Prosus (ENXTAM:PRX): Exploring Valuation as Investor Optimism Rises Following Increased AI Investments

Reviewed by Kshitija Bhandaru

Prosus (ENXTAM:PRX) has been getting extra attention lately due to its increased investments in artificial intelligence, which are aimed at improving operational efficiency and profitability. This focus is generating renewed interest in the stock’s growth prospects.

See our latest analysis for Prosus.

Prosus has been edging higher in recent months, with a 1-month share price return of 0.17% and a 3-month gain of 0.28%. This gradual momentum reflects a broader optimism, as investors warm up to its ambitious push into artificial intelligence and the promise of improved profitability. Over the longer run, total shareholder returns remain positive, highlighting the company's steady appeal even as the market weighs future growth against past volatility.

If Prosus’s recent moves have you scanning for the next opportunity, why not take the next step and discover fast growing stocks with high insider ownership

With shares edging higher and optimism building around Prosus’s tech-focused strategy, the key question now is whether the current share price fully reflects its future potential or if there is still room for buyers to benefit.

Most Popular Narrative: 1.5% Overvalued

Prosus’s narrative fair value is just below its current market price, suggesting that investor optimism may be outpacing forward-looking fundamentals. This invites a closer examination of the assumptions that support the prevailing valuation story.

The company is increasingly investing in AI to improve operational efficiencies, reduce customer acquisition costs, and fight fraud. These efforts are expected to enhance profitability and could potentially expand net margins over time. Prosus maintains a strong cash position of $10 billion available for strategic investments, with a disciplined approach to pursuing opportunities that complement its ecosystem. This indicates potential for revenue growth through strategic acquisitions.

Curious about the foundation underpinning this price target? The consensus narrative relies on several significant forecasts, such as shrinking margins, changing profit expectations, and a substantial decrease in share count. Interested in exploring the catalyst and controversies influencing analyst opinions? Review the detailed projections driving this valuation and consider if the logic aligns with your perspective.

Result: Fair Value of $60.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Prosus’s aggressive AI strategy or internal collaboration fails to deliver operational gains, its profitability and growth expectations could be at risk.

Find out about the key risks to this Prosus narrative.

Another View: Market Multiples Tell a Different Story

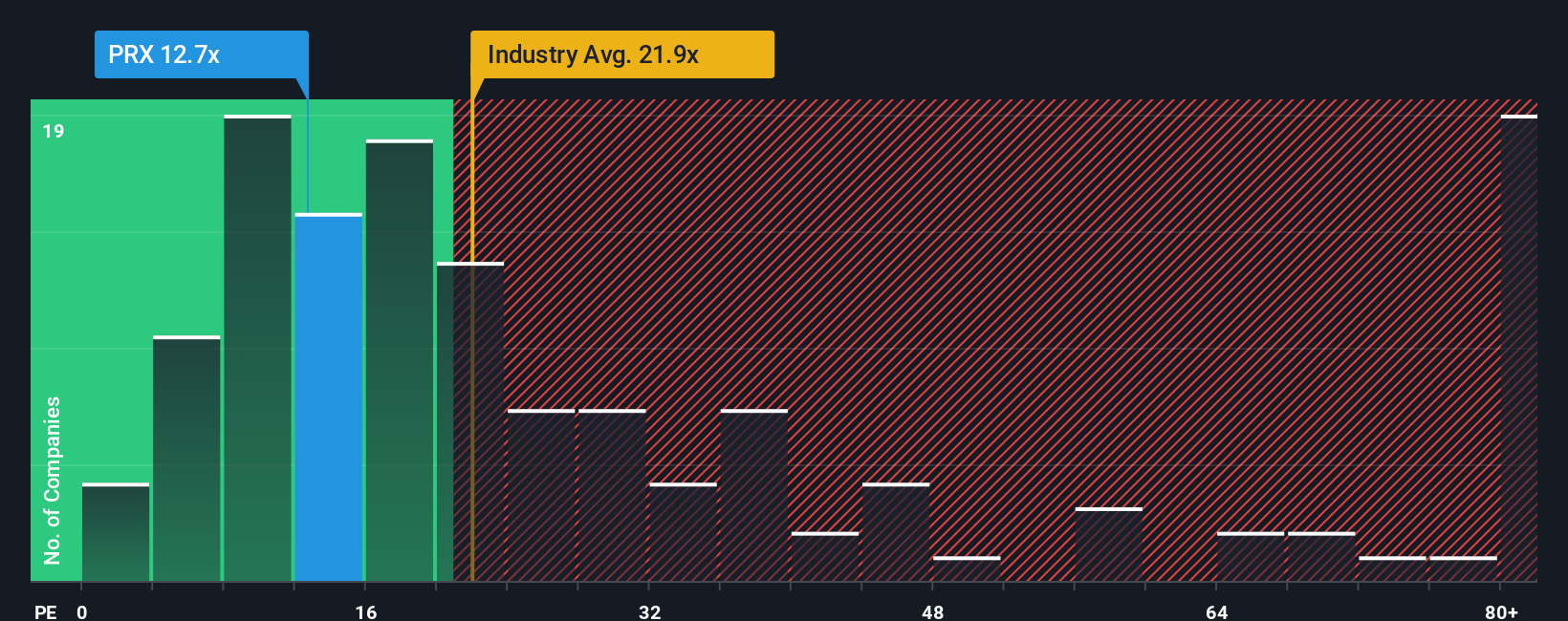

Looking from a market multiples perspective, Prosus is trading at a price-to-earnings ratio of 12.8x, well below both its peer average of 50.7x and the industry’s 21.8x. This suggests Prosus is attractively valued relative to its sector, with the market potentially underestimating its long-term potential. But could this low valuation signal underlying risks, or is there true opportunity ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Prosus Narrative

If you want a different angle or prefer independent analysis, you can dive into the data and build your own perspective in just minutes. Do it your way

A great starting point for your Prosus research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for opportunities to pass by when you can act now. Use these hand-picked screens to uncover stocks with the potential to boost your portfolio:

- Uncover growth potential by tapping into these 25 AI penny stocks, which are making waves in artificial intelligence across multiple industries.

- Capture attractive yields with these 19 dividend stocks with yields > 3%, offering reliable income and strong fundamentals for income-focused investors.

- Seize undervalued gems hiding in plain sight by screening for these 894 undervalued stocks based on cash flows, backed by healthy cash flows and forecasted upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:PRX

Prosus

Engages in the e-commerce and internet businesses in Asia, Europe, Latin America, North America, and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives