- Netherlands

- /

- Software

- /

- ENXTAM:MTRK

Top Growth Companies With Insider Ownership On Euronext Amsterdam October 2024

Reviewed by Simply Wall St

As European markets show signs of optimism with major indexes like the STOXX Europe 600 Index ending higher, investors are keenly observing growth opportunities within the Netherlands. In this context, companies with high insider ownership can be particularly appealing as they often signal confidence from those closest to the business.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 84.4% |

| Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 33.5% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.5% |

Let's uncover some gems from our specialized screener.

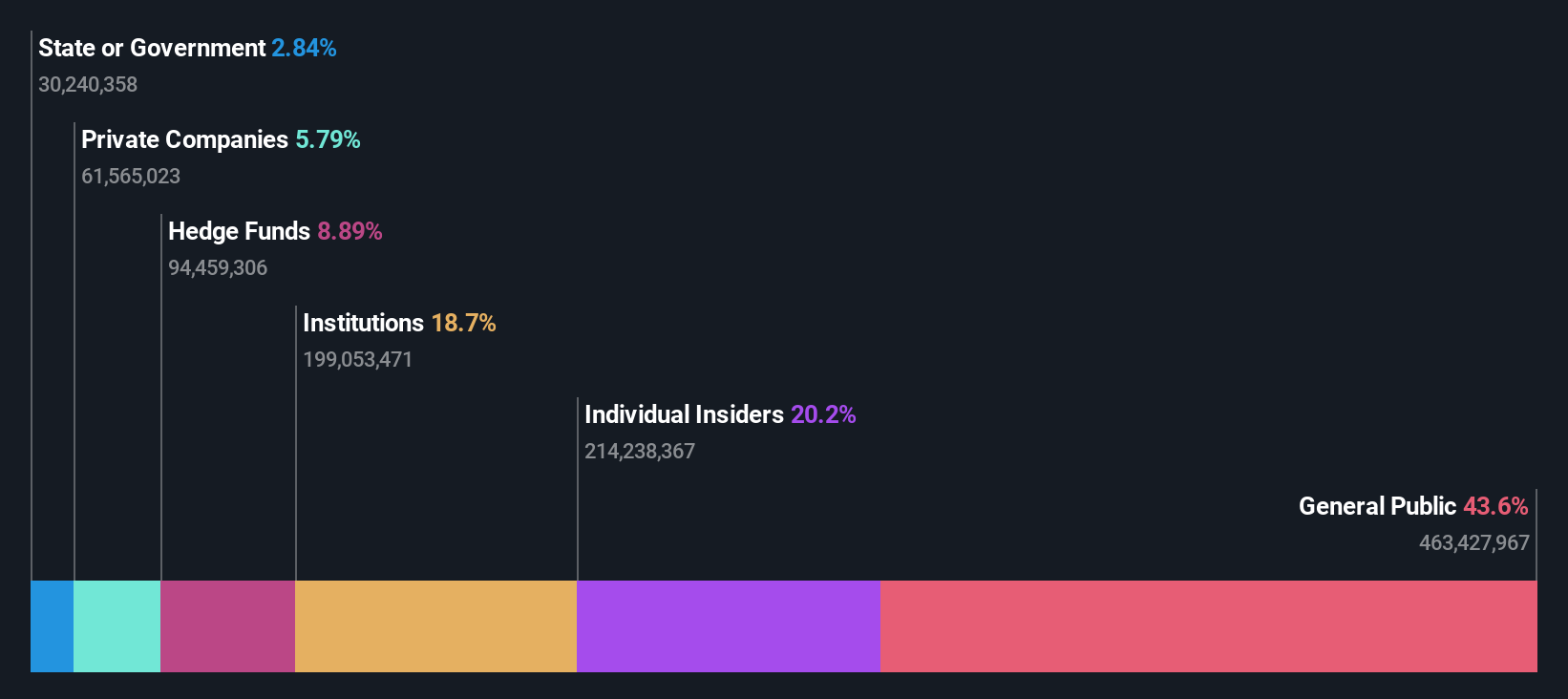

CVC Capital Partners (ENXTAM:CVC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts with a market cap of €21.50 billion.

Operations: CVC Capital Partners plc generates revenue through its focus on private equity and venture capital activities, including middle market secondaries, infrastructure and credit investments, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales, and spinouts.

Insider Ownership: 20.2%

Revenue Growth Forecast: 13.6% p.a.

CVC Capital Partners, a private equity firm in the Netherlands, exhibits significant growth potential with high insider ownership. Despite a slower revenue growth forecast of 13.6% annually, its earnings are expected to grow significantly at 33.5%, outpacing the Dutch market average. Trading below estimated fair value and boasting a high future return on equity forecast of 44.7%, CVC is actively pursuing strategic acquisitions like Deutsche Bahn's logistics unit and Aavas Financiers to enhance its portfolio amidst ongoing M&A activity.

- Navigate through the intricacies of CVC Capital Partners with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that CVC Capital Partners is priced higher than what may be justified by its financials.

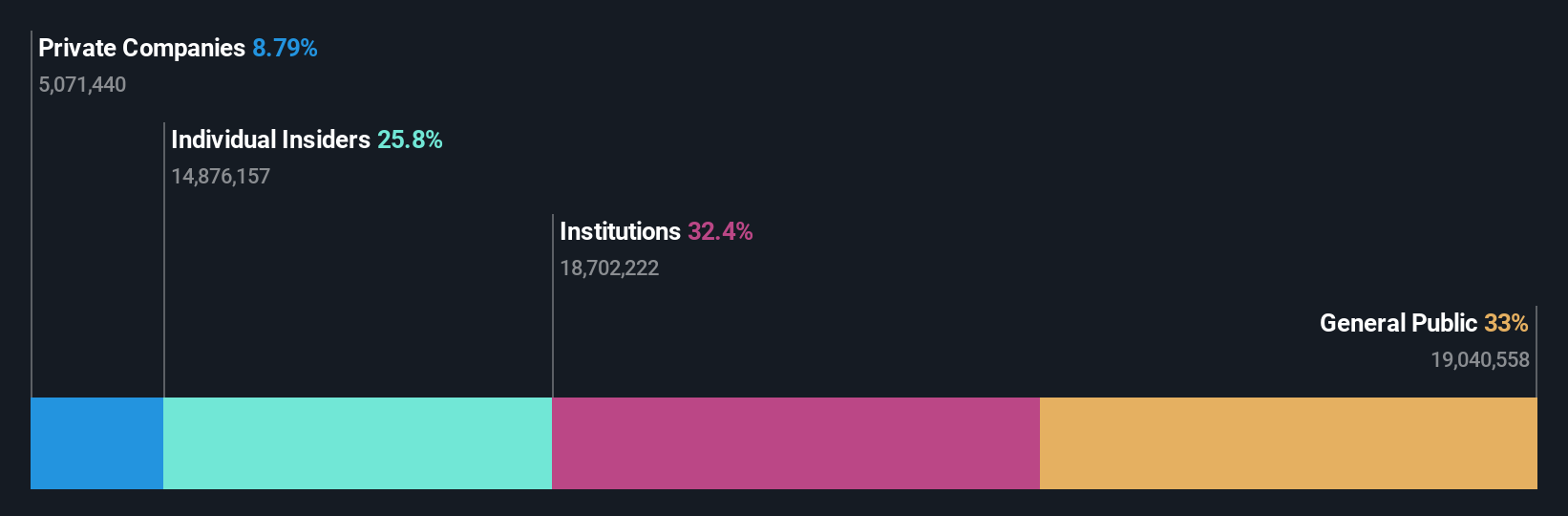

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★★

Overview: Envipco Holding N.V. designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines for collecting and processing used beverage containers in the Netherlands, North America, and Europe with a market cap of €297.11 million.

Operations: Envipco Holding N.V. generates revenue through the design, development, manufacture, assembly, marketing, sales, leasing, and servicing of reverse vending machines for used beverage container collection and processing across the Netherlands, North America, and Europe.

Insider Ownership: 36.7%

Revenue Growth Forecast: 34.6% p.a.

Envipco Holding demonstrates robust growth potential with high insider ownership, driven by a forecasted revenue increase of 34.6% annually and earnings growth of 84.4%, both significantly outpacing the Dutch market averages. Recent achievements include securing substantial orders in Romania, though the company has experienced share price volatility and past shareholder dilution. Despite reporting a net loss reduction, Envipco's strategic initiatives and board changes signal an evolving business landscape poised for expansion.

- Get an in-depth perspective on Envipco Holding's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Envipco Holding's current price could be inflated.

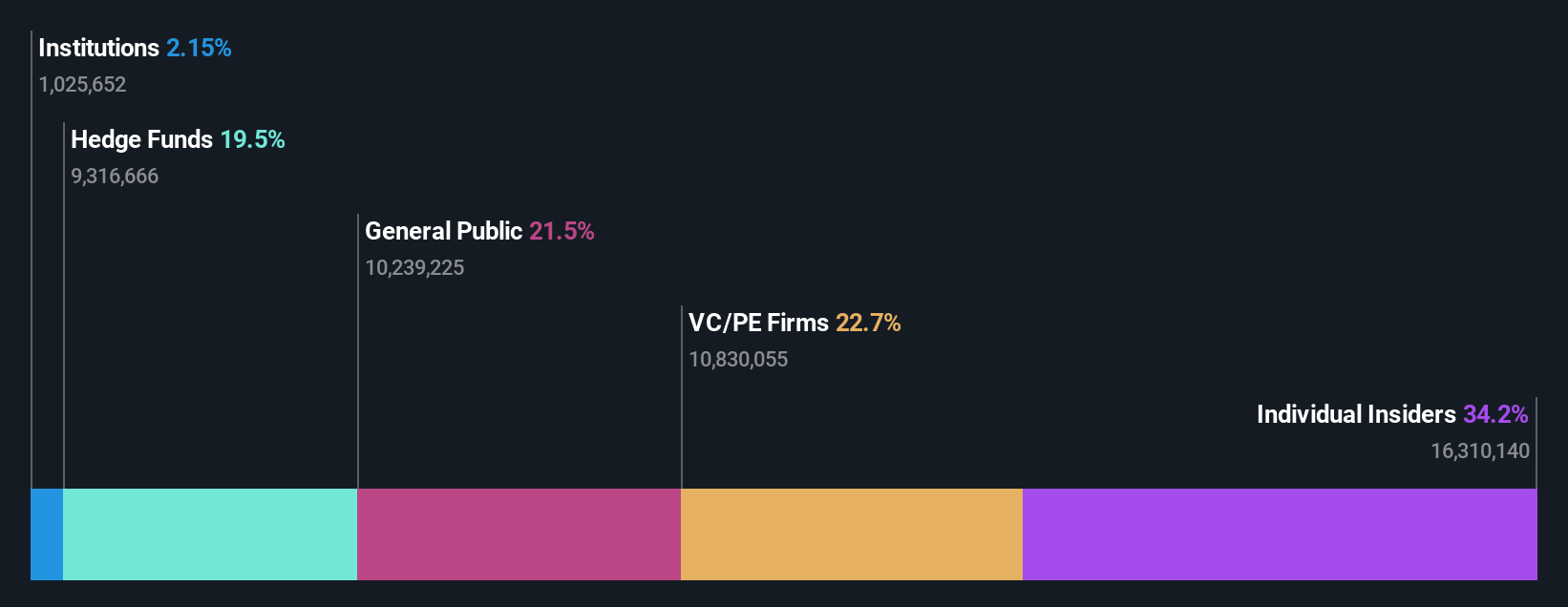

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, along with its subsidiaries, offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union with a market cap of €262.95 million.

Operations: The company generates revenue of €42.50 million from its Software & Programming segment, providing solutions to the automotive retail sector in several European countries.

Insider Ownership: 35.7%

Revenue Growth Forecast: 22.1% p.a.

MotorK shows promising growth potential with high insider ownership, as it is forecast to achieve revenue growth of 22.1% per year, surpassing the Dutch market average. Despite recent share price volatility and past shareholder dilution, MotorK's net loss decreased to €6.48 million for the half-year ending June 2024. The appointment of Zoltan Gelencser as CFO could strengthen financial management, supporting MotorK's path toward profitability within three years amidst expected earnings growth of over 100% annually.

- Dive into the specifics of MotorK here with our thorough growth forecast report.

- Our expertly prepared valuation report MotorK implies its share price may be too high.

Where To Now?

- Access the full spectrum of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MTRK

MotorK

Provides software-as-a-service for the automotive retail industry in Italy, Spain, France, Germany, and the Benelux Union.

High growth potential with adequate balance sheet.