- Netherlands

- /

- Diversified Financial

- /

- ENXTAM:ADYEN

Should You Be Adding Adyen (AMS:ADYEN) To Your Watchlist Today?

Some have more dollars than sense, they say, so even companies that have no revenue, no profit, and a record of falling short, can easily find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like Adyen (AMS:ADYEN). While profit is not necessarily a social good, it's easy to admire a business that can consistently produce it. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Adyen

Adyen's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. Who among us would not applaud Adyen's stratospheric annual EPS growth of 50%, compound, over the last three years? While that sort of growth rate isn't sustainable for long, it certainly catches my attention; like a crow with a sparkly stone.

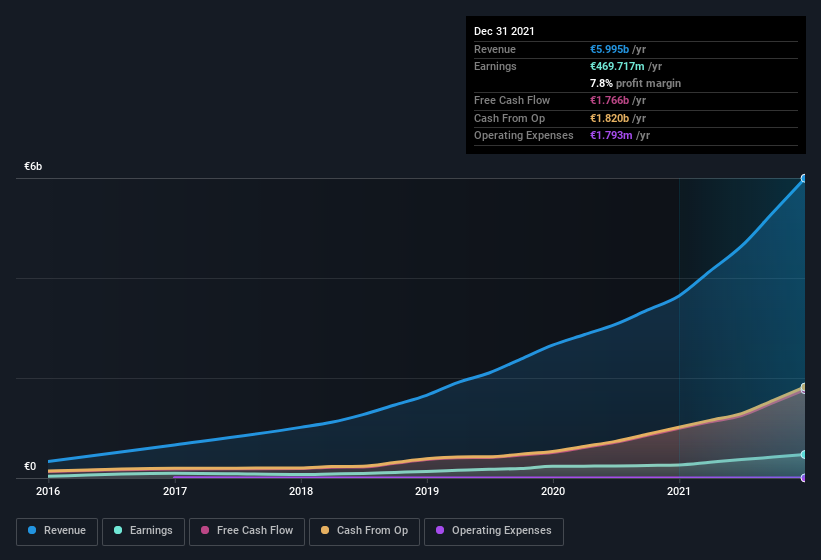

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). While we note Adyen's EBIT margins were flat over the last year, revenue grew by a solid 65% to €6.0b. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. To see the actual numbers, click on the chart.

While we live in the present moment at all times, there's no doubt in my mind that the future matters more than the past. So why not check this interactive chart depicting future EPS estimates, for Adyen?

Are Adyen Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a €52b company like Adyen. But we are reassured by the fact they have invested in the company. Indeed, they have a glittering mountain of wealth invested in it, currently valued at €4.1b. This suggests to me that leadership will be very mindful of shareholders' interests when making decisions!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalizations over €7.4b, like Adyen, the median CEO pay is around €3.7m.

The Adyen CEO received total compensation of just €629k in the year to . That looks like modest pay to me, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does Adyen Deserve A Spot On Your Watchlist?

Adyen's earnings per share have taken off like a rocket aimed right at the moon. The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so I do think Adyen is worth considering carefully. You should always think about risks though. Case in point, we've spotted 1 warning sign for Adyen you should be aware of.

Although Adyen certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:ADYEN

Adyen

Operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion