Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies AutoStore Holdings Ltd. (OB:AUTO) makes use of debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for AutoStore Holdings

What Is AutoStore Holdings's Net Debt?

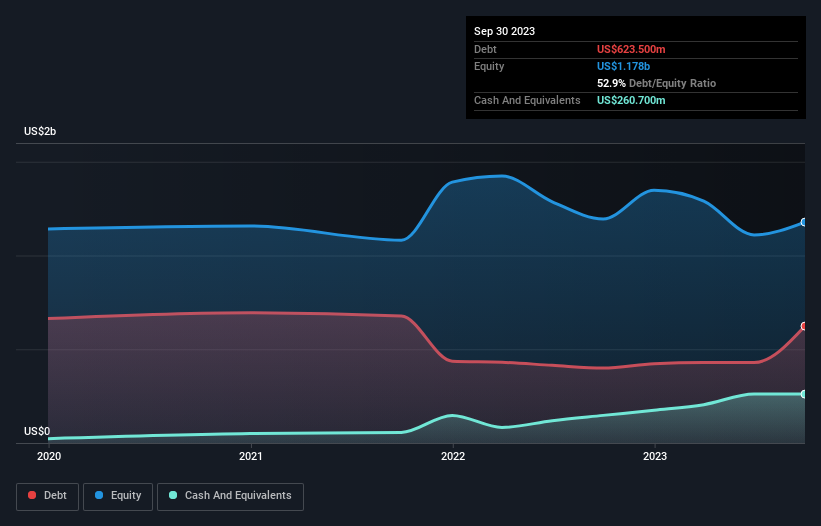

The image below, which you can click on for greater detail, shows that at September 2023 AutoStore Holdings had debt of US$623.5m, up from US$399.5m in one year. However, because it has a cash reserve of US$260.7m, its net debt is less, at about US$362.8m.

How Healthy Is AutoStore Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that AutoStore Holdings had liabilities of US$244.0m due within 12 months and liabilities of US$624.1m due beyond that. Offsetting this, it had US$260.7m in cash and US$128.4m in receivables that were due within 12 months. So it has liabilities totalling US$479.0m more than its cash and near-term receivables, combined.

Of course, AutoStore Holdings has a market capitalization of US$6.49b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

AutoStore Holdings's net debt of 1.6 times EBITDA suggests graceful use of debt. And the alluring interest cover (EBIT of 7.2 times interest expense) certainly does not do anything to dispel this impression. Another good sign is that AutoStore Holdings has been able to increase its EBIT by 24% in twelve months, making it easier to pay down debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if AutoStore Holdings can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. During the last three years, AutoStore Holdings produced sturdy free cash flow equating to 53% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

AutoStore Holdings's EBIT growth rate suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And its interest cover is good too. When we consider the range of factors above, it looks like AutoStore Holdings is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - AutoStore Holdings has 1 warning sign we think you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AUTO

AutoStore Holdings

A robotic and software technology company, provides warehouse automation solutions in Norway, Germany, rest of Europe, the United States, Asia, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives