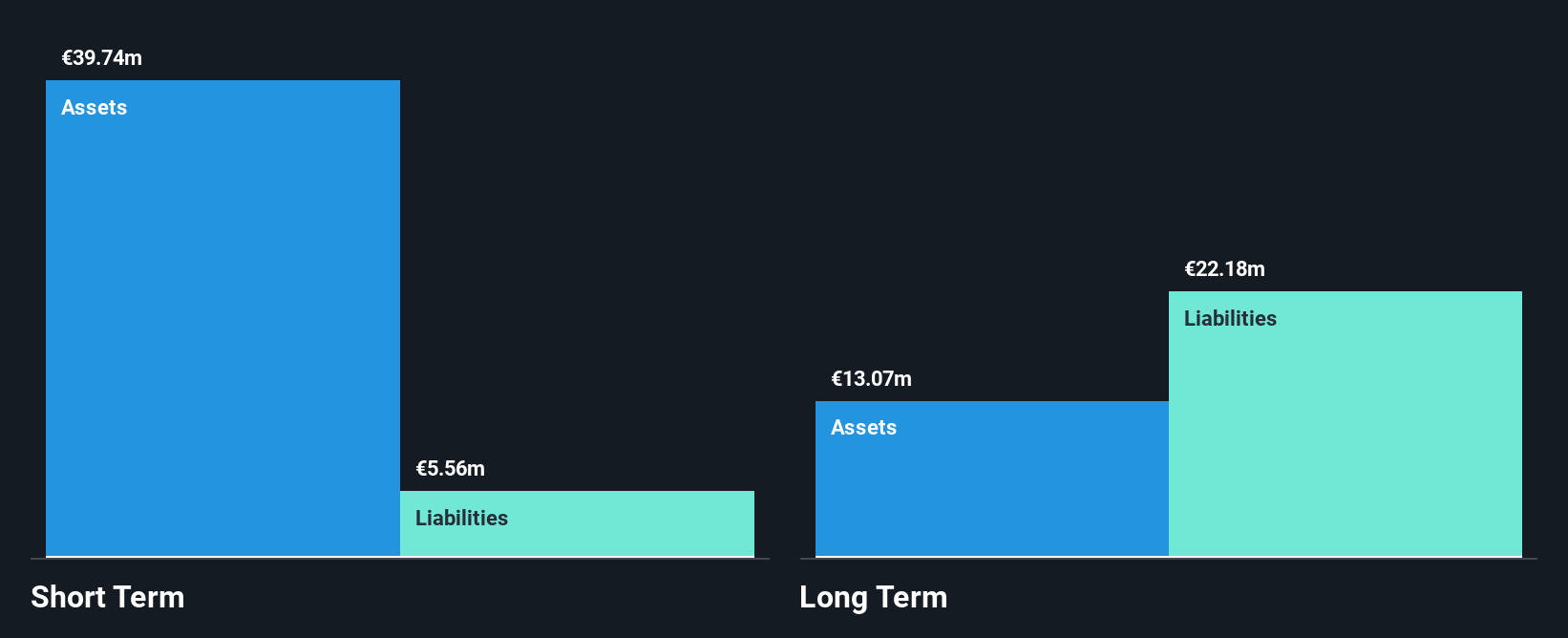

Heidelberg Pharma AG, with a market cap of €128.16 million, is navigating the challenges typical of penny stocks in the biotech sector. The company remains unprofitable and faces an operating loss forecast between €30 million and €35 million for 2025. Despite this, Heidelberg Pharma has secured significant financial agreements, including a recent amendment with HealthCare Royalty that provides a $20 million payment and extends its cash runway into 2027. Short-term assets (€47.6M) comfortably cover both short-term (€8M) and long-term liabilities (€21.9M), although the cash runway is less than one year without additional financing or revenue growth.

- Jump into the full analysis health report here for a deeper understanding of Heidelberg Pharma.

- Examine Heidelberg Pharma's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Navigate through the entire inventory of 430 European Penny Stocks here.

- Contemplating Other Strategies? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HPHA

Heidelberg Pharma

A biopharmaceutical company, focuses on oncology and antibody targeted amanitin conjugates (ATAC) in Germany, the United States, and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives