- Netherlands

- /

- Telecom Services and Carriers

- /

- ENXTAM:KPN

I Ran A Stock Scan For Earnings Growth And Koninklijke KPN (AMS:KPN) Passed With Ease

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. And in their study titled Who Falls Prey to the Wolf of Wall Street?' Leuz et. al. found that it is 'quite common' for investors to lose money by buying into 'pump and dump' schemes.

In contrast to all that, I prefer to spend time on companies like Koninklijke KPN (AMS:KPN), which has not only revenues, but also profits. While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Koninklijke KPN

How Fast Is Koninklijke KPN Growing?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. Who among us would not applaud Koninklijke KPN's stratospheric annual EPS growth of 53%, compound, over the last three years? That sort of growth never lasts long, but like a shooting star it is well worth watching when it happens.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While Koninklijke KPN may have maintained EBIT margins over the last year, revenue has fallen. And that does make me a little more cautious of the stock.

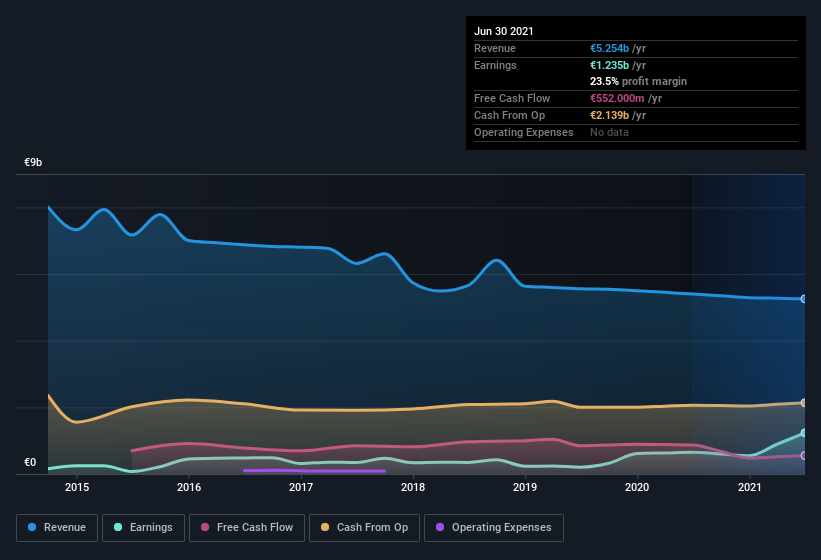

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Koninklijke KPN's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Koninklijke KPN Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's good to see Koninklijke KPN insiders walking the walk, by spending €323k on shares in just twelve months. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by Chairman of Management Board & CEO Joost F. Farwerck for €124k worth of shares, at about €2.48 per share.

The good news, alongside the insider buying, for Koninklijke KPN bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold €11m worth of its stock. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 0.09% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does Koninklijke KPN Deserve A Spot On Your Watchlist?

Koninklijke KPN's earnings have taken off like any random crypto-currency did, back in 2017. What's more insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Koninklijke KPN deserves timely attention. What about risks? Every company has them, and we've spotted 4 warning signs for Koninklijke KPN (of which 1 is a bit unpleasant!) you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Koninklijke KPN, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you decide to trade Koninklijke KPN, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Koninklijke KPN might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTAM:KPN

Koninklijke KPN

Provides telecommunications and information technology (IT) services in the Netherlands.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives