- China

- /

- Renewable Energy

- /

- SZSE:000690

3 Promising Penny Stocks With Market Caps Under US$2B

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and shifting trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks leading the charge. In such a dynamic market landscape, investors often seek opportunities in lesser-known areas like penny stocks, which despite their outdated moniker, continue to represent potential for significant returns. By focusing on companies with strong financials and clear growth potential, penny stocks can offer a unique blend of affordability and opportunity for those willing to explore beyond the mainstream indices.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.85 | HK$44.2B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.97 | £479.09M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.10 | £331.23M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.835 | MYR277.17M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £4.04 | £459.09M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

Click here to see the full list of 5,669 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

PostNL (ENXTAM:PNL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services to businesses and consumers across the Netherlands, Europe, and globally, with a market cap of €530.73 million.

Operations: PostNL N.V. does not report specific revenue segments, but it provides postal and logistics services to businesses and consumers both domestically in the Netherlands and internationally.

Market Cap: €530.73M

PostNL N.V., with a market cap of €530.73 million, has recently become profitable, marking a significant turnaround from its previous financial struggles. The company is trading at 43.1% below its estimated fair value, which may appeal to value-focused investors. Although PostNL's return on equity is low at 11.8%, it has improved its debt situation over time and now covers interest payments comfortably with earnings. However, the net debt to equity ratio remains high at 169.3%, indicating potential risk if not managed carefully. Recent corporate guidance suggests normalized EBIT for 2024 around €53 million, reflecting cautious optimism in financial performance improvement.

- Click here to discover the nuances of PostNL with our detailed analytical financial health report.

- Review our growth performance report to gain insights into PostNL's future.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Guangdong DFP New Material Group Co., Ltd. operates in the materials sector, focusing on the production and distribution of various new materials, with a market cap of approximately CN¥6.39 billion.

Operations: Guangdong DFP New Material Group Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥6.39B

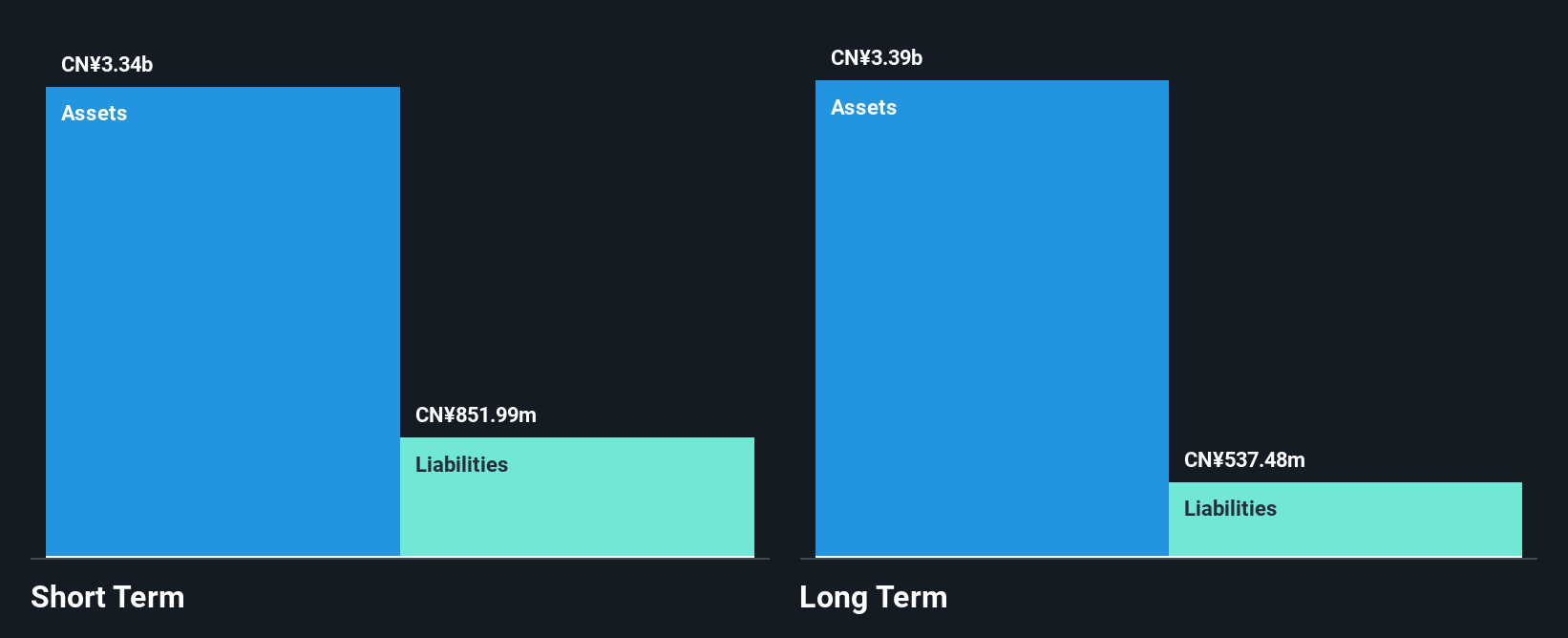

Guangdong DFP New Material Group, with a market cap of CN¥6.39 billion, is currently unprofitable and pre-revenue, complicating comparisons to industry peers. The company's short-term assets significantly exceed both its long-term and short-term liabilities, indicating solid asset management. Despite having more cash than total debt, its operating cash flow does not sufficiently cover debt obligations. Recent developments include a major acquisition where Quzhou Zhishang and Quzhou Zhiwei acquired a 29.90% stake for CN¥2 billion from Hong Kong Tung Fung Investment Group, subject to regulatory approval, which could influence future strategic directions.

- Get an in-depth perspective on Guangdong DFP New Material Group's performance by reading our balance sheet health report here.

- Evaluate Guangdong DFP New Material Group's prospects by accessing our earnings growth report.

Guangdong Baolihua New Energy Stock (SZSE:000690)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Baolihua New Energy Stock Co., Ltd. operates in the renewable energy sector, focusing on power generation and related services, with a market cap of CN¥9.40 billion.

Operations: The company generates revenue of CN¥8.68 billion from its operations in China.

Market Cap: CN¥9.4B

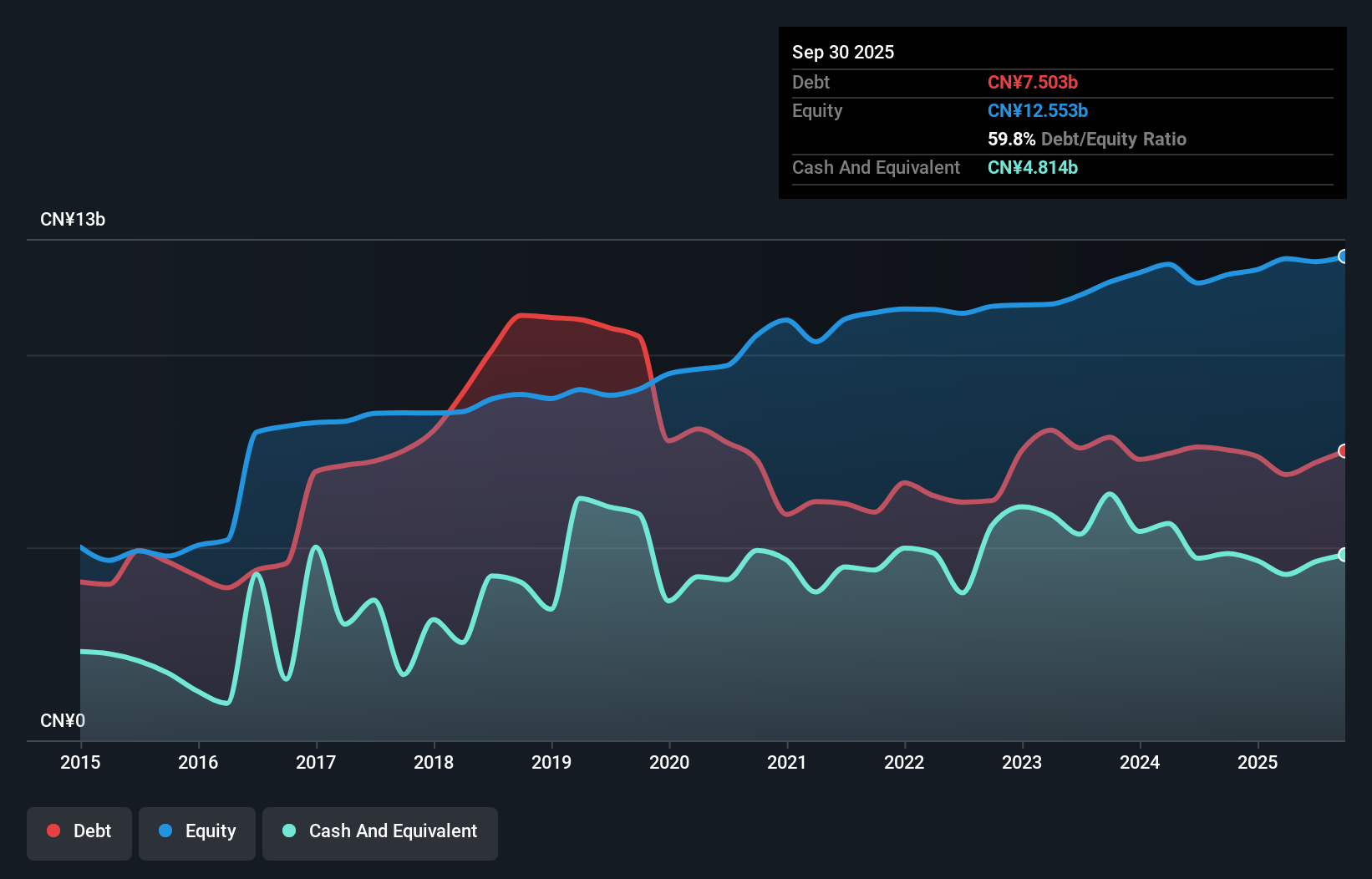

Guangdong Baolihua New Energy Stock, with a market cap of CN¥9.40 billion, operates in the renewable energy sector and has shown promising financial stability. The company benefits from a satisfactory net debt to equity ratio of 22.3% and its short-term assets (CN¥6.6 billion) comfortably cover both short-term (CN¥3.9 billion) and long-term liabilities (CN¥5.6 billion). Earnings grew significantly by 31% over the past year, surpassing industry averages, although they have declined by 12.7% annually over five years. Despite trading below estimated fair value, dividend sustainability remains questionable due to insufficient free cash flow coverage.

- Unlock comprehensive insights into our analysis of Guangdong Baolihua New Energy Stock stock in this financial health report.

- Evaluate Guangdong Baolihua New Energy Stock's historical performance by accessing our past performance report.

Taking Advantage

- Get an in-depth perspective on all 5,669 Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000690

Guangdong Baolihua New Energy Stock

Guangdong Baolihua New Energy Stock Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives