- Netherlands

- /

- Entertainment

- /

- ENXTAM:BNJ

FL Entertainment N.V. (AMS:FLE) Might Not Be As Mispriced As It Looks

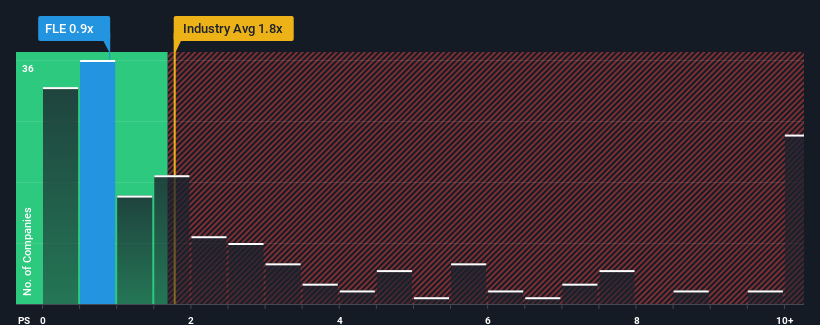

With a price-to-sales (or "P/S") ratio of 0.9x FL Entertainment N.V. (AMS:FLE) may be sending bullish signals at the moment, given that almost half of all the Entertainment companies in the Netherlands have P/S ratios greater than 1.8x and even P/S higher than 6x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for FL Entertainment

How FL Entertainment Has Been Performing

FL Entertainment could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think FL Entertainment's future stacks up against the industry? In that case, our free report is a great place to start.How Is FL Entertainment's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as FL Entertainment's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.1% last year. Pleasingly, revenue has also lifted 97% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 8.6% during the coming year according to the four analysts following the company. With the industry only predicted to deliver 4.3%, the company is positioned for a stronger revenue result.

With this information, we find it odd that FL Entertainment is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A look at FL Entertainment's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

We don't want to rain on the parade too much, but we did also find 4 warning signs for FL Entertainment (1 doesn't sit too well with us!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Banijay Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:BNJ

Banijay Group

Engages in the content production, distribution, online sports betting, and gaming businesses in the United States of America, Europe, and internationally.

Good value with reasonable growth potential.