- Netherlands

- /

- Semiconductors

- /

- ENXTAM:BESI

BE Semiconductor Industries And 2 Other European Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

Amidst ongoing uncertainty about U.S. trade policy, the European market has experienced mixed performance, with the pan-European STOXX Europe 600 Index recently snapping a ten-week streak of gains. Despite this volatility, opportunities may exist for investors to identify stocks that are potentially undervalued based on current market conditions and economic developments. In such an environment, a good stock might be one that demonstrates strong fundamentals and resilience in sectors poised for growth or stability despite broader economic challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €0.965 | €1.91 | 49.4% |

| Airbus (ENXTPA:AIR) | €164.10 | €321.27 | 48.9% |

| Wienerberger (WBAG:WIE) | €34.68 | €69.35 | 50% |

| Comet Holding (SWX:COTN) | CHF234.50 | CHF462.48 | 49.3% |

| Theon International (ENXTAM:THEON) | €19.00 | €37.22 | 49% |

| Net Insight (OM:NETI B) | SEK4.81 | SEK9.62 | 50% |

| JOST Werke (XTRA:JST) | €50.50 | €98.69 | 48.8% |

| Vestas Wind Systems (CPSE:VWS) | DKK103.35 | DKK201.48 | 48.7% |

| Xplora Technologies (OB:XPLRA) | NOK27.00 | NOK53.73 | 49.7% |

| Neosperience (BIT:NSP) | €0.538 | €1.06 | 49.2% |

Let's dive into some prime choices out of the screener.

BE Semiconductor Industries (ENXTAM:BESI)

Overview: BE Semiconductor Industries N.V. is a company that develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries globally, with a market cap of €8.43 billion.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, totaling €607.47 million.

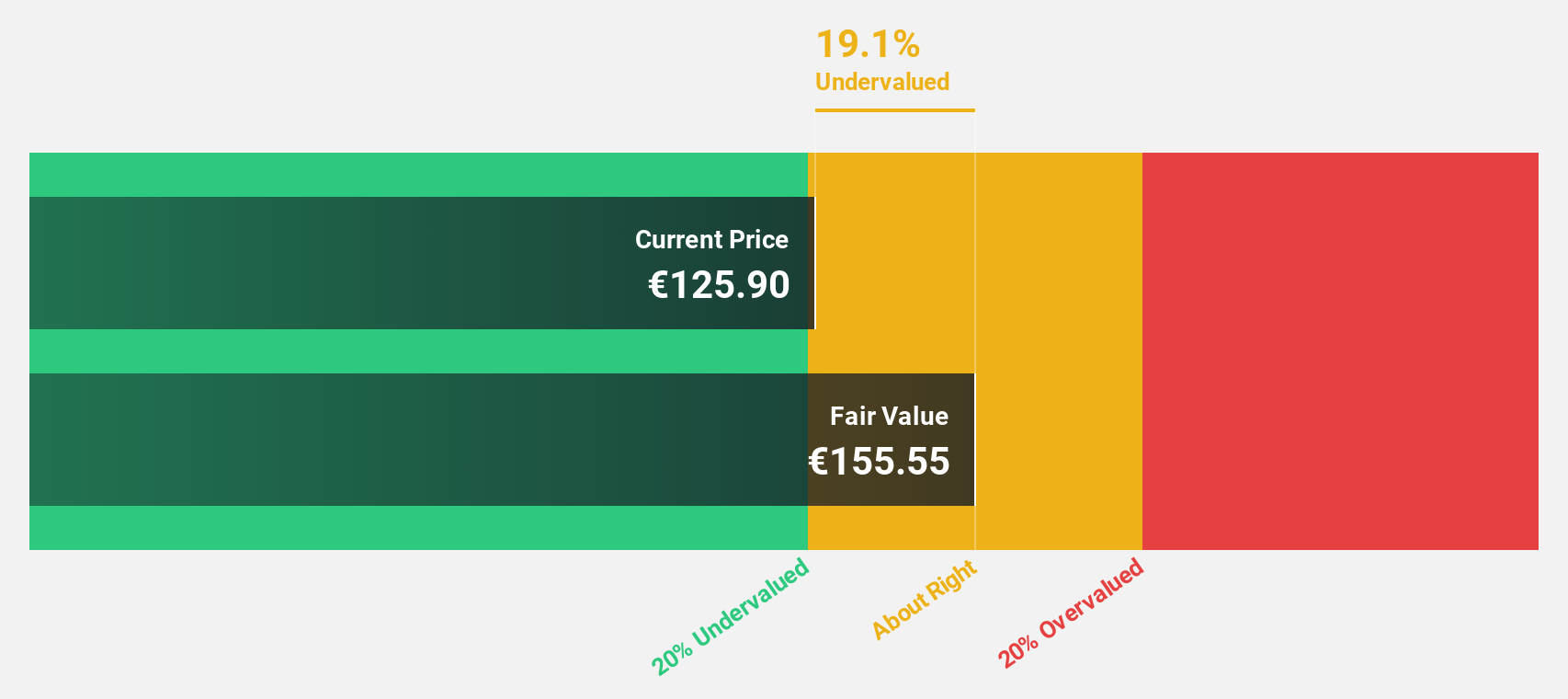

Estimated Discount To Fair Value: 30.3%

BE Semiconductor Industries is trading at €106.35, significantly below its estimated fair value of €152.55, suggesting it may be undervalued based on discounted cash flow analysis. Despite a forecasted revenue decline in Q1 2025, the company expects strong earnings growth of 23% annually over the next three years, outpacing the Dutch market's 12.6%. Recent full-year results show modest sales and net income growth with an increased dividend and completed share buyback program enhancing shareholder value.

- The analysis detailed in our BE Semiconductor Industries growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in BE Semiconductor Industries' balance sheet health report.

Kinepolis Group (ENXTBR:KIN)

Overview: Kinepolis Group NV operates cinema complexes across several countries including Belgium, the Netherlands, France, and others, with a market cap of €887.37 million.

Operations: The company's revenue is primarily derived from Box office (€294.05 million), In-Theatre Sales (€177.61 million), Real Estate (€13.88 million), Film Distribution (€4.07 million), and its Technical Department (€0.07 million).

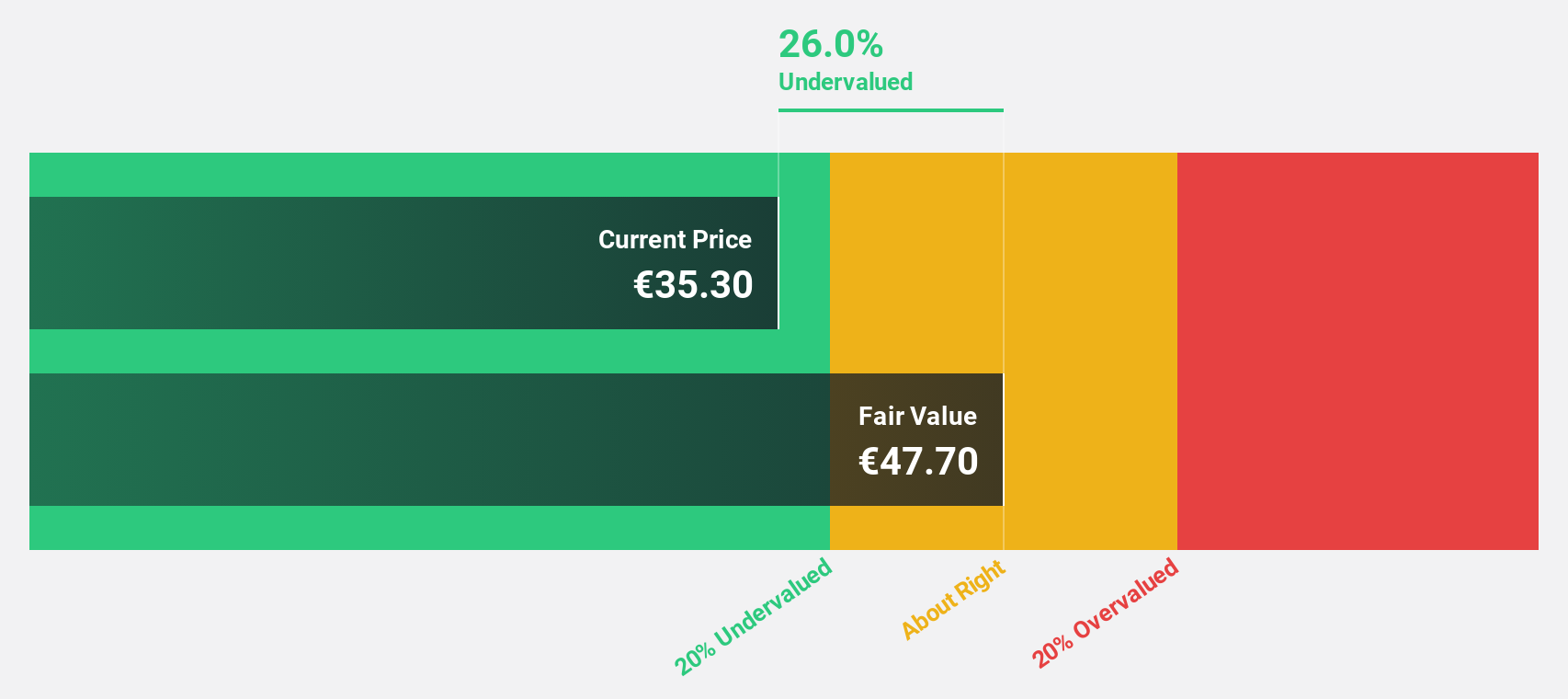

Estimated Discount To Fair Value: 34.9%

Kinepolis Group is trading at €33.2, considerably below its estimated fair value of €51, highlighting potential undervaluation based on discounted cash flow analysis. Despite projected revenue growth of 4.8% annually, which lags behind the Belgian market's 6.6%, earnings are expected to grow significantly at 25.79% per year, surpassing the market average of 14.2%. However, a high debt level poses a financial risk despite strong anticipated return on equity reaching 27% in three years.

- Upon reviewing our latest growth report, Kinepolis Group's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Kinepolis Group.

Plejd (NGM:PLEJD)

Overview: Plejd AB (publ) is a technology company that develops products and services for smart lighting control across several countries, including Sweden, Norway, Finland, the Netherlands, and Germany, with a market cap of SEK5.39 billion.

Operations: The company's revenue is primarily derived from electronic security devices, totaling SEK771.49 million.

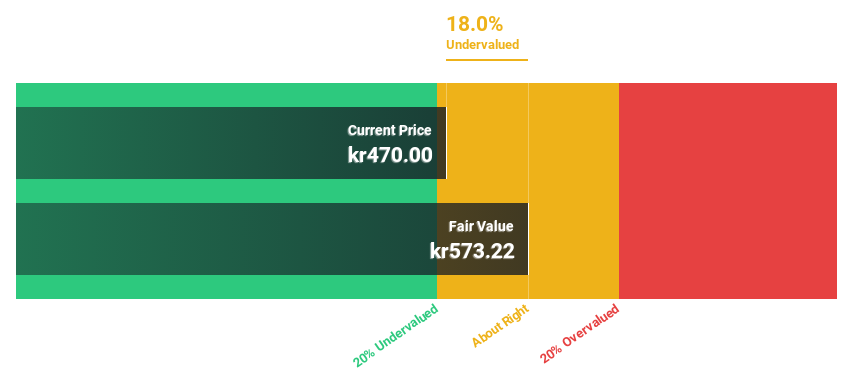

Estimated Discount To Fair Value: 10.2%

Plejd, trading at SEK482.5, is undervalued compared to its fair value estimate of SEK537.14. Earnings are forecast to grow significantly at 31.6% annually, outpacing the Swedish market's 9.3%. Revenue growth is expected at 17.1% per year, faster than the market average of 0.9%. However, recent significant insider selling could be a concern despite strong earnings prospects and a high projected return on equity of 26.8% in three years.

- Our growth report here indicates Plejd may be poised for an improving outlook.

- Click here to discover the nuances of Plejd with our detailed financial health report.

Seize The Opportunity

- Embark on your investment journey to our 200 Undervalued European Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade BE Semiconductor Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if BE Semiconductor Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BESI

BE Semiconductor Industries

Develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries in the Netherlands, Switzerland, Austria, Singapore, Malaysia, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives