- Norway

- /

- Auto Components

- /

- OB:KOA

Investors Could Be Concerned With Kongsberg Automotive's (OB:KOA) Returns On Capital

To find a multi-bagger stock, what are the underlying trends we should look for in a business? Ideally, a business will show two trends; firstly a growing return on capital employed (ROCE) and secondly, an increasing amount of capital employed. Basically this means that a company has profitable initiatives that it can continue to reinvest in, which is a trait of a compounding machine. However, after investigating Kongsberg Automotive (OB:KOA), we don't think it's current trends fit the mold of a multi-bagger.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for Kongsberg Automotive, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.049 = €33m ÷ (€952m - €288m) (Based on the trailing twelve months to March 2021).

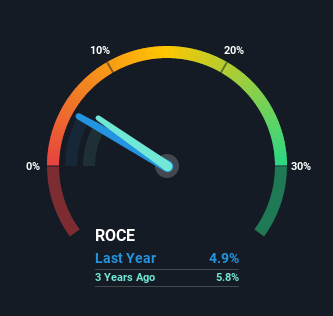

Thus, Kongsberg Automotive has an ROCE of 4.9%. Ultimately, that's a low return and it under-performs the Auto Components industry average of 9.3%.

Check out our latest analysis for Kongsberg Automotive

Historical performance is a great place to start when researching a stock so above you can see the gauge for Kongsberg Automotive's ROCE against it's prior returns. If you want to delve into the historical earnings, revenue and cash flow of Kongsberg Automotive, check out these free graphs here.

What Does the ROCE Trend For Kongsberg Automotive Tell Us?

The trend of ROCE doesn't look fantastic because it's fallen from 9.8% five years ago, while the business's capital employed increased by 33%. Usually this isn't ideal, but given Kongsberg Automotive conducted a capital raising before their most recent earnings announcement, that would've likely contributed, at least partially, to the increased capital employed figure. It's unlikely that all of the funds raised have been put to work yet, so as a consequence Kongsberg Automotive might not have received a full period of earnings contribution from it.

What We Can Learn From Kongsberg Automotive's ROCE

Bringing it all together, while we're somewhat encouraged by Kongsberg Automotive's reinvestment in its own business, we're aware that returns are shrinking. It seems that investors have little hope of these trends getting any better and that may have partly contributed to the stock collapsing 95% in the last five years. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

One more thing: We've identified 2 warning signs with Kongsberg Automotive (at least 1 which is significant) , and understanding these would certainly be useful.

While Kongsberg Automotive isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

If you’re looking to trade Kongsberg Automotive, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Automotive might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OB:KOA

Kongsberg Automotive

Develops, manufactures, and sells products to the automotive industry worldwide.

Flawless balance sheet and slightly overvalued.