- Japan

- /

- Retail Distributors

- /

- TSE:7483

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate adjustments and mixed performances across major indices, investors are increasingly considering strategies to weather potential volatility. In this environment, dividend stocks can offer a compelling option for those seeking income stability and potential growth, providing regular payouts that may help cushion against broader market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.12% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.23% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.73% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.35% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.36% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.31% | ★★★★★★ |

Click here to see the full list of 1937 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

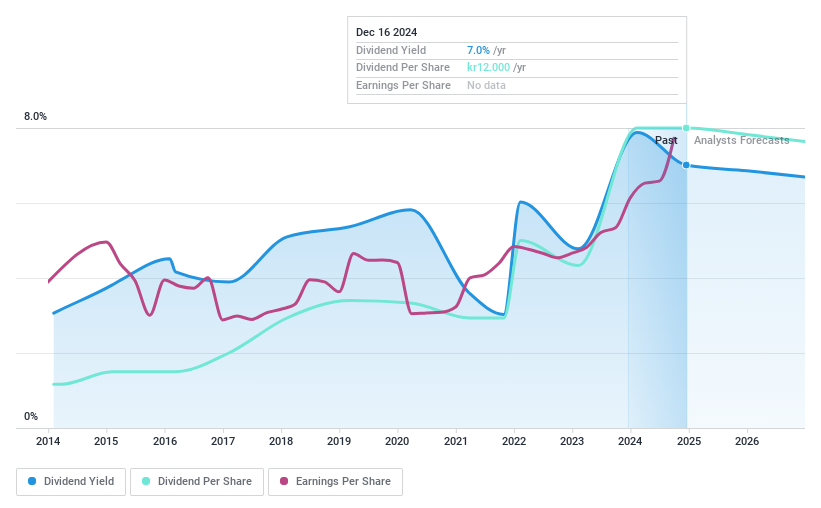

SpareBank 1 SMN (OB:MING)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SpareBank 1 SMN, along with its subsidiaries, offers a range of banking, accounting, and real estate products and services to individuals and businesses in Norway and internationally, with a market cap of NOK24.45 billion.

Operations: SpareBank 1 SMN generates revenue through several segments, including Retail Banking (NOK3.00 billion), Corporate Market (NOK1.89 billion), Sunnmøre and Fjordane (NOK858 million), Eiendoms Megler 1 Midt-Norge (NOK616 million), Sparebank 1 Finans Midt-Norge (NOK431 million), and Sparebank 1 Regnskapshuset SMN (NOK709 million).

Dividend Yield: 7.0%

SpareBank 1 SMN's dividend has been stable and reliable over the past decade, with a current yield of 7.01%, although lower than the top quartile in Norway. The payout ratio is sustainable at 56.5% and forecasted to remain covered by earnings in three years. Recent earnings growth, highlighted by a significant increase in net income for Q3 2024, supports its dividend coverage and potential for continued payouts.

- Dive into the specifics of SpareBank 1 SMN here with our thorough dividend report.

- Our expertly prepared valuation report SpareBank 1 SMN implies its share price may be lower than expected.

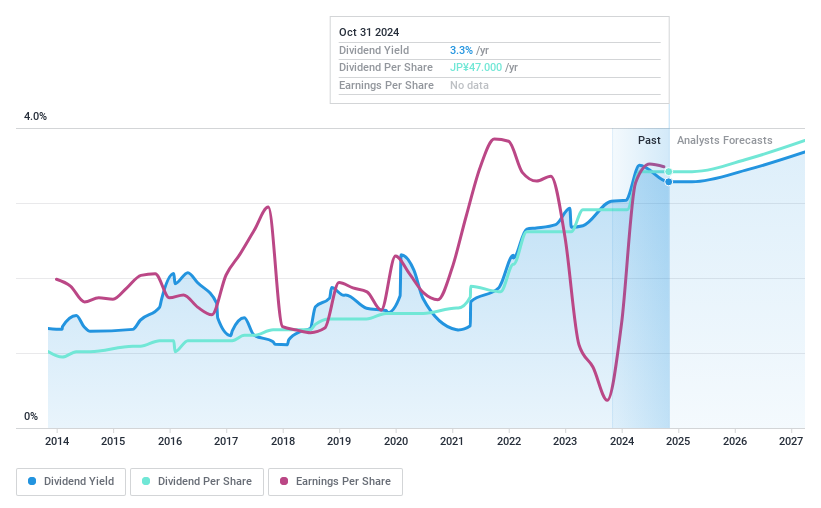

Zeon (TSE:4205)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Zeon Corporation operates in the elastomers and specialty materials sectors, with a market cap of ¥287.26 billion.

Operations: Zeon Corporation generates revenue from its Elastomer Materials Business, which accounts for ¥231.21 billion, and its High-Performance Materials Business, contributing ¥117.53 billion.

Dividend Yield: 4.8%

Zeon's dividends have been stable and reliable over the past decade, with a current yield of 4.84%, placing it in the top 25% of Japanese dividend payers. However, despite a low payout ratio of 38.3%, dividends are not well covered by free cash flows, raising sustainability concerns. Recent buyback plans indicate strong capital management, but significant one-off items have impacted earnings quality, highlighting potential volatility in future financial performance.

- Get an in-depth perspective on Zeon's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, Zeon's share price might be too pessimistic.

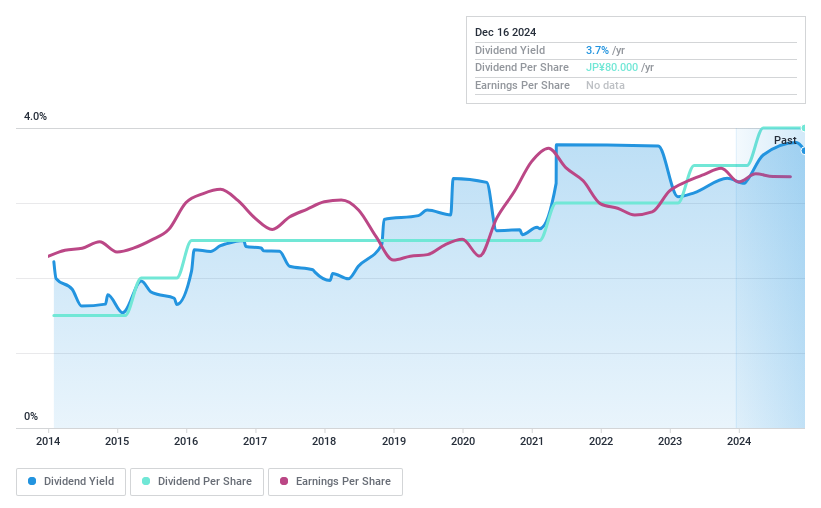

DoshishaLtd (TSE:7483)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Doshisha Co., Ltd. plans, develops, produces, and sells lifestyle-related products both in Japan and internationally, with a market cap of ¥75.21 billion.

Operations: Doshisha Co., Ltd. generates revenue through its planning, development, production, and sale of lifestyle-related products across domestic and international markets.

Dividend Yield: 3.7%

Doshisha Ltd.'s dividend payments are well-supported by both earnings and cash flows, with a low payout ratio of 20.9% and a cash payout ratio of 30.7%. The company has maintained stable dividends over the past decade, recently increasing its quarterly dividend from ¥35 to ¥40 per share. Although its yield of 3.7% is slightly below the top tier in Japan, Doshisha's dividends have shown consistent growth and reliability.

- Take a closer look at DoshishaLtd's potential here in our dividend report.

- Our valuation report unveils the possibility DoshishaLtd's shares may be trading at a premium.

Summing It All Up

- Embark on your investment journey to our 1937 Top Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7483

DoshishaLtd

Plans, develops, produces, and sells lifestyle-related products in Japan and internationally.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives