Morrow Bank ASA's (OB:MOBA) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Morrow Bank will host its Annual General Meeting on 18th of April

- Salary of kr4.10m is part of CEO Oyvind Oanes's total remuneration

- Total compensation is 84% above industry average

- Over the past three years, Morrow Bank's EPS fell by 25% and over the past three years, the total loss to shareholders 59%

Morrow Bank ASA (OB:MOBA) has not performed well recently and CEO Oyvind Oanes will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 18th of April. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. From our analysis, we think CEO compensation may need a review in light of the recent performance.

See our latest analysis for Morrow Bank

How Does Total Compensation For Oyvind Oanes Compare With Other Companies In The Industry?

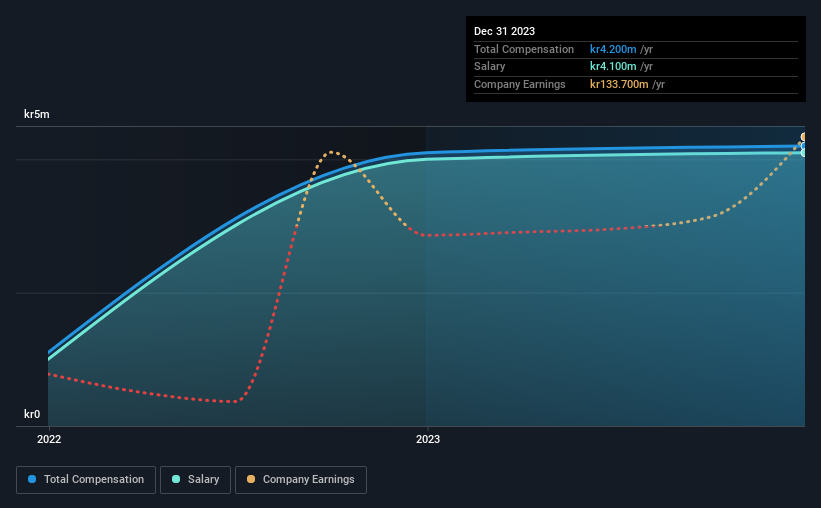

At the time of writing, our data shows that Morrow Bank ASA has a market capitalization of kr978m, and reported total annual CEO compensation of kr4.2m for the year to December 2023. That's mostly flat as compared to the prior year's compensation. In particular, the salary of kr4.10m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar-sized companies in the Norwegian Banks industry with market capitalizations below kr2.2b, we found that the median total CEO compensation was kr2.3m. Accordingly, our analysis reveals that Morrow Bank ASA pays Oyvind Oanes north of the industry median. Moreover, Oyvind Oanes also holds kr1.7m worth of Morrow Bank stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | kr4.1m | kr4.0m | 98% |

| Other | kr100k | kr100k | 2% |

| Total Compensation | kr4.2m | kr4.1m | 100% |

Speaking on an industry level, nearly 80% of total compensation represents salary, while the remainder of 20% is other remuneration. Morrow Bank pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Morrow Bank ASA's Growth

Over the last three years, Morrow Bank ASA has shrunk its earnings per share by 25% per year. Its revenue is up 3.6% over the last year.

The decline in EPS is a bit concerning. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Morrow Bank ASA Been A Good Investment?

Few Morrow Bank ASA shareholders would feel satisfied with the return of -59% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Oyvind receives almost all of their compensation through a salary. Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 2 warning signs for Morrow Bank that investors should think about before committing capital to this stock.

Switching gears from Morrow Bank, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:MOBA

Morrow Bank

Provides unsecured financing to private individuals in Norway, Finland, Sweden, Netherlands, and Germany.

Solid track record with reasonable growth potential.

Market Insights

Community Narratives