The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Arendals Fossekompani ASA (OB:AFK) does have debt on its balance sheet. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Arendals Fossekompani

What Is Arendals Fossekompani's Debt?

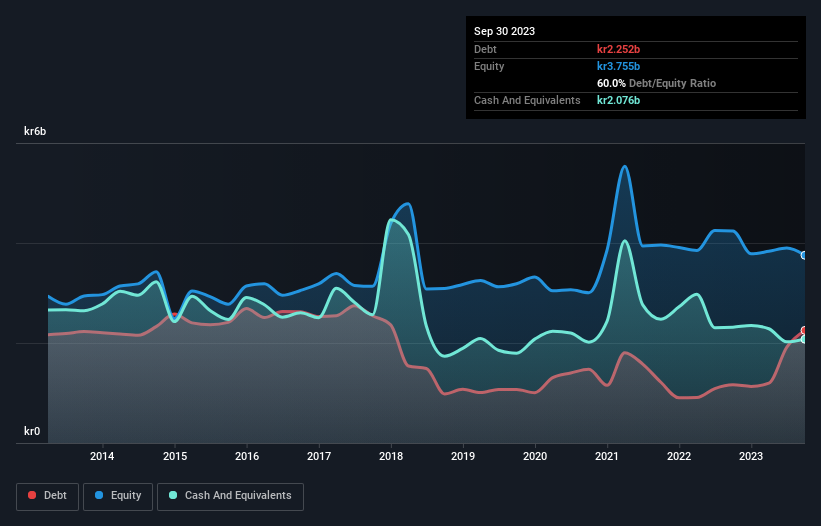

The image below, which you can click on for greater detail, shows that at September 2023 Arendals Fossekompani had debt of kr2.25b, up from kr1.17b in one year. However, it does have kr2.08b in cash offsetting this, leading to net debt of about kr176.0m.

A Look At Arendals Fossekompani's Liabilities

The latest balance sheet data shows that Arendals Fossekompani had liabilities of kr2.61b due within a year, and liabilities of kr2.39b falling due after that. On the other hand, it had cash of kr2.08b and kr1.40b worth of receivables due within a year. So its liabilities total kr1.52b more than the combination of its cash and short-term receivables.

Given Arendals Fossekompani has a market capitalization of kr8.60b, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Arendals Fossekompani has a low debt to EBITDA ratio of only 0.25. But the really cool thing is that it actually managed to receive more interest than it paid, over the last year. So it's fair to say it can handle debt like a hotshot teppanyaki chef handles cooking. While Arendals Fossekompani doesn't seem to have gained much on the EBIT line, at least earnings remain stable for now. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Arendals Fossekompani will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. In the last three years, Arendals Fossekompani created free cash flow amounting to 2.2% of its EBIT, an uninspiring performance. For us, cash conversion that low sparks a little paranoia about is ability to extinguish debt.

Our View

Both Arendals Fossekompani's ability to to cover its interest expense with its EBIT and its net debt to EBITDA gave us comfort that it can handle its debt. In contrast, our confidence was undermined by its apparent struggle to convert EBIT to free cash flow. When we consider all the elements mentioned above, it seems to us that Arendals Fossekompani is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. We've identified 1 warning sign with Arendals Fossekompani , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

If you're looking to trade Arendals Fossekompani, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:AFK

Arendals Fossekompani

An industrial investment company, owns and operates hydropower plants in Norway, rest of Europe, Asia, and North America.

Flawless balance sheet with solid track record.