- Netherlands

- /

- Software

- /

- ENXTAM:MTRK

3 High Growth Companies With Insider Ownership On Euronext Amsterdam

Reviewed by Simply Wall St

As global markets face renewed fears of economic slowdown, the Euronext Amsterdam has not been immune to these pressures, reflecting broader concerns about growth and stability. Despite this challenging backdrop, certain high-growth companies with significant insider ownership stand out as potential bright spots for investors. In times of market uncertainty, stocks with high insider ownership can be particularly appealing. This alignment of interests between company insiders and shareholders often signals confidence in the company's future prospects and can provide a stabilizing effect during volatile periods.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 82.7% |

| Ebusco Holding (ENXTAM:EBUS) | 33.2% | 107.8% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.1% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 32.6% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Let's uncover some gems from our specialized screener.

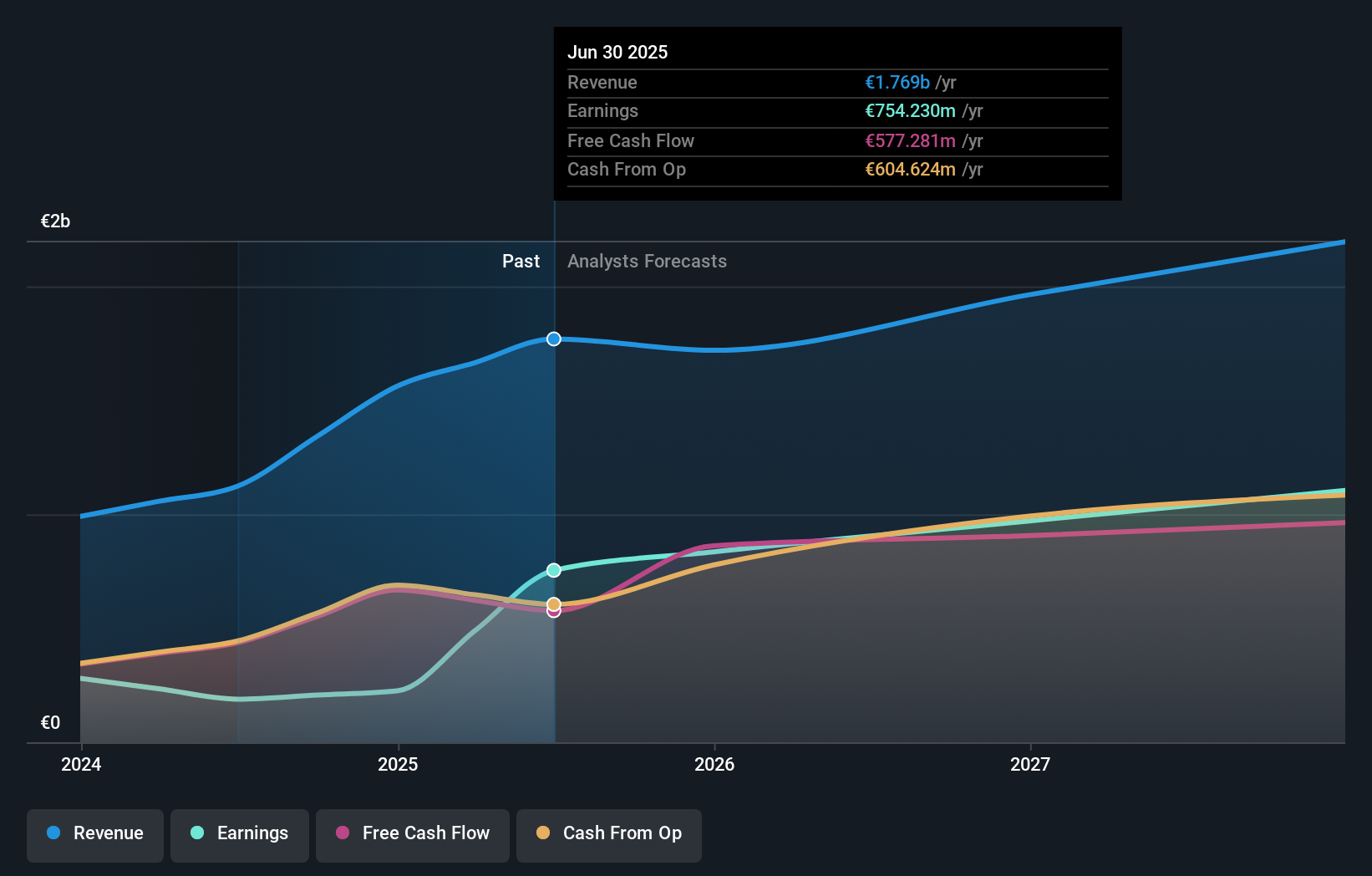

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm specializing in various investment strategies including middle market secondaries, infrastructure and credit, with a market cap of €20.38 billion.

Operations: CVC Capital Partners plc generates revenue through middle market secondaries, infrastructure and credit investments, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts.

Insider Ownership: 20.2%

Earnings Growth Forecast: 32.6% p.a.

CVC Capital Partners, a prominent private equity firm in the Netherlands, is experiencing robust growth with forecasted earnings expected to increase by 32.6% annually, outpacing the Dutch market's 19%. Despite trading at 30% below its estimated fair value, CVC maintains high insider ownership and is actively involved in significant M&A activities, including potential acquisitions of DB Schenker and Aavas Financiers. Recent bids highlight its strategic focus on expanding its portfolio across diverse sectors.

- Get an in-depth perspective on CVC Capital Partners' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, CVC Capital Partners' share price might be too optimistic.

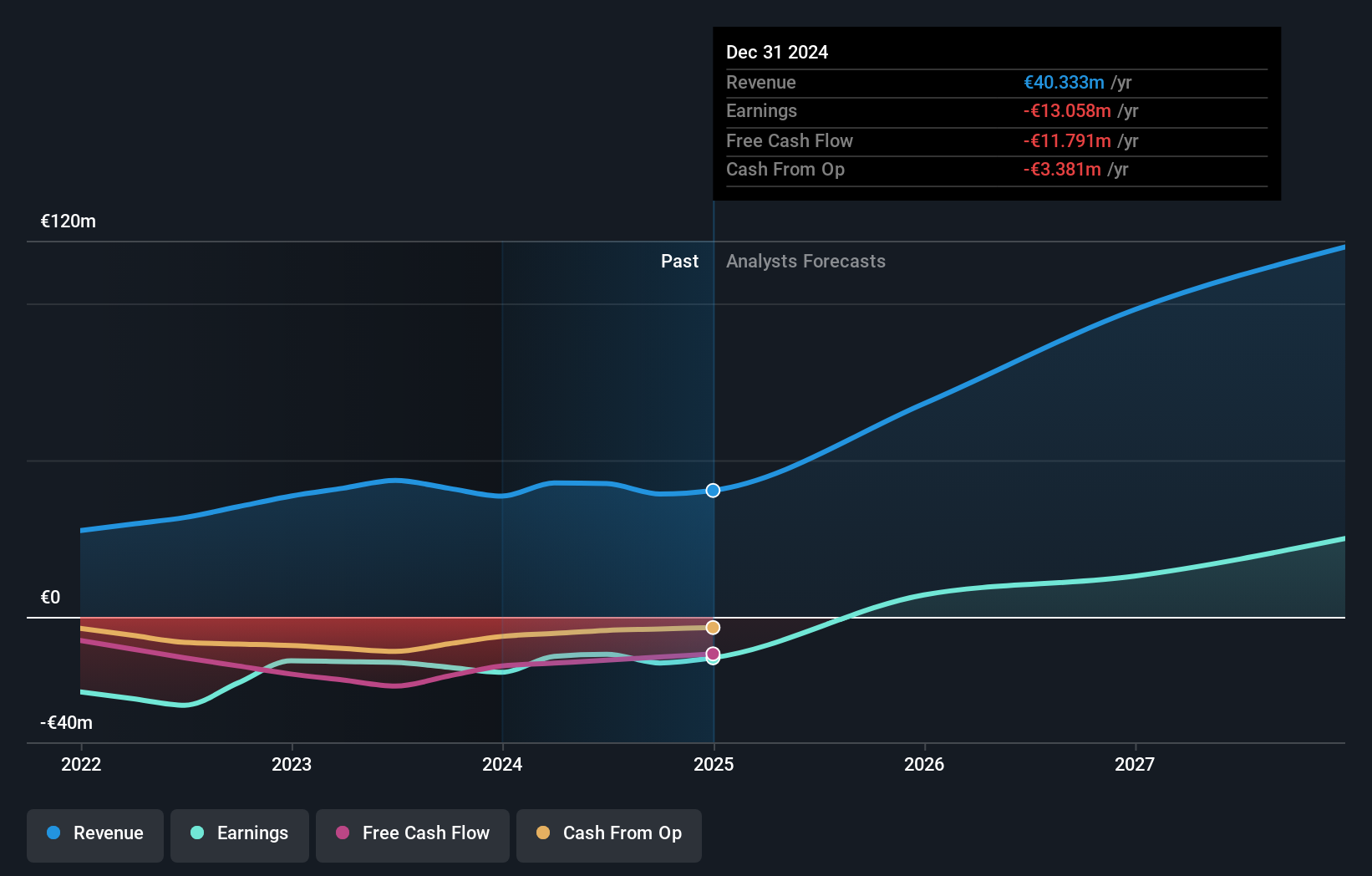

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, with a market cap of €264.69 million, provides software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union.

Operations: MotorK plc generates €42.50 million in revenue from its Software & Programming segment, offering SaaS solutions to the automotive retail sector across several European countries.

Insider Ownership: 35.7%

Earnings Growth Forecast: 108.4% p.a.

MotorK is forecast to grow its revenue by 22.1% annually, outpacing the Dutch market's 9.5%. Despite a net loss of €6.48 million for H1 2024, down from €7.8 million a year ago, the company is expected to become profitable within three years with earnings growth projected at 108.44% per year. Recent executive changes include Zoltan Gelencser joining as CFO, bringing extensive global finance experience from companies like Vodafone and eBay.

- Click here and access our complete growth analysis report to understand the dynamics of MotorK.

- The valuation report we've compiled suggests that MotorK's current price could be inflated.

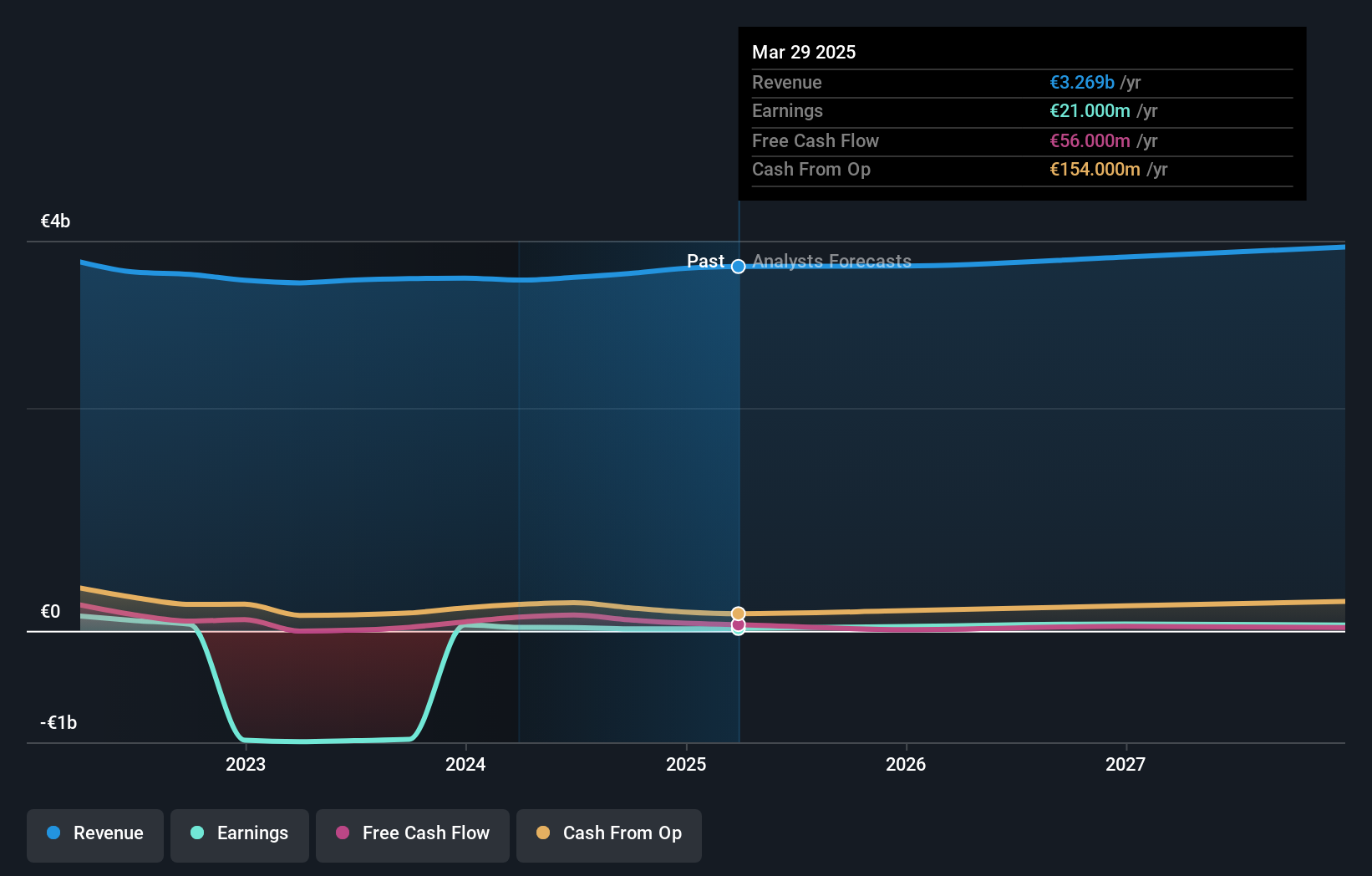

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. provides postal and logistics services to businesses and consumers in the Netherlands, rest of Europe, and internationally with a market cap of €6 billion.

Operations: The company's revenue segments include Parcels (€2.28 billion) and Mail in the Netherlands (€1.35 billion).

Insider Ownership: 35.6%

Earnings Growth Forecast: 36.4% p.a.

PostNL is trading at 53.1% below its estimated fair value, with earnings expected to grow significantly over the next three years at 36.4% per year, outpacing the Dutch market's 19%. Despite a high level of debt and a recent net loss of €9 million for H1 2024, its Return on Equity is forecasted to reach 26.7%. However, revenue growth is projected at only 2.6% annually, slower than the market average of 9.5%.

- Delve into the full analysis future growth report here for a deeper understanding of PostNL.

- Insights from our recent valuation report point to the potential undervaluation of PostNL shares in the market.

Make It Happen

- Get an in-depth perspective on all 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MTRK

MotorK

Provides software-as-a-service for the automotive retail industry in Italy, Spain, France, Germany, and the Benelux Union.

High growth potential with adequate balance sheet.