As global markets navigate a period of economic adjustments, with major indices experiencing mixed performances and central banks adjusting interest rates, investors are closely monitoring opportunities for stable returns. In this environment, dividend stocks can be appealing as they offer the potential for regular income streams and may provide some cushion against market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.05% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.58% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.05% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.32% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.96% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.88% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.42% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.12% | ★★★★★★ |

Click here to see the full list of 1851 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

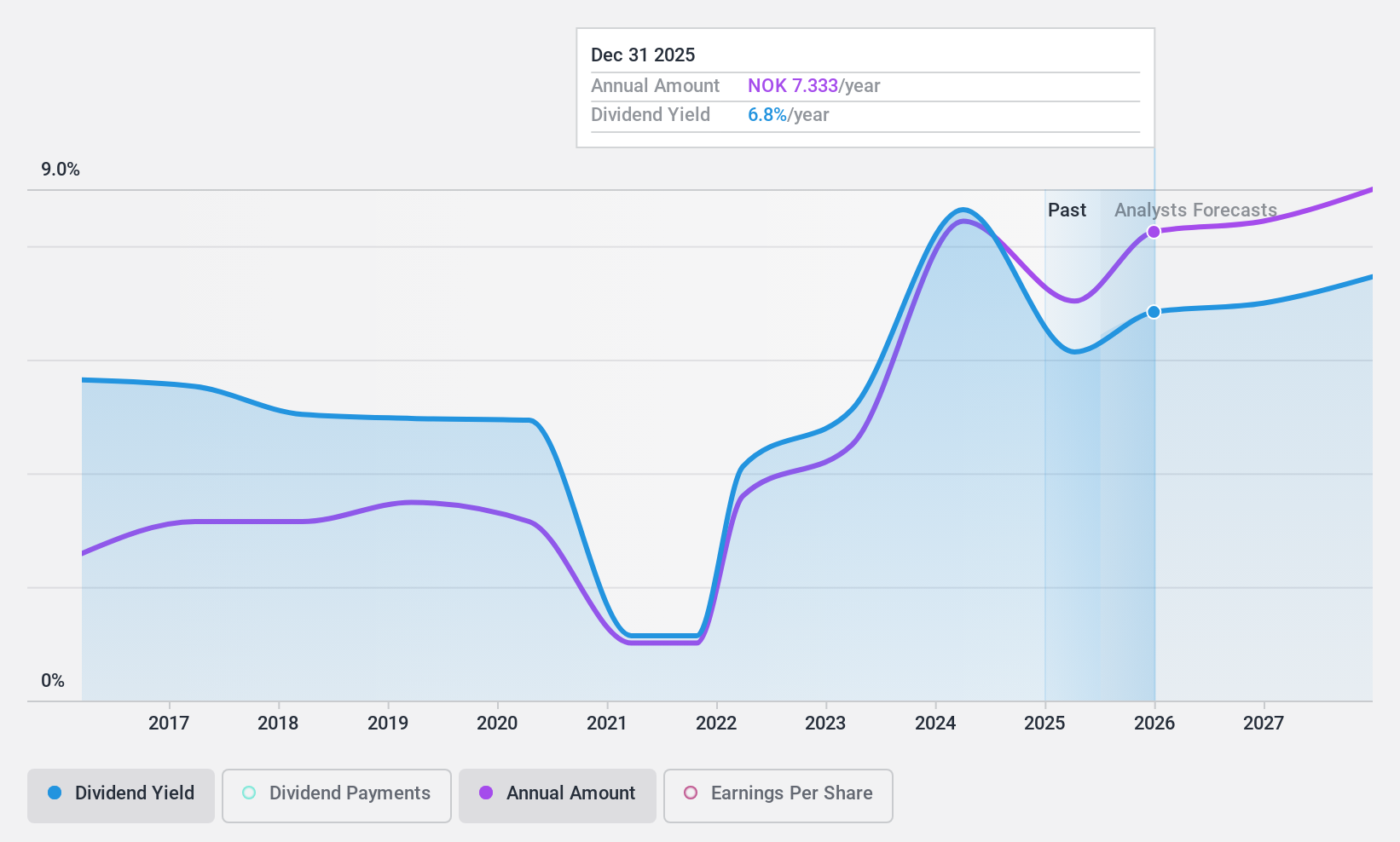

Sparebanken Møre (OB:MORG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sparebanken Møre, along with its subsidiaries, offers banking services to retail and corporate clients in Norway and has a market cap of NOK4.53 billion.

Operations: Sparebanken Møre generates revenue primarily from its retail segment at NOK1.06 billion and corporate segment at NOK1.00 billion, along with a contribution from real estate brokerage amounting to NOK43 million.

Dividend Yield: 8.1%

Sparebanken Møre's earnings have grown by 22.3% over the past year, supporting its dividend, which is currently covered by a payout ratio of 66.8%. Despite this coverage and a top-tier yield of 8.06%, dividends have been volatile over the past decade. The bank trades at good value, being 35.5% below estimated fair value, but maintains a low allowance for bad loans (53%). Recent earnings show increased net income and interest income year-over-year.

- Dive into the specifics of Sparebanken Møre here with our thorough dividend report.

- Upon reviewing our latest valuation report, Sparebanken Møre's share price might be too pessimistic.

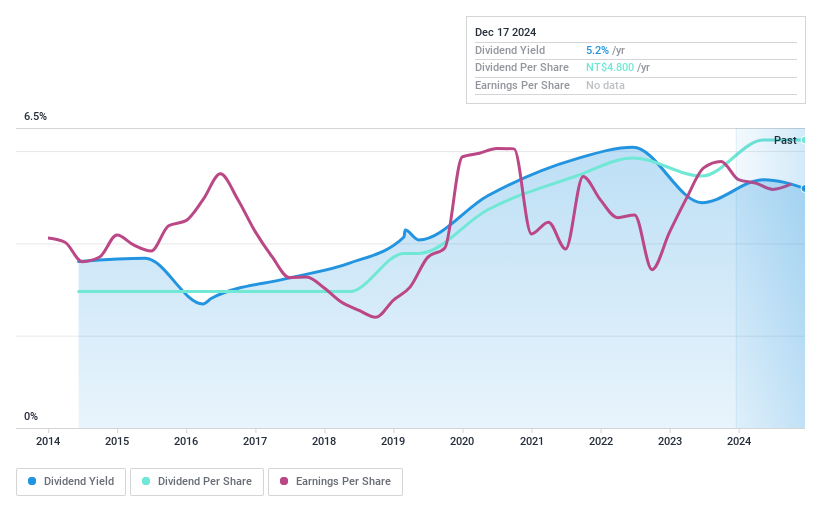

Pacific Hospital Supply (TPEX:4126)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Pacific Hospital Supply Co., Ltd. and its subsidiaries manufacture, process, and sell medical disposable products and equipment in Taiwan with a market cap of NT$6.72 billion.

Operations: Pacific Hospital Supply Co., Ltd. generates its revenue from the sale of disposable medical products, amounting to NT$2.23 billion.

Dividend Yield: 5.2%

Pacific Hospital Supply's dividend reliability is underscored by a stable and growing payout over the past decade, with a top-tier yield of 5.19% in Taiwan. The dividends are well-covered by earnings (84.4% payout ratio) and cash flows (67.8% cash payout ratio). Despite trading at 35% below estimated fair value, recent earnings show steady performance with slight declines in sales but increased net income, supporting ongoing dividend sustainability.

- Delve into the full analysis dividend report here for a deeper understanding of Pacific Hospital Supply.

- According our valuation report, there's an indication that Pacific Hospital Supply's share price might be on the cheaper side.

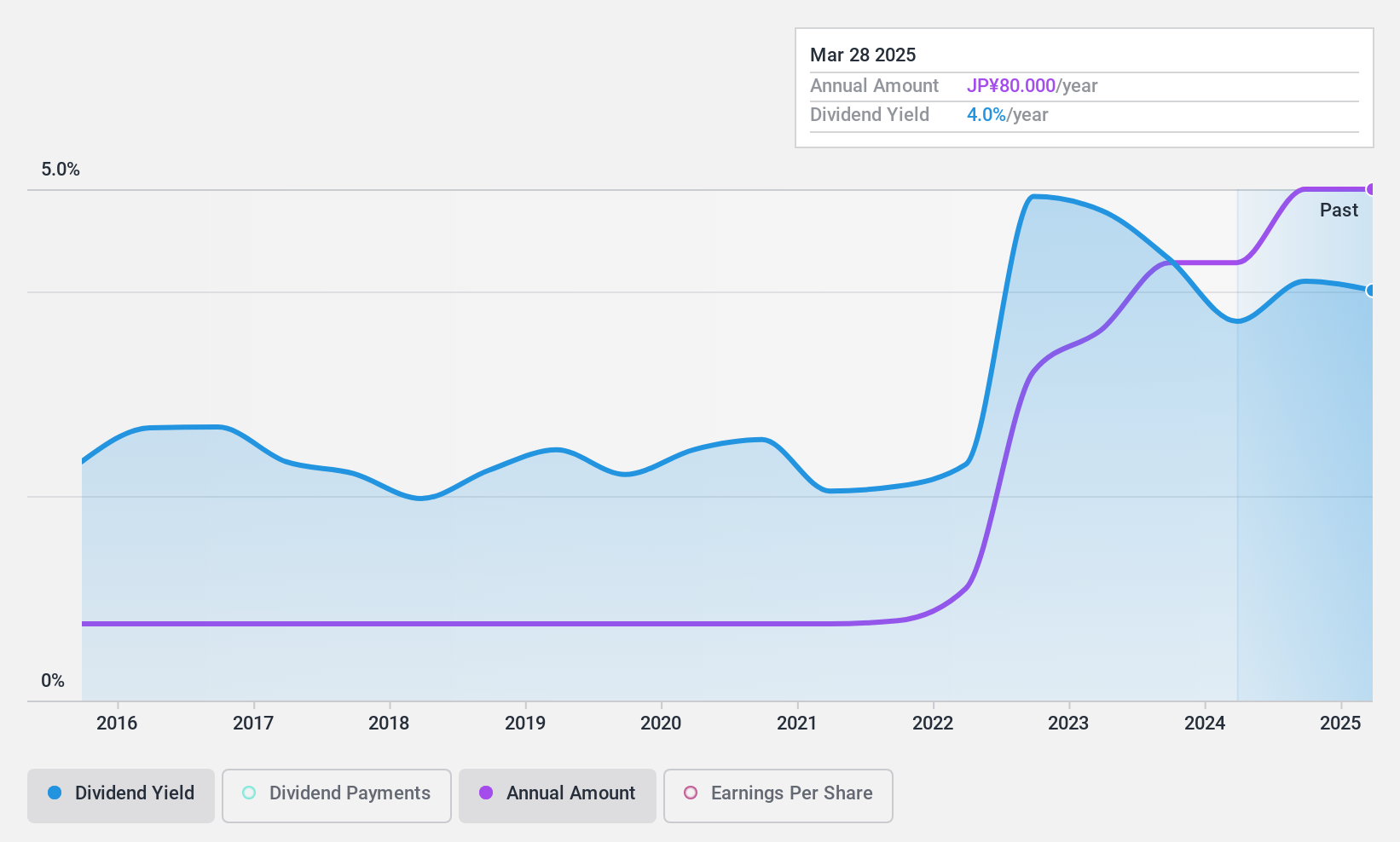

Takachiho KohekiLtd (TSE:2676)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Takachiho Koheki Co., Ltd. is an electronics technology trading company operating in Japan with a market cap of ¥35.62 billion.

Operations: Takachiho Koheki Co., Ltd.'s revenue is comprised of ¥12.73 billion from Device, ¥9.97 billion from Systems, and ¥3.11 billion from Cloud Service & Support segments.

Dividend Yield: 4.3%

Takachiho Koheki Ltd.'s dividend yield of 4.26% ranks in the top 25% of JP market payers, but it's not covered by earnings due to a high payout ratio of 113%. Despite this, dividends have been stable and growing over the past decade. Recent increases to ¥58 per share highlight ongoing commitment, yet shareholder dilution and reliance on cash flow for coverage (82.7%) raise sustainability concerns amidst modest earnings growth and new guidance for FY2025.

- Take a closer look at Takachiho KohekiLtd's potential here in our dividend report.

- Our valuation report unveils the possibility Takachiho KohekiLtd's shares may be trading at a premium.

Turning Ideas Into Actions

- Access the full spectrum of 1851 Top Dividend Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MORG

Sparebanken Møre

Provides banking services for retail and corporate customers in Norway.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives