- Switzerland

- /

- Biotech

- /

- SWX:MOLN

October 2024's Promising Penny Stocks to Watch

Reviewed by Simply Wall St

As global markets continue to navigate a complex economic landscape, the S&P 500 has seen gains driven by utilities and real estate, while small-cap indices like the Russell 2000 have outperformed. In this context, penny stocks—often representing smaller or newer companies—remain a compelling area for investors seeking growth opportunities at lower price points. Despite being considered an outdated term, these stocks can offer significant potential when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Seafco (SET:SEAFCO) | THB2.44 | THB1.98B | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.07B | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

Click here to see the full list of 5,783 stocks from our Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pharming Group (ENXTAM:PHARM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pharming Group N.V. is a biopharmaceutical company that develops and commercializes protein replacement therapies and precision medicines for rare diseases across the United States, Europe, and internationally, with a market cap of €572.87 million.

Operations: The company's revenue is primarily derived from its Recombinant Human C1 Esterase Inhibitor Business, generating $277.56 million.

Market Cap: €572.87M

Pharming Group N.V., with a market cap of €572.87 million, is navigating the complexities of the biopharmaceutical sector by focusing on its Recombinant Human C1 Esterase Inhibitor Business, generating US$277.56 million in revenue. Despite being unprofitable and experiencing shareholder dilution, the company has reduced its debt to equity ratio from 76% to 40.9% over five years and maintains sufficient short-term assets to cover liabilities. Recent developments include a Phase II clinical trial for leniolisib targeting primary immunodeficiencies, potentially expanding its therapeutic reach beyond APDS, indicating ongoing efforts towards innovation and growth in niche markets.

- Navigate through the intricacies of Pharming Group with our comprehensive balance sheet health report here.

- Learn about Pharming Group's future growth trajectory here.

FIT Hon Teng (SEHK:6088)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: FIT Hon Teng Limited manufactures and sells mobile and wireless devices and connectors in Taiwan and internationally, with a market cap of HK$21.54 billion.

Operations: The company's revenue is primarily derived from Intermediate Products at $3.94 billion and Consumer Products at $690.95 million.

Market Cap: HK$21.54B

FIT Hon Teng Limited, with a market cap of HK$21.54 billion, is making strides in AI data center solutions while maintaining solid financial health. Recent earnings reveal sales of US$2.07 billion for the first half of 2024, up from US$1.78 billion the previous year, and a net income turnaround to US$32.52 million from a loss. The company's short-term assets exceed both short- and long-term liabilities, indicating strong liquidity management. Despite an increase in debt-to-equity ratio over five years, its debt remains well-covered by operating cash flow and interest payments are adequately managed by EBIT coverage.

- Unlock comprehensive insights into our analysis of FIT Hon Teng stock in this financial health report.

- Evaluate FIT Hon Teng's prospects by accessing our earnings growth report.

Molecular Partners (SWX:MOLN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Molecular Partners AG is a clinical-stage biotechnology company in Switzerland that develops designed ankyrin repeat proteins therapeutics for oncology and virology diseases, with a market cap of CHF189.21 million.

Operations: The company generates revenue of CHF7.86 million from its biopharmaceutical products segment.

Market Cap: CHF189.21M

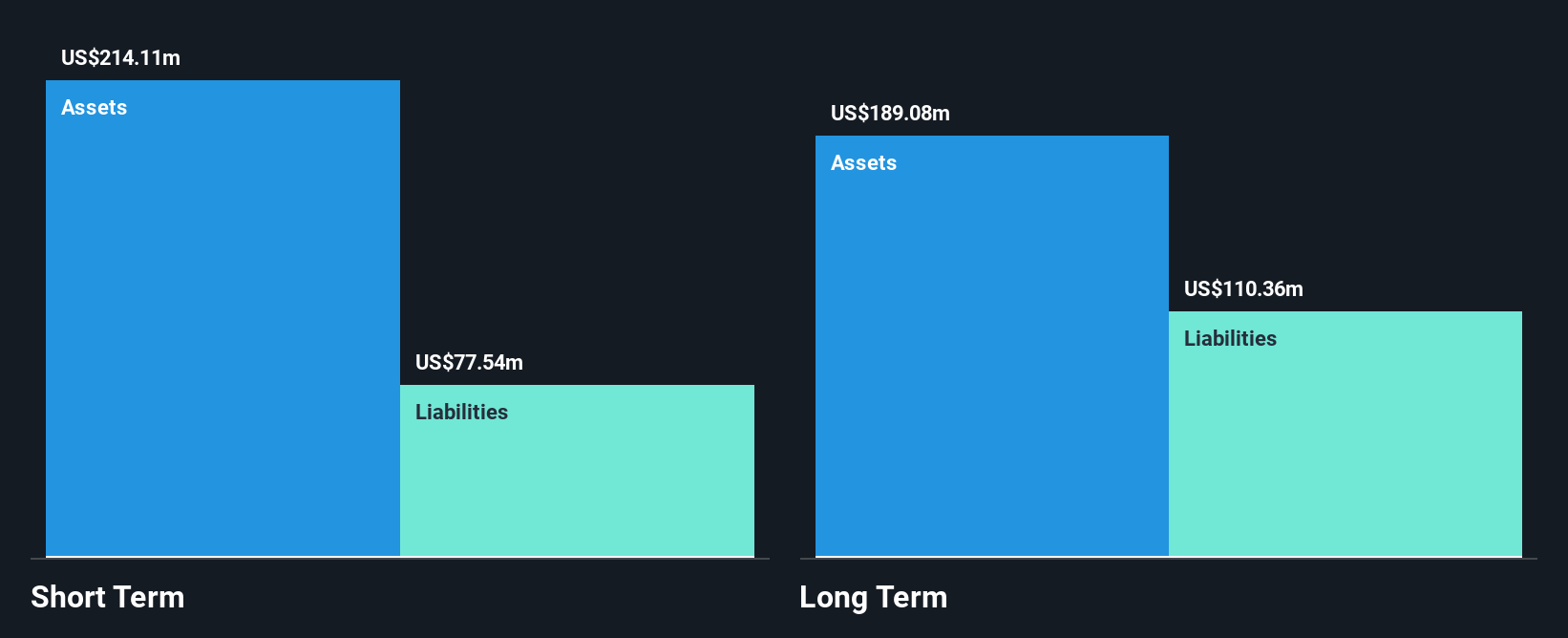

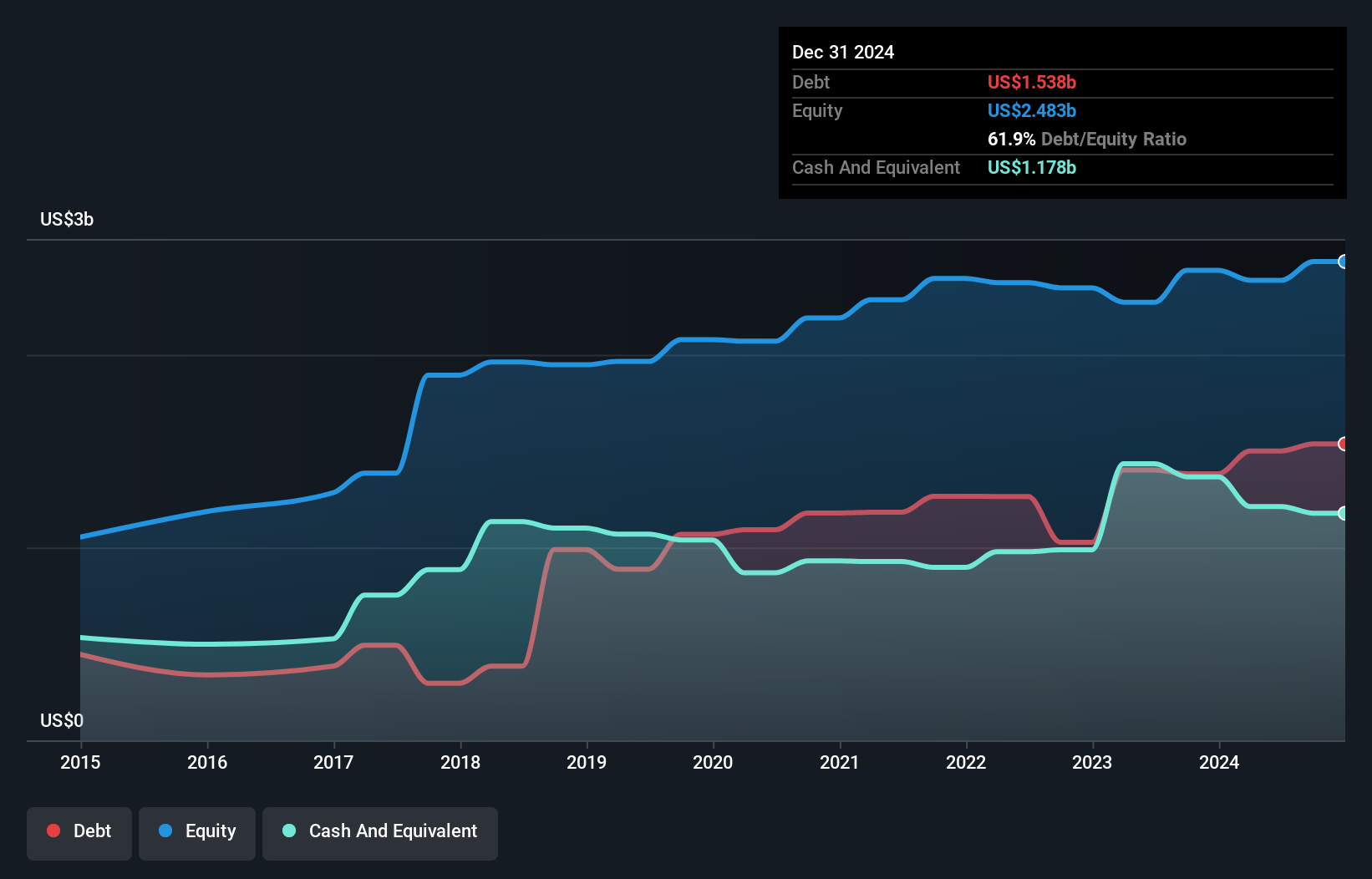

Molecular Partners AG, with a market cap of CHF189.21 million, is navigating the biotech landscape with promising developments despite current unprofitability. The company reported increased revenue of CHF1.55 million for Q2 2024 compared to CHF0.415 million a year prior, while net losses narrowed slightly to CHF15.08 million from CHF15.99 million in the same period last year. With no debt and sufficient cash runway for over two years if growth continues, Molecular Partners shows financial resilience amid high share price volatility and forecasts of declining earnings but significant revenue growth potential at 53% annually over the next few years.

- Click here to discover the nuances of Molecular Partners with our detailed analytical financial health report.

- Explore Molecular Partners' analyst forecasts in our growth report.

Seize The Opportunity

- Gain an insight into the universe of 5,783 Penny Stocks by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MOLN

Molecular Partners

A clinical-stage biotechnology company, develops designed ankyrin repeat proteins therapeutics for the treatment of oncology and virology diseases in Switzerland.

Flawless balance sheet with moderate growth potential.