This article will reflect on the compensation paid to Rolf Delingsrud who has served as CEO of Totens Sparebank (OB:TOTG) since 2011. This analysis will also assess whether Totens Sparebank pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Totens Sparebank

How Does Total Compensation For Rolf Delingsrud Compare With Other Companies In The Industry?

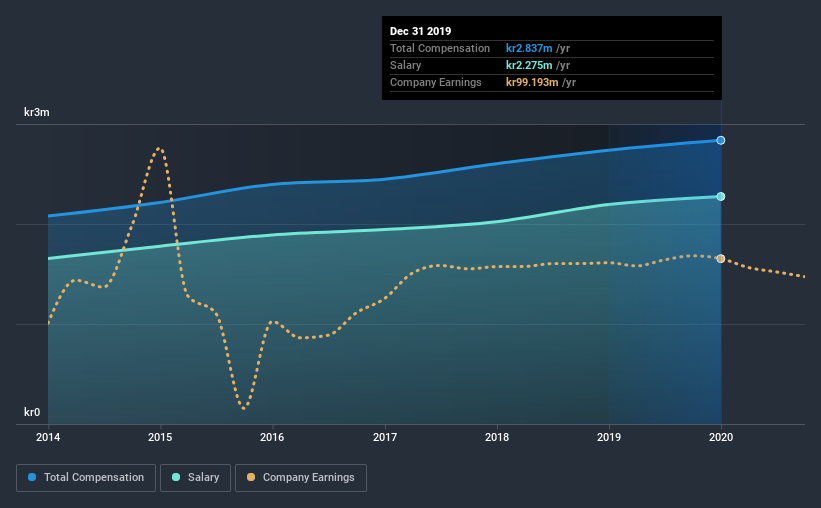

Our data indicates that Totens Sparebank has a market capitalization of kr821m, and total annual CEO compensation was reported as kr2.8m for the year to December 2019. That's a modest increase of 3.6% on the prior year. In particular, the salary of kr2.28m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the industry with market capitalizations below kr1.8b, we found that the median total CEO compensation was kr2.7m. From this we gather that Rolf Delingsrud is paid around the median for CEOs in the industry.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | kr2.3m | kr2.2m | 80% |

| Other | kr562k | kr543k | 20% |

| Total Compensation | kr2.8m | kr2.7m | 100% |

Speaking on an industry level, nearly 81% of total compensation represents salary, while the remainder of 19% is other remuneration. Although there is a difference in how total compensation is set, Totens Sparebank more or less reflects the market in terms of setting the salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Totens Sparebank's Growth Numbers

Earnings per share at Totens Sparebank are much the same as they were three years ago, albeit with slightly higher. Revenue was pretty flat on last year.

We would argue that the improvement in revenue is good, but isn't particularly impressive, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Totens Sparebank Been A Good Investment?

Totens Sparebank has generated a total shareholder return of 31% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

To Conclude...

As we touched on above, Totens Sparebank is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, EPS and shareholder returns have been stable over the last three years, but have not grown substantially. Considering the steady performance, it's tough to call out CEO compensation as too high, but shareholders might want to see more robust growth metrics before agreeing to a future raise.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 3 warning signs for Totens Sparebank that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Totens Sparebank or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Totens Sparebank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:TOTG

Totens Sparebank

Provides various banking and financial products and services in Norway.

Established dividend payer with moderate growth potential.

Market Insights

Community Narratives