- Finland

- /

- Medical Equipment

- /

- HLSE:BIOBV

Spotlight On 3 Penny Stocks With Market Caps Over US$30M

Reviewed by Simply Wall St

As global markets wrap up another year, the mixed performance of major stock indexes and fluctuating economic indicators highlight both challenges and opportunities for investors. Amidst these broader market dynamics, penny stocks continue to intrigue those seeking potential growth in smaller or newer companies. Although the term "penny stocks" might seem outdated, they remain relevant as an investment area offering affordability and growth potential when backed by strong financials. In this article, we explore three penny stocks that stand out for their financial strength and potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.54 | MYR2.69B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR298.75M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.79 | £453.67M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.66 | HK$40.3B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.415 | MYR1.15B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.85 | HK$539.57M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.965 | £491.62M | ★★★★★★ |

| Stelrad Group (LSE:SRAD) | £1.40 | £185.93M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £3.54 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,804 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Biohit Oyj (HLSE:BIOBV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Biohit Oyj is a biotechnology company that produces and sells acetaldehyde-binding products, diagnostic tools, and systems for research institutions, healthcare, and industry globally, with a market cap of €37.04 million.

Operations: Biohit Oyj generates its revenue from the sale of diagnostic kits and equipment, amounting to €13.98 million.

Market Cap: €37.04M

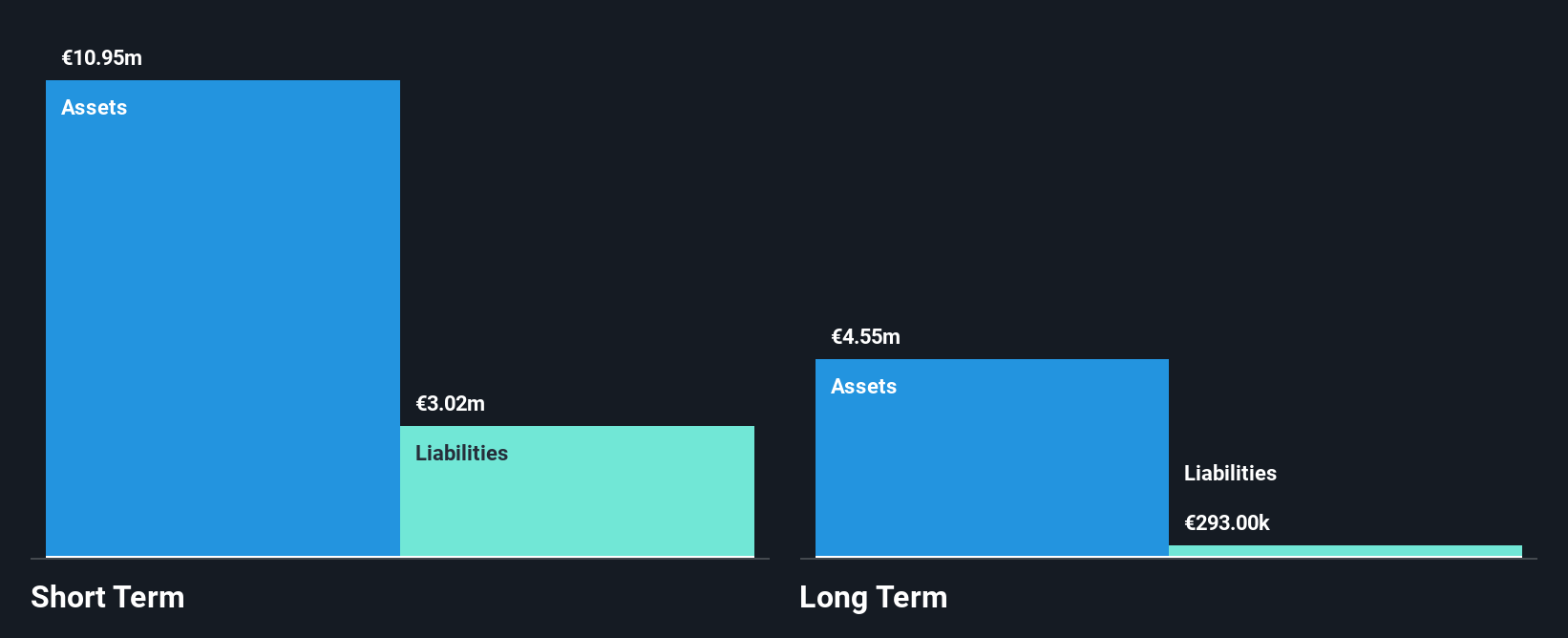

Biohit Oyj, with a market cap of €37.04 million, has shown significant earnings growth over the past year at 50%, surpassing industry averages. Despite recent lowered revenue guidance for 2024 due to geopolitical tensions affecting sales in the Middle East, Biohit remains debt-free and maintains strong financial health with short-term assets exceeding liabilities. The company trades below its estimated fair value and has not diluted shareholders recently. While its return on equity is considered low at 15.3%, Biohit's experienced board and management team support its operational stability amidst current challenges.

- Navigate through the intricacies of Biohit Oyj with our comprehensive balance sheet health report here.

- Gain insights into Biohit Oyj's outlook and expected performance with our report on the company's earnings estimates.

Instabank (OB:INSTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Instabank ASA offers a range of banking products and services in Norway, with a market cap of NOK786.78 million.

Operations: The company generates revenue of NOK319.17 million from its banking operations in Norway.

Market Cap: NOK786.78M

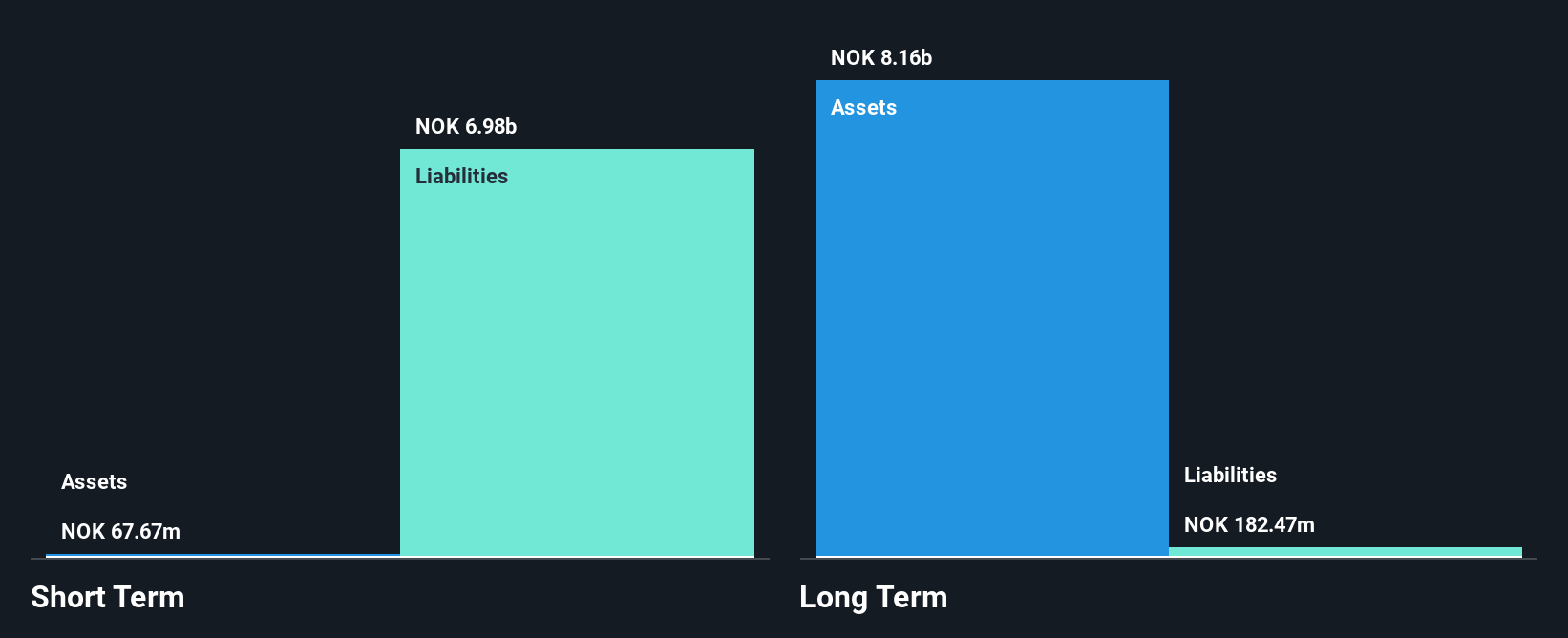

Instabank ASA, with a market cap of NOK786.78 million, operates in Norway's banking sector, generating NOK319.17 million in revenue. The company is trading at a significant discount to its estimated fair value and maintains stable weekly volatility at 3%. Instabank's funding is primarily low-risk customer deposits, with an appropriate loans to deposits ratio of 100%. Despite high-quality earnings and an experienced board, the bank faces challenges with high non-performing loans (6.9%) and declining profit margins from last year. Earnings growth has been negative recently but is forecasted to grow by 16.54% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Instabank.

- Gain insights into Instabank's future direction by reviewing our growth report.

Capital Industrial Financial Services Group (SEHK:730)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Capital Industrial Financial Services Group Limited is an investment holding company that offers financial services in Mainland China and Hong Kong, with a market capitalization of approximately HK$435.30 million.

Operations: The company's revenue is primarily derived from Property Leasing Services (HK$4.25 million), Sale and Leaseback Arrangements Services (HK$195.33 million), and Supply Chain Management and Financial Technology Business (HK$29.14 million).

Market Cap: HK$435.3M

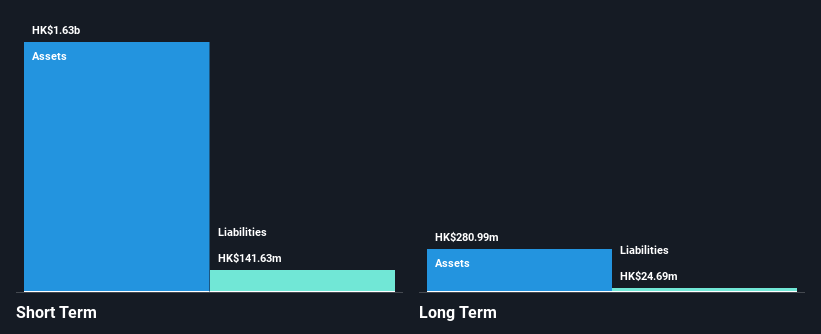

Capital Industrial Financial Services Group, with a market cap of HK$435.30 million, derives revenue from Property Leasing (HK$4.25 million), Sale and Leaseback Arrangements (HK$195.33 million), and Supply Chain Management and Financial Technology (HK$29.14 million). The company's debt is well covered by operating cash flow, indicating strong financial health, while its short-term assets significantly exceed both long-term and short-term liabilities. Although Return on Equity is low at 2.2%, the company has reduced its debt to equity ratio dramatically over five years and achieved stable earnings growth of 0.2% last year amidst industry declines.

- Get an in-depth perspective on Capital Industrial Financial Services Group's performance by reading our balance sheet health report here.

- Examine Capital Industrial Financial Services Group's past performance report to understand how it has performed in prior years.

Where To Now?

- Click this link to deep-dive into the 5,804 companies within our Penny Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biohit Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:BIOBV

Biohit Oyj

A biotechnology company, manufactures and sells bind acetaldehyde, diagnostic products, and systems for diagnostic analysis for the use of research institutions, healthcare, and industry worldwide.

Flawless balance sheet and good value.