- Sweden

- /

- Healthcare Services

- /

- OM:MCOV B

European Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

As the European markets navigate a landscape of mixed stock index performances and ongoing trade discussions with the U.S., investors are keenly observing economic indicators such as inflation and industrial output. In this environment, growth companies with substantial insider ownership can be particularly appealing, as they often signal strong internal confidence and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Xbrane Biopharma (OM:XBRANE) | 21.8% | 56.8% |

| Pharma Mar (BME:PHM) | 11.8% | 43.3% |

| MedinCell (ENXTPA:MEDCL) | 13.9% | 130.8% |

| Marinomed Biotech (WBAG:MARI) | 29.7% | 20.2% |

| KebNi (OM:KEBNI B) | 38.3% | 94.5% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 79% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.7% | 94.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 62.3% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 63.2% |

Here's a peek at a few of the choices from the screener.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

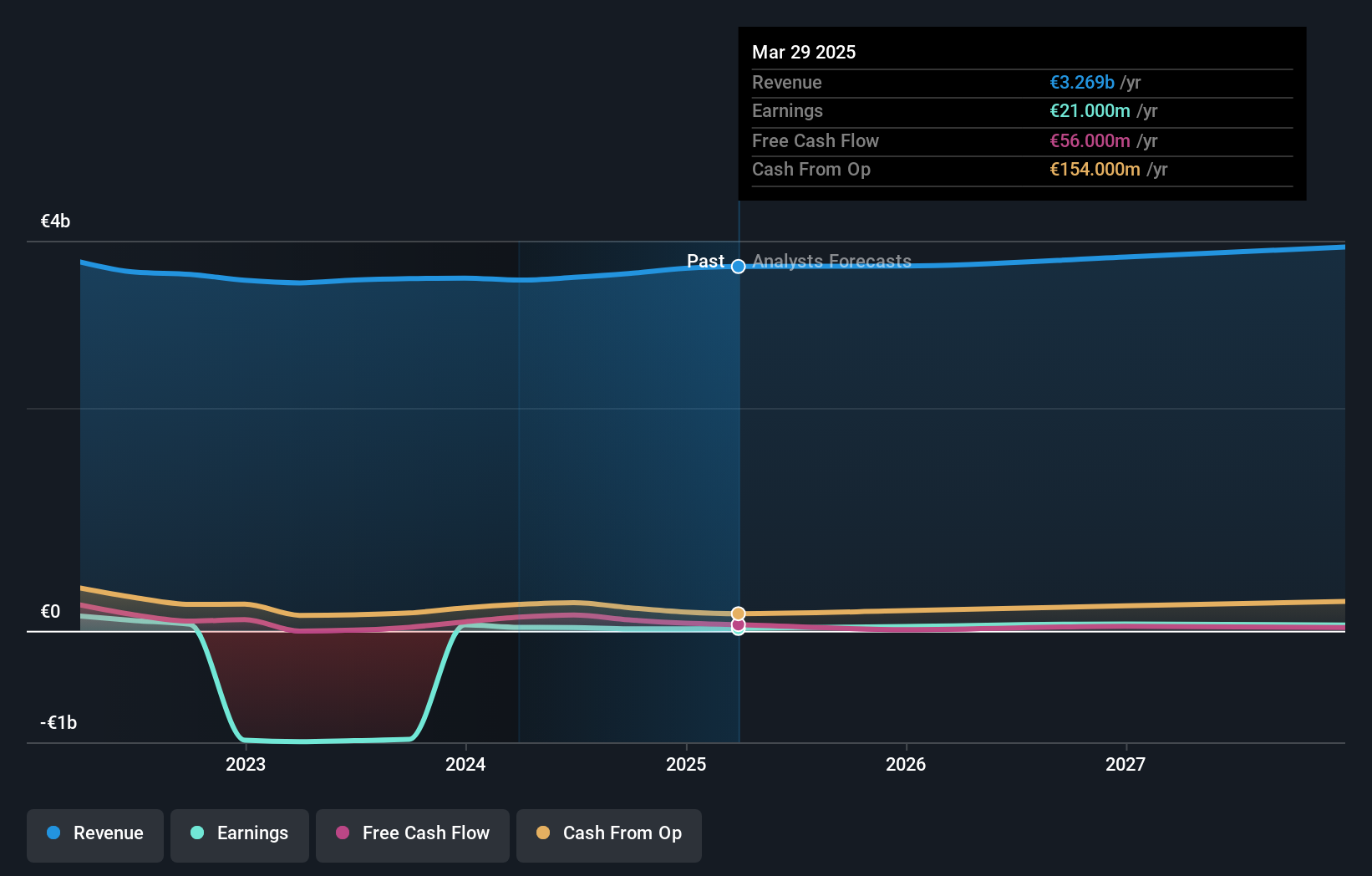

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers in the Netherlands, Europe, and internationally, with a market cap of €536.66 million.

Operations: The company's revenue is primarily derived from its Parcels segment, generating €2.39 billion, and the Mail in The Netherlands segment, contributing €1.33 billion.

Insider Ownership: 35.1%

Earnings Growth Forecast: 32.9% p.a.

PostNL is experiencing significant earnings growth, forecasted at 32.88% annually, outpacing the Dutch market's 9.1%. Despite a recent net loss of €17 million for Q1 2025, this marks an improvement from the previous year's €20 million loss. However, revenue growth remains modest at 1.9% per year and below the market average of 7.3%. The company faces challenges with high debt levels and volatile share prices but trades significantly below its estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of PostNL.

- Upon reviewing our latest valuation report, PostNL's share price might be too optimistic.

Medicover (OM:MCOV B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medicover AB (publ) offers healthcare and diagnostic services in Poland, Sweden, and internationally, with a market cap of SEK43.03 billion.

Operations: The company's revenue segments include healthcare services at €1.17 billion and diagnostic services at €0.80 billion.

Insider Ownership: 11.2%

Earnings Growth Forecast: 23.5% p.a.

Medicover shows strong growth potential, with earnings forecasted to grow significantly at 23.5% annually, surpassing the Swedish market's average. Recent earnings reports highlight a substantial increase in net income and revenue for the first half of 2025. Despite no substantial insider buying recently, insider transactions have been more purchases than sales. Medicover’s innovative MRD assay development marks a promising advancement in personalized cancer treatment, potentially enhancing its market position and supporting future growth prospects.

- Take a closer look at Medicover's potential here in our earnings growth report.

- Our expertly prepared valuation report Medicover implies its share price may be too high.

Yubico (OM:YUBICO)

Simply Wall St Growth Rating: ★★★★★☆

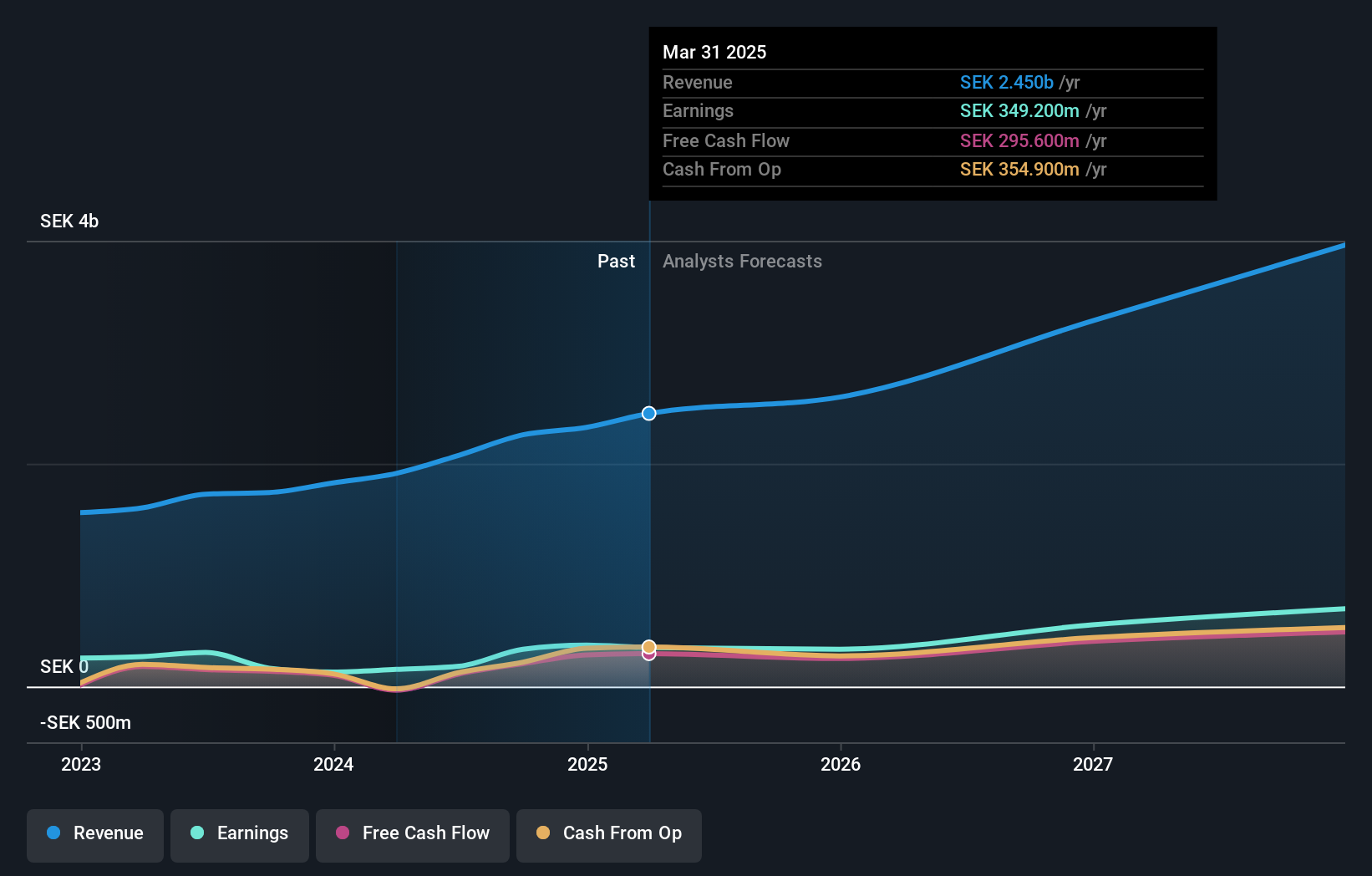

Overview: Yubico AB offers authentication solutions for computers, networks, and online services with a market cap of SEK12 billion.

Operations: The company's revenue primarily comes from its Security Software & Services segment, totaling SEK2.45 billion.

Insider Ownership: 36.5%

Earnings Growth Forecast: 23.9% p.a.

Yubico demonstrates strong growth potential with earnings expected to grow significantly at 23.9% annually, outpacing the Swedish market. Recent expansions, including YubiKey as a Service in the EU and increased delivery coverage, enhance its market reach and operational efficiency against phishing threats. Despite a decline in net income for Q1 2025, insider buying has been substantial recently, indicating confidence in future prospects. The company trades at good value compared to peers within the industry.

- Click to explore a detailed breakdown of our findings in Yubico's earnings growth report.

- Upon reviewing our latest valuation report, Yubico's share price might be too pessimistic.

Where To Now?

- Click here to access our complete index of 214 Fast Growing European Companies With High Insider Ownership.

- Want To Explore Some Alternatives? This technology could replace computers: discover the 27 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MCOV B

Medicover

Provides healthcare and diagnostic services in Poland, Sweden, and internationally.

High growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives