In the current market landscape, major U.S. stock indexes have shown mixed results, with the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks in the Russell 2000 faced a decline after outperforming larger peers in previous weeks. As economic indicators like job growth show resilience and expectations for interest rate cuts grow, investors are increasingly looking for opportunities beyond well-trodden paths. In this context, identifying stocks with strong fundamentals and potential for growth can be particularly rewarding, offering a chance to uncover hidden gems that might thrive amid broader market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| PSC | 17.90% | 2.07% | 13.38% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Thai Energy Storage Technology | 9.49% | -1.42% | 1.73% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| Al-Deera Holding Company K.P.S.C | 6.11% | 51.44% | 59.77% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Vestjysk Bank (CPSE:VJBA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vestjysk Bank A/S offers a range of banking products and services to both private and business customers in Denmark, with a market capitalization of DKK5.24 billion.

Operations: Vestjysk Bank generates revenue primarily through its banking segment, which reported DKK2.40 billion. The company's financial performance is reflected in its market capitalization of DKK5.24 billion.

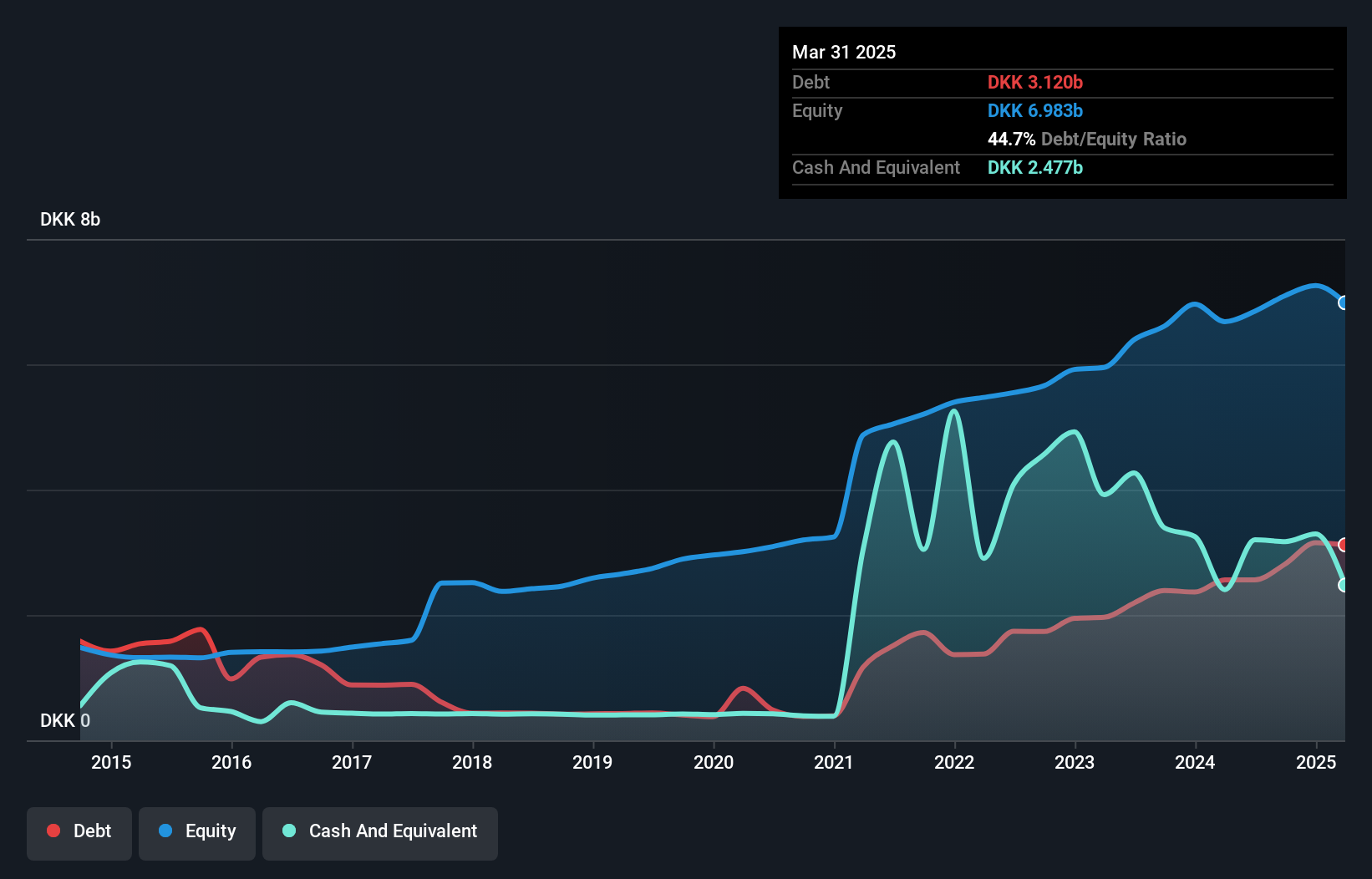

Vestjysk Bank, a smaller player in the financial sector, is trading at 71.1% below its estimated fair value, indicating potential for value investors. With total assets of DKK47.3 billion and equity of DKK7.1 billion, it shows a solid balance sheet foundation. Customer deposits are the primary funding source for 90% of liabilities, reducing external borrowing risks significantly. Over the past five years, earnings have grown annually by 16.4%, although recent growth at 13.5% lags behind industry averages of 16.7%. Despite high-quality past earnings and robust deposit levels (DKK36.1 billion), data on non-performing loans remains insufficient to assess risk fully.

- Get an in-depth perspective on Vestjysk Bank's performance by reading our health report here.

Evaluate Vestjysk Bank's historical performance by accessing our past performance report.

SpareBank 1 Nord-Norge (OB:NONG)

Simply Wall St Value Rating: ★★★★☆☆

Overview: SpareBank 1 Nord-Norge operates as a banking services provider in Northern Norway with a market capitalization of NOK12.03 billion.

Operations: The primary revenue streams for SpareBank 1 Nord-Norge include the Retail Market, Corporate Banking, and Segment Adjustment, contributing NOK 2.41 billion, NOK 1.53 billion, and NOK 1.57 billion respectively. Additional contributions come from Eiendoms-Megler 1 Nord-Norge at NOK 222 million and Sparebank 1 Finans Nord-Norge at NOK 327 million.

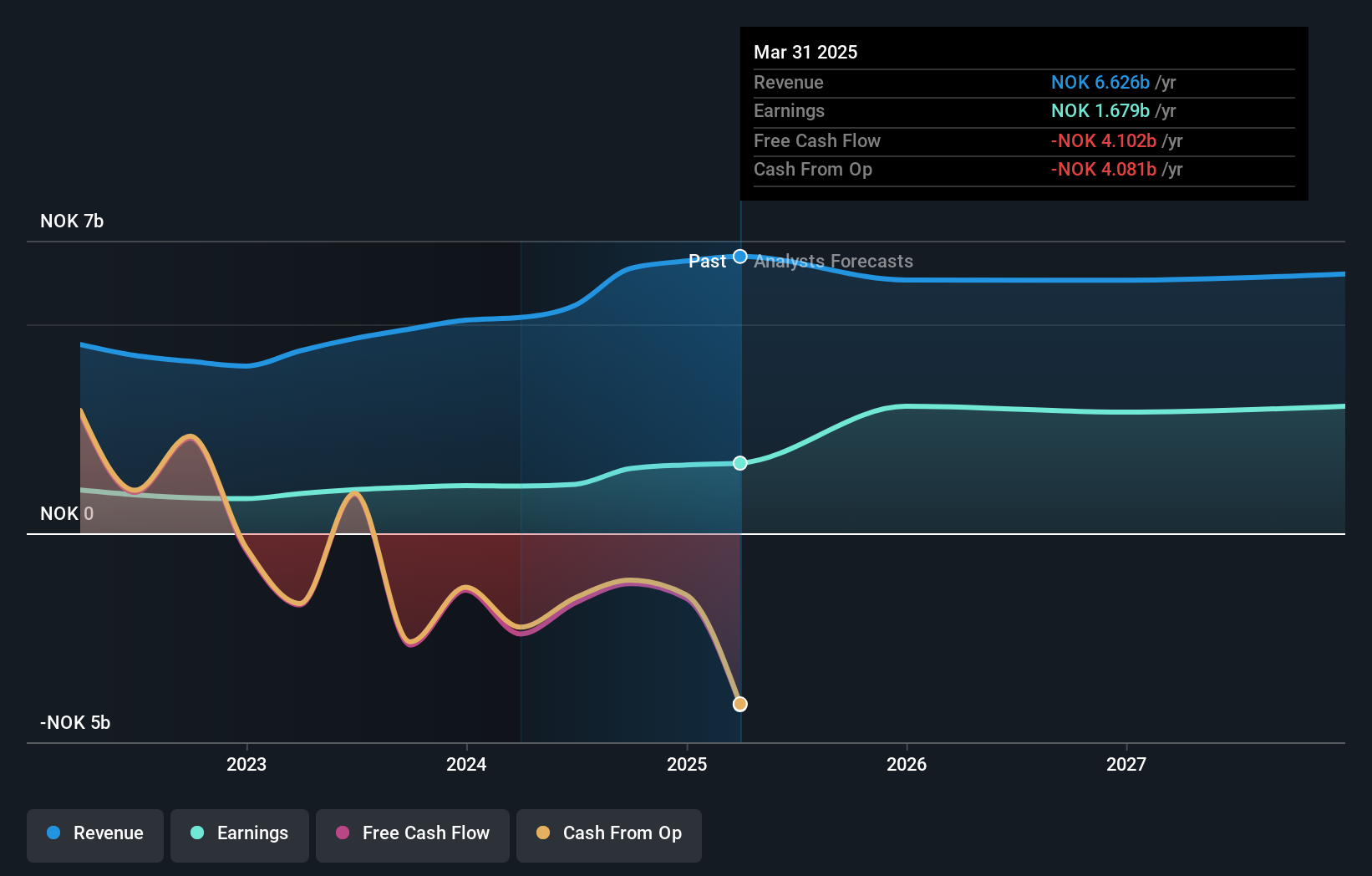

SpareBank 1 Nord-Norge, with assets totaling NOK135.2 billion and equity of NOK18.3 billion, showcases strong earnings growth at 44.8%, surpassing the industry average of 18.2%. The bank's total loans stand at NOK69.3 billion against deposits of NOK87.5 billion, highlighting a solid funding base primarily from low-risk sources like customer deposits, which comprise 75% of liabilities. Despite a high level of bad loans at 2%, its allowance for bad loans is relatively low at 60%. Recent organizational changes aim to enhance efficiency and collaboration within its divisions starting January 2025, potentially boosting future performance further.

- Delve into the full analysis health report here for a deeper understanding of SpareBank 1 Nord-Norge.

Assess SpareBank 1 Nord-Norge's past performance with our detailed historical performance reports.

Suzhou West Deane New Power ElectricLtd (SHSE:603312)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou West Deane New Power Electric Co., Ltd. is an engineering and manufacturing company that offers laminated bus bar products globally, with a market capitalization of CN¥5.53 billion.

Operations: The company's primary revenue stream is from the Electrical Machinery and Equipment Manufacturing segment, generating CN¥1.90 billion. Its net profit margin reflects its financial performance efficiency.

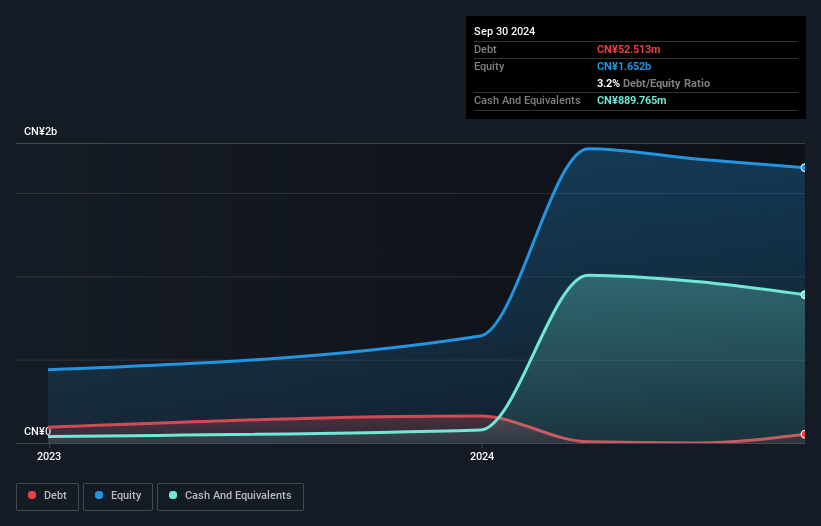

Suzhou West Deane New Power Electric, a small cap player in the electrical industry, has shown promising growth with earnings rising 11.5% over the past year, outpacing the industry's 1.1%. Trading at a significant discount of 70.5% below estimated fair value, it seems to offer good relative value compared to peers. Despite reporting sales of CNY 1.41 billion for nine months ending September 2024 and net income of CNY 147.89 million, basic earnings per share dropped to CNY 0.95 from CNY 1.18 last year, indicating some pressure on profitability amidst its expansion efforts and financial strategies like share repurchase plans.

Turning Ideas Into Actions

- Delve into our full catalog of 4621 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NONG

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives