As the European markets navigate a period of political turmoil and trade tensions, with key indices like the STOXX Europe 600 experiencing a slight downturn after reaching record highs, investors are increasingly turning their attention to stable income sources such as dividend stocks. In this environment, selecting dividend stocks that offer consistent payouts and have strong fundamentals can be particularly appealing for those seeking to mitigate volatility while maintaining potential for steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.40% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.38% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.74% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.61% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.10% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.73% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.73% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.74% | ★★★★★☆ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

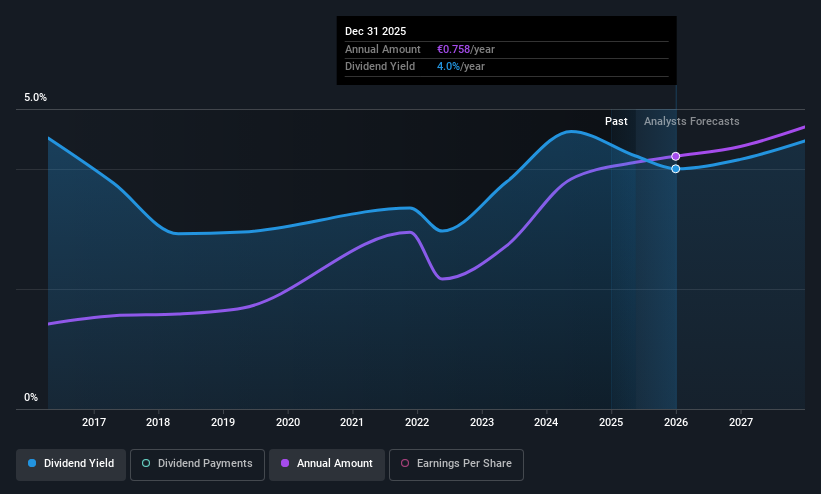

FinecoBank Banca Fineco (BIT:FBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FinecoBank Banca Fineco S.p.A. offers banking, credit, trading and investment services in Italy with a market cap of €11.64 billion.

Operations: FinecoBank Banca Fineco S.p.A.'s revenue is primarily derived from its banking segment, which generated €1.30 billion.

Dividend Yield: 3.9%

FinecoBank Banca Fineco has experienced volatile dividend payments over the past decade, with a modest yield of 3.89%, lower than Italy's top quartile of dividend payers. Despite this, its dividends are covered by earnings with a current payout ratio of 69.6%, and future forecasts suggest continued coverage at 81.5%. Recent financials indicate declining net interest income and net income compared to the previous year, potentially impacting future dividend stability.

- Get an in-depth perspective on FinecoBank Banca Fineco's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of FinecoBank Banca Fineco shares in the market.

Faes Farma (BME:FAE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Faes Farma, S.A. is engaged in the research, development, production, and marketing of pharmaceutical and healthcare products as well as raw materials on an international scale with a market cap of €1.40 billion.

Operations: Faes Farma generates revenue primarily from its Pharmaceutical Specialties and Healthcare segment, amounting to €478.50 million, and its Nutrition and Animal Health segment, which contributes €63.94 million.

Dividend Yield: 3.5%

Faes Farma's dividend payments have been volatile over the past decade, with a yield of 3.49%, below Spain's top quartile of dividend payers. Despite this instability, dividends are covered by earnings and cash flows, with payout ratios of 50.3% and 67.4%, respectively. Recent financials show increased sales to €296.16 million for H1 2025 but a decline in net income to €52.33 million, potentially affecting future dividend reliability.

- Dive into the specifics of Faes Farma here with our thorough dividend report.

- The analysis detailed in our Faes Farma valuation report hints at an deflated share price compared to its estimated value.

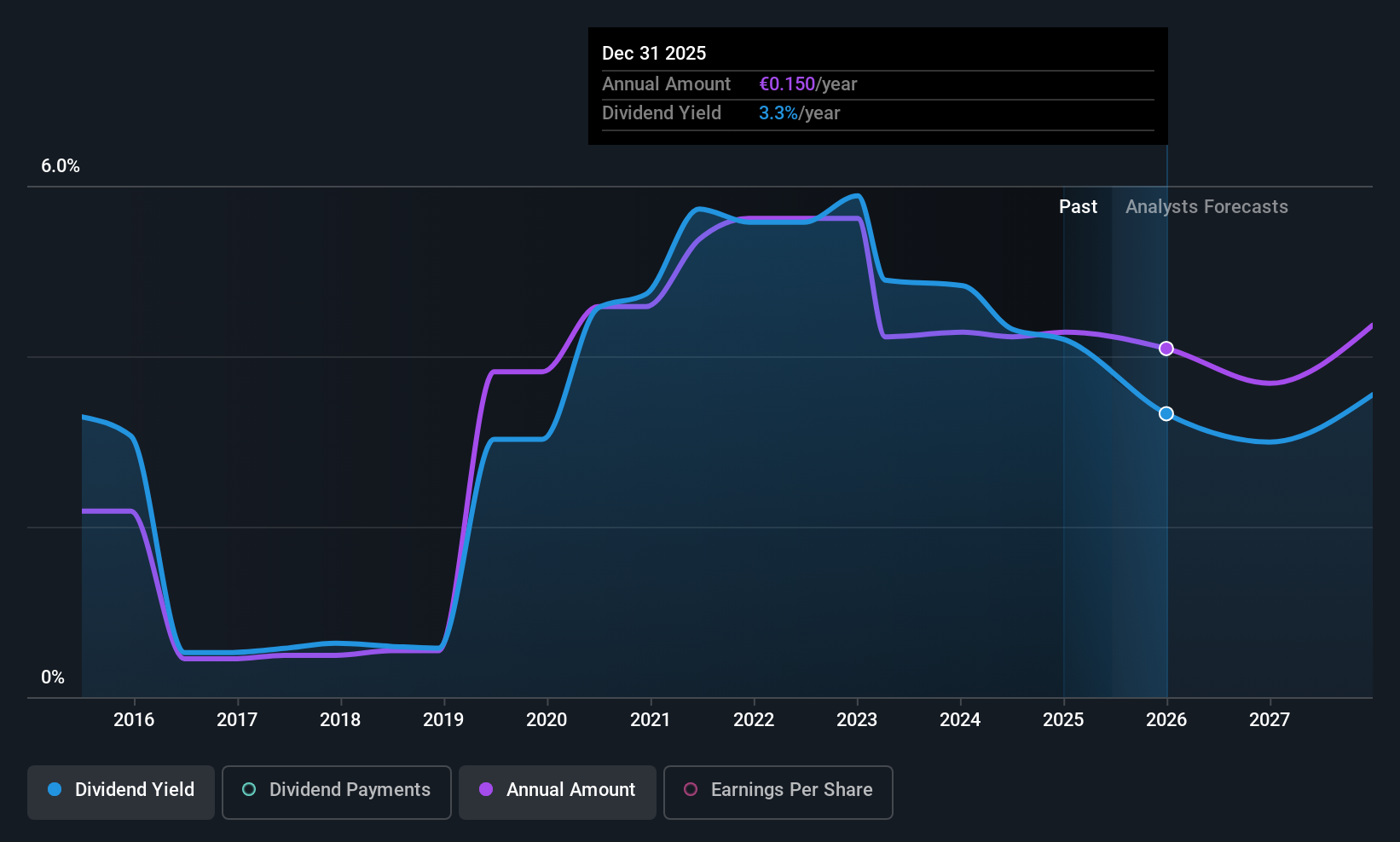

Sparebanken Møre (OB:MORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Møre, along with its subsidiaries, offers banking services to retail and corporate clients in Norway and has a market cap of NOK5.36 billion.

Operations: Sparebanken Møre generates revenue from several segments, including Retail at NOK1.03 billion, Corporate at NOK855 million, and Real Estate Brokerage at NOK55 million.

Dividend Yield: 5.8%

Sparebanken Møre's dividends are currently covered by earnings with a payout ratio of 67.3%, though its dividend yield of 5.79% is below the top quartile in Norway. Despite an increase in dividend payments over the past decade, they have been volatile and unreliable, experiencing significant drops at times. Recent financials indicate a decline in net income to NOK 243 million for Q2 2025, which may impact future dividend stability and reliability.

- Click here and access our complete dividend analysis report to understand the dynamics of Sparebanken Møre.

- Our valuation report here indicates Sparebanken Møre may be overvalued.

Turning Ideas Into Actions

- Discover the full array of 229 Top European Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MORG

Sparebanken Møre

Provides banking services for retail and corporate customers in Norway.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives