- Netherlands

- /

- Semiconductors

- /

- ENXTAM:BESI

3 Stocks Estimated To Be Up To 33.7% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical tensions and economic shifts, major U.S. indexes have approached record highs with broad-based gains, buoyed by strong labor market data and positive sentiment in housing sales. Amidst this environment of cautious optimism, investors are increasingly on the lookout for undervalued stocks that could offer potential value as they trade below their intrinsic worth. Identifying such stocks requires careful analysis of their fundamentals and market position, particularly in times when broader macroeconomic stability supports the asset class.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shenzhen Lifotronic Technology (SHSE:688389) | CN¥15.53 | CN¥30.89 | 49.7% |

| SeSa (BIT:SES) | €75.10 | €149.67 | 49.8% |

| HD Korea Shipbuilding & Offshore Engineering (KOSE:A009540) | ₩201500.00 | ₩402771.51 | 50% |

| PLAIDInc (TSE:4165) | ¥1597.00 | ¥3193.29 | 50% |

| EnomotoLtd (TSE:6928) | ¥1473.00 | ¥2932.52 | 49.8% |

| Winking Studios (Catalist:WKS) | SGD0.27 | SGD0.54 | 49.7% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.96 | THB9.87 | 49.7% |

| SK Biopharmaceuticals (KOSE:A326030) | ₩95400.00 | ₩190022.03 | 49.8% |

| Cavotec (OM:CCC) | SEK17.55 | SEK35.07 | 50% |

| Snap (NYSE:SNAP) | US$11.42 | US$22.72 | 49.7% |

Let's explore several standout options from the results in the screener.

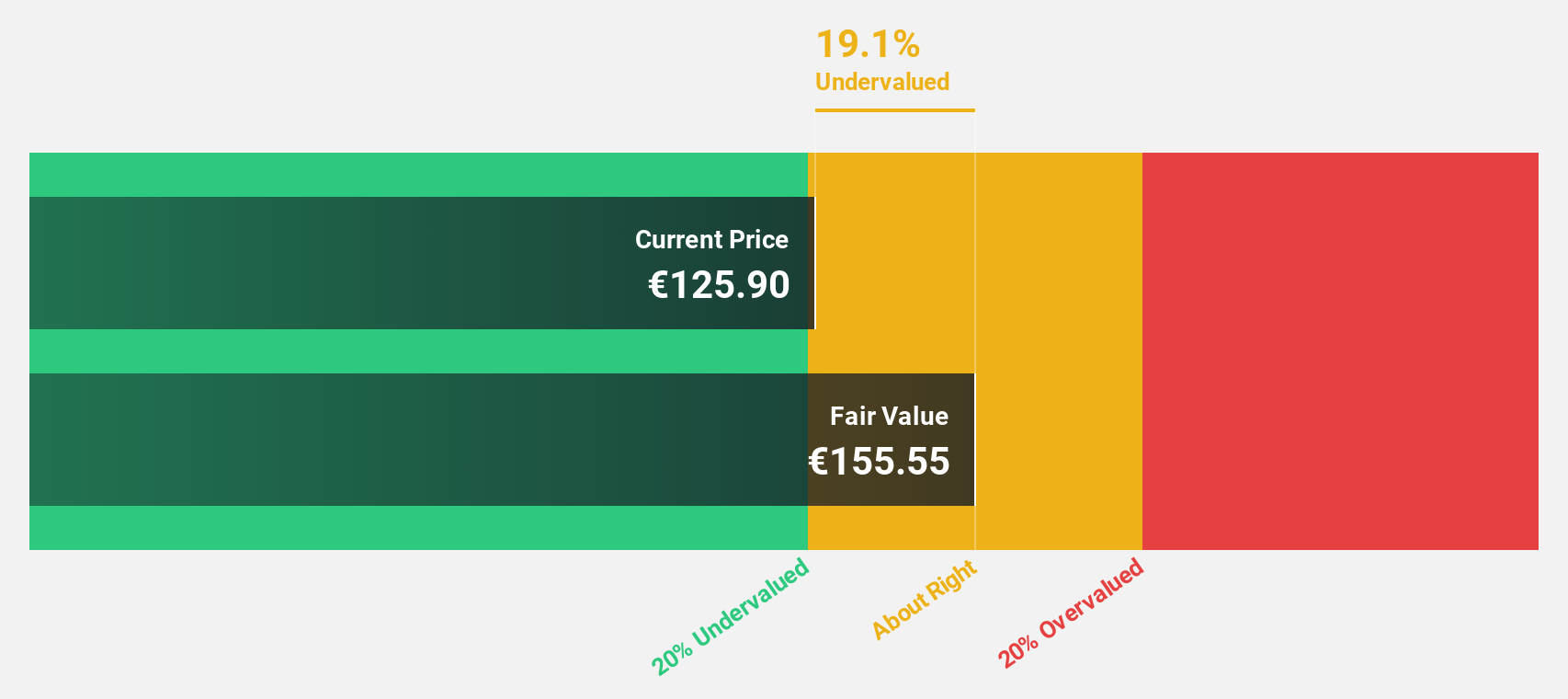

BE Semiconductor Industries (ENXTAM:BESI)

Overview: BE Semiconductor Industries N.V. develops, manufactures, markets, sells, and services semiconductor assembly equipment for the semiconductor and electronics industries across various international markets with a market cap of €8.99 billion.

Operations: The company's revenue primarily comes from its Semiconductor Equipment and Services segment, totaling €613.70 million.

Estimated Discount To Fair Value: 11.8%

BE Semiconductor Industries is trading at €112.8, below its estimated fair value of €127.95, reflecting potential undervaluation based on cash flows. Despite recent share price volatility and past shareholder dilution, the company forecasts robust earnings growth of 30.1% annually, outpacing the Dutch market's 16.3%. Recent third-quarter results showed increased net income to €46.77 million from €35.04 million year-over-year, supporting its strong cash flow position amidst ongoing share buybacks totaling €67 million this year.

- Upon reviewing our latest growth report, BE Semiconductor Industries' projected financial performance appears quite optimistic.

- Take a closer look at BE Semiconductor Industries' balance sheet health here in our report.

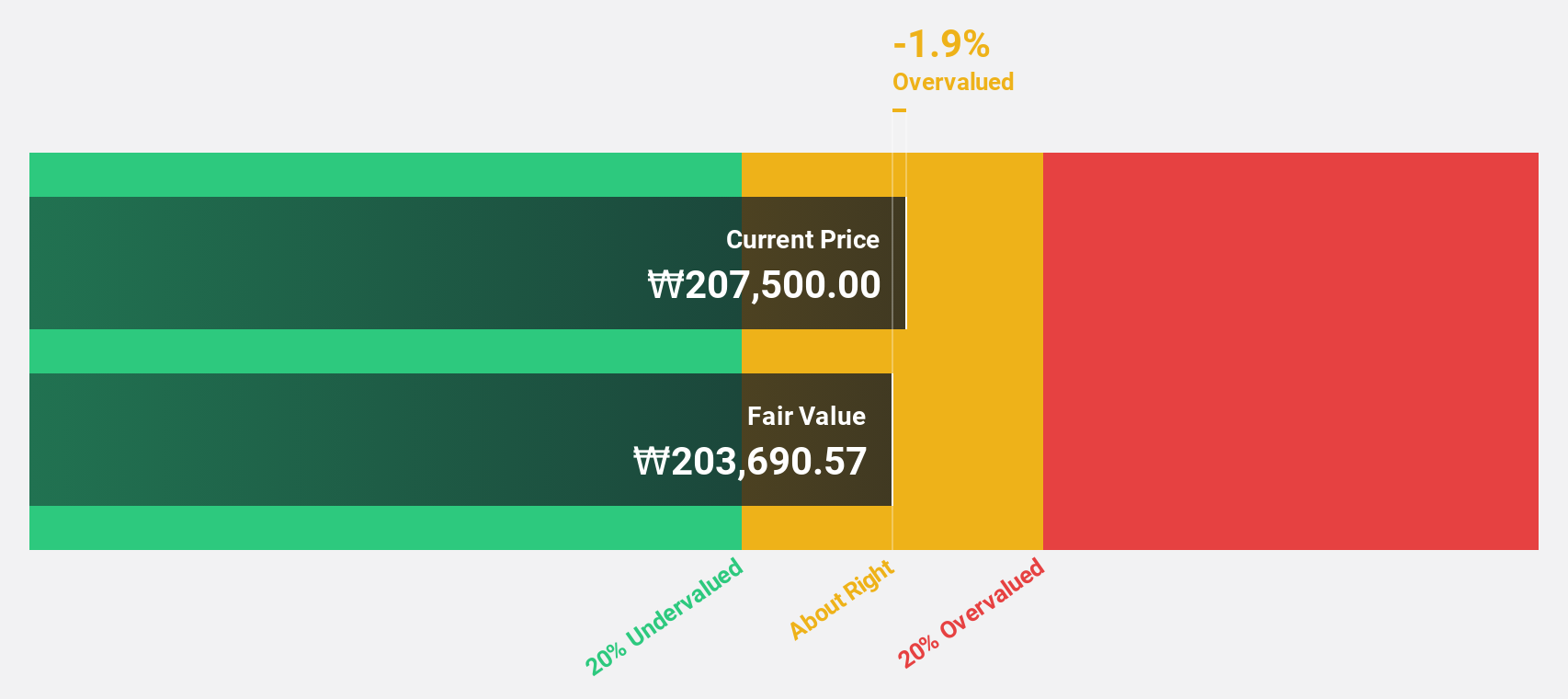

NCSOFT (KOSE:A036570)

Overview: NCSOFT Corporation develops and publishes online games worldwide, with a market cap of ₩4.28 trillion.

Operations: NCSOFT generates revenue through the development and publication of online games across global markets.

Estimated Discount To Fair Value: 14.1%

NCSOFT, trading at ₩216,500, is below its estimated fair value of ₩251,921.28, suggesting potential undervaluation based on cash flows. Despite a third-quarter net loss of ₩26.5 billion compared to last year's net income of ₩43.61 billion and declining sales figures year-over-year, the company forecasts significant annual earnings growth of 39.6%, surpassing the Korean market's 29.1% projection and indicating robust future cash flow prospects despite current challenges.

- Our comprehensive growth report raises the possibility that NCSOFT is poised for substantial financial growth.

- Get an in-depth perspective on NCSOFT's balance sheet by reading our health report here.

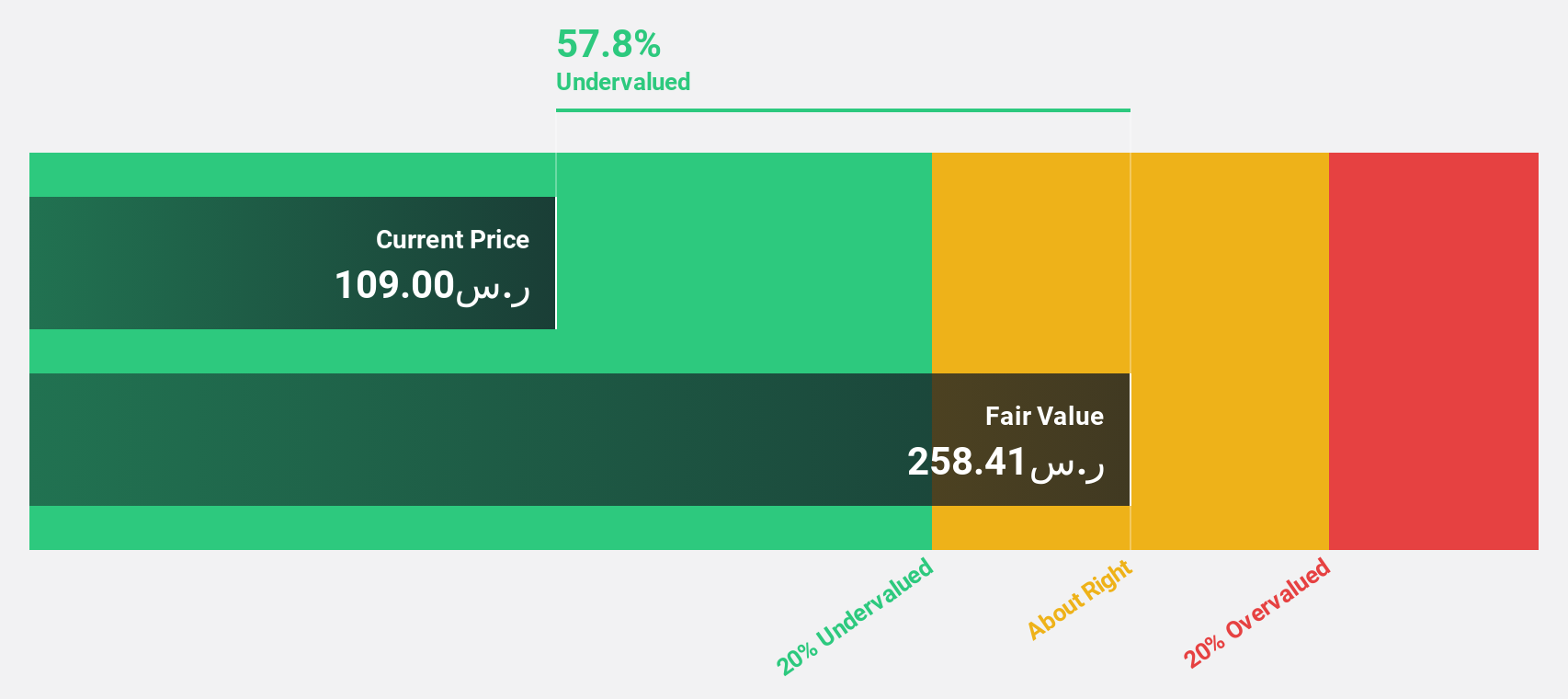

Arabian Contracting Services (SASE:4071)

Overview: Arabian Contracting Services Company, along with its subsidiaries, operates in the printing business in Saudi Arabia and Egypt with a market cap of SAR8.38 billion.

Operations: The company's revenue primarily comes from its Advertising Segment, which generated SAR1.52 billion.

Estimated Discount To Fair Value: 33.7%

Arabian Contracting Services, trading at SAR 167.6, is significantly below its estimated fair value of SAR 252.89, indicating potential undervaluation based on cash flows. Despite a decline in profit margins to 17.8% from last year's 26.6%, the company's earnings and revenue are forecast to grow annually by over 31% and 22%, respectively, outpacing the Saudi Arabian market's averages. Recent strategic investments further support its growth trajectory despite current financial challenges.

- Insights from our recent growth report point to a promising forecast for Arabian Contracting Services' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Arabian Contracting Services.

Taking Advantage

- Embark on your investment journey to our 919 Undervalued Stocks Based On Cash Flows selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BE Semiconductor Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:BESI

BE Semiconductor Industries

Engages in the development, manufacture, marketing, sale, and service of semiconductor assembly equipment for the semiconductor and electronics industries in China, the United States, Malaysia, Ireland, Korea, Taiwan, Thailand, Other Asia Pacific and Europe, and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives