- Netherlands

- /

- Semiconductors

- /

- ENXTAM:BESI

Investors Appear Satisfied With BE Semiconductor Industries N.V.'s (AMS:BESI) Prospects As Shares Rocket 25%

BE Semiconductor Industries N.V. (AMS:BESI) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 77%.

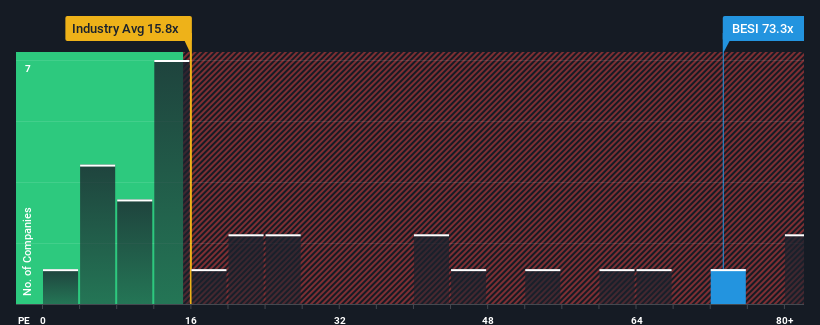

Following the firm bounce in price, given close to half the companies in the Netherlands have price-to-earnings ratios (or "P/E's") below 16x, you may consider BE Semiconductor Industries as a stock to avoid entirely with its 72.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

BE Semiconductor Industries hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for BE Semiconductor Industries

What Are Growth Metrics Telling Us About The High P/E?

BE Semiconductor Industries' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. Regardless, EPS has managed to lift by a handy 6.9% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 42% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 13% each year, which is noticeably less attractive.

With this information, we can see why BE Semiconductor Industries is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

The strong share price surge has got BE Semiconductor Industries' P/E rushing to great heights as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of BE Semiconductor Industries' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for BE Semiconductor Industries with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BE Semiconductor Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BESI

BE Semiconductor Industries

Engages in the development, manufacture, marketing, sale, and service of semiconductor assembly equipment for the semiconductor and electronics industries in China, the United States, Malaysia, Ireland, Korea, Taiwan, Thailand, Other Asia Pacific and Europe, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives