Could SpareBank 1 BV (OB:SBVG) Have The Makings Of Another Dividend Aristocrat?

Dividend paying stocks like SpareBank 1 BV (OB:SBVG) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Unfortunately, it's common for investors to be enticed in by the seemingly attractive yield, and lose money when the company has to cut its dividend payments.

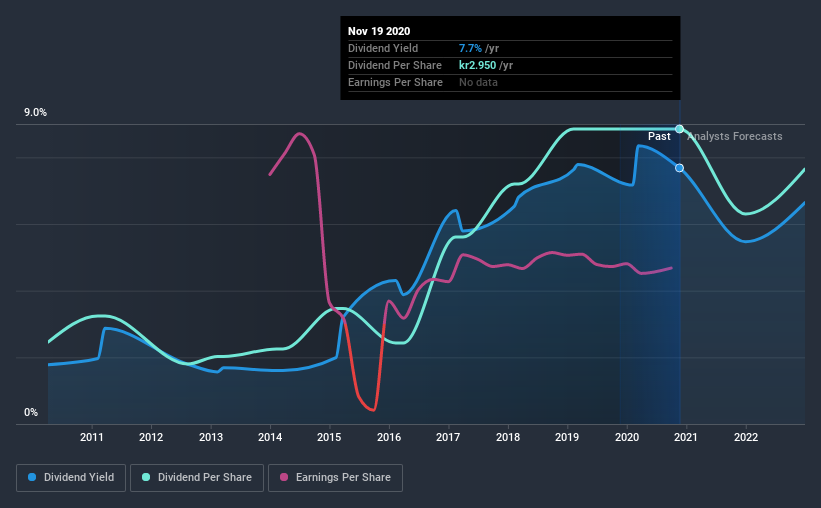

In this case, SpareBank 1 BV likely looks attractive to investors, given its 7.7% dividend yield and a payment history of over ten years. It would not be a surprise to discover that many investors buy it for the dividends. During the year, the company also conducted a buyback equivalent to around 2.1% of its market capitalisation. There are a few simple ways to reduce the risks of buying SpareBank 1 BV for its dividend, and we'll go through these below.

Explore this interactive chart for our latest analysis on SpareBank 1 BV!

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, SpareBank 1 BV paid out 66% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

Remember, you can always get a snapshot of SpareBank 1 BV's latest financial position, by checking our visualisation of its financial health.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. SpareBank 1 BV has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having been cut one or more times over this time. During the past 10-year period, the first annual payment was kr0.8 in 2010, compared to kr3.0 last year. Dividends per share have grown at approximately 14% per year over this time. SpareBank 1 BV's dividend payments have fluctuated, so it hasn't grown 14% every year, but the CAGR is a useful rule of thumb for approximating the historical growth.

So, its dividends have grown at a rapid rate over this time, but payments have been cut in the past. The stock may still be worth considering as part of a diversified dividend portfolio.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to evaluate if earnings per share (EPS) are growing - it's not worth taking the risk on a dividend getting cut, unless you might be rewarded with larger dividends in future. It's good to see SpareBank 1 BV has been growing its earnings per share at 21% a year over the past five years. With recent, rapid earnings per share growth and a payout ratio of 66%, this business looks like an interesting prospect if earnings are reinvested effectively.

Conclusion

To summarise, shareholders should always check that SpareBank 1 BV's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. SpareBank 1 BV's payout ratio is within normal bounds. We were also glad to see it growing earnings, but it was concerning to see the dividend has been cut at least once in the past. In summary, we're unenthused by SpareBank 1 BV as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For instance, we've picked out 1 warning sign for SpareBank 1 BV that investors should take into consideration.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you’re looking to trade SpareBank 1 BV, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:SOON

SpareBank 1 Sørøst-Norge

Provides various banking products and services for private and corporate customers in Norway.

Adequate balance sheet average dividend payer.