- Netherlands

- /

- Software

- /

- ENXTAM:MTRK

European Growth Companies With High Insider Ownership For May 2025

Reviewed by Simply Wall St

As trade tensions show signs of easing, European markets have experienced a positive shift, with the STOXX Europe 600 Index rising by 2.77% in April 2025. This climate of cautious optimism provides an intriguing backdrop for investors seeking growth companies with high insider ownership, as such stocks often benefit from strong internal commitment and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 43.1% |

| KebNi (OM:KEBNI B) | 38.3% | 67.3% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Elicera Therapeutics (OM:ELIC) | 23.8% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Lokotech Group (OB:LOKO) | 13.6% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.7% | 60.7% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

Let's dive into some prime choices out of the screener.

NTG Nordic Transport Group (CPSE:NTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NTG Nordic Transport Group A/S, with a market cap of DKK5.55 billion, offers asset-light freight forwarding services across road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Operations: The company's revenue segments consist of DKK2.75 billion from Air & Ocean and DKK6.64 billion from Road & Logistics.

Insider Ownership: 24.9%

Return On Equity Forecast: 22% (2027 estimate)

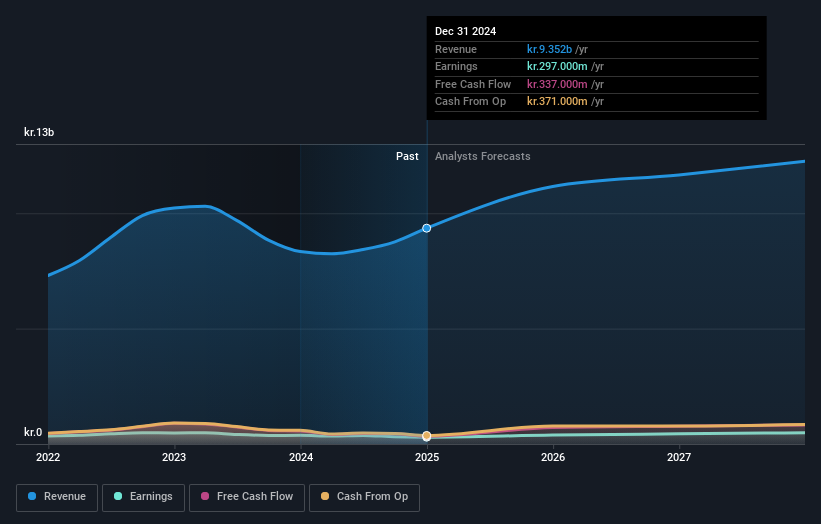

NTG Nordic Transport Group shows potential as a growth company with high insider ownership, driven by its strategic focus on mergers and acquisitions to enhance scale and capabilities. Despite a decrease in net income to DKK 297 million for 2024, earnings are expected to grow annually by 16%, outpacing the Danish market. The stock trades significantly below its estimated fair value, with analysts predicting a price increase of over 40%. Recent board changes may influence future strategies.

- Click to explore a detailed breakdown of our findings in NTG Nordic Transport Group's earnings growth report.

- Insights from our recent valuation report point to the potential undervaluation of NTG Nordic Transport Group shares in the market.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc, with a market cap of €238.48 million, offers software-as-a-service solutions for the automotive retail sector across Italy, Spain, France, Germany, and the Benelux Union.

Operations: The company's revenue is primarily generated from its Software & Programming segment, amounting to €40.33 million.

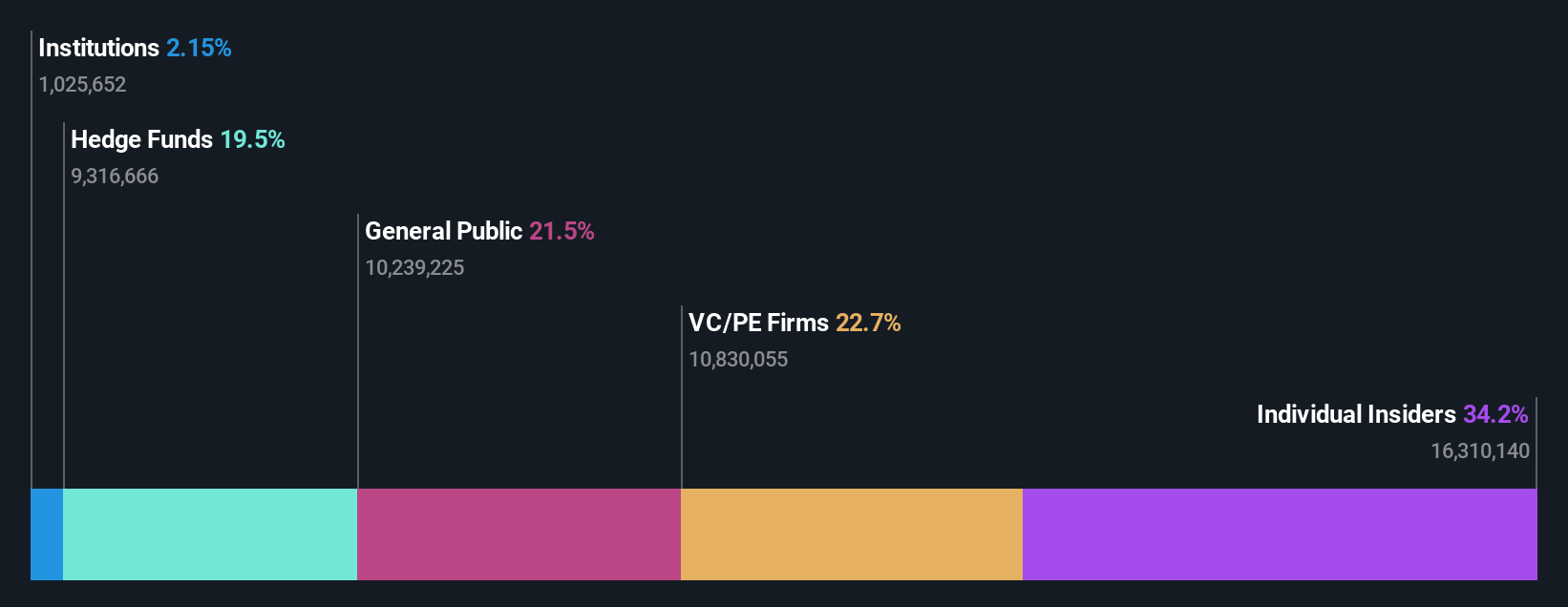

Insider Ownership: 34.2%

Return On Equity Forecast: N/A (2027 estimate)

MotorK demonstrates potential for growth with high insider ownership, evidenced by its forecasted revenue growth of 38.8% annually, surpassing the Dutch market average. Despite a volatile share price and past shareholder dilution, the company is on track to achieve profitability within three years. Recent private placements raised €5.36 million from investors like 83North Limited and Lucerne Capital Management, indicating strong investor interest despite lowered earnings guidance for 2024 due to reduced Committed Annual Recurring Revenues.

- Unlock comprehensive insights into our analysis of MotorK stock in this growth report.

- According our valuation report, there's an indication that MotorK's share price might be on the expensive side.

Gentoo Media (OB:G2MNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Gentoo Media Inc. is an iGaming technology company offering solutions, products, and services to operators in the Nordic region, other parts of Europe, and globally, with a market cap of NOK2.71 billion.

Operations: The company's revenue is derived from two main segments: Paid, generating €28.37 million, and Publishing, contributing €94.40 million.

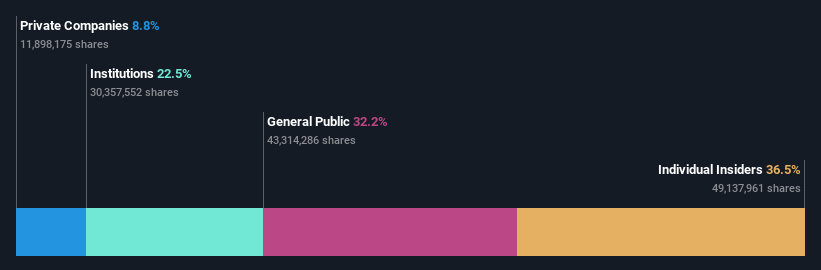

Insider Ownership: 37.7%

Return On Equity Forecast: 55% (2027 estimate)

Gentoo Media's high insider ownership aligns with its strong growth trajectory, as earnings are expected to grow significantly at 21% annually, outpacing the Norwegian market. Recent substantial insider buying underscores confidence in the company's future. Despite trading at a significant discount to estimated fair value, financial challenges exist with interest payments not well covered by earnings. The company is delisting from Euronext Oslo Børs but remains listed on Nasdaq Stockholm, maintaining accessibility for investors.

- Click here to discover the nuances of Gentoo Media with our detailed analytical future growth report.

- Our valuation report here indicates Gentoo Media may be undervalued.

Seize The Opportunity

- Access the full spectrum of 207 Fast Growing European Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

If you're looking to trade MotorK, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:MTRK

MotorK

Provides software-as-a-service for the automotive retail industry in Italy, Spain, France, Germany, and the Benelux Union.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives